“Get control over your assets with a BNPL application like Tamara.”

Management of money is very important in the present time. There is a possibility that users may not have any money while buying different stuff for personal or commercial use. So, to overcome this issue businesses have invested in this unique concept to develop BNPL app like Tamara.

Almost every person performs transactions digitally as it is fast and easy. BNPL apps allow users to pay for different commodities or facilities after a specific time. Additionally, it helps in the management of money and other funds.

So, before investing resources in the banking app development services in UAE make sure to go through this blog. You will understand basic things that will be beneficial for you in future. Let us get into it.

What is Tamara?

One of the top Buy Now, Pay Later (BNPL) platforms in the Middle East is Tamara, which gives customers flexible payment options for both in-person and online purchases. Established in 2020, it lets customers shop now and, as long as they pay on time, divide their payments into manageable installments without incurring interest.

Customers may enjoy a smooth, safe purchasing experience because Tamara has partnerships with a variety of merchants delivering services like payment gateway in UAE. The platform’s major goal is to increase financial accessibility while upholding clear conditions.

Tamara is rapidly rising to prominence in the fintech sector by emphasizing innovation and consumer happiness, which is changing how people in the area handle payments and shop.

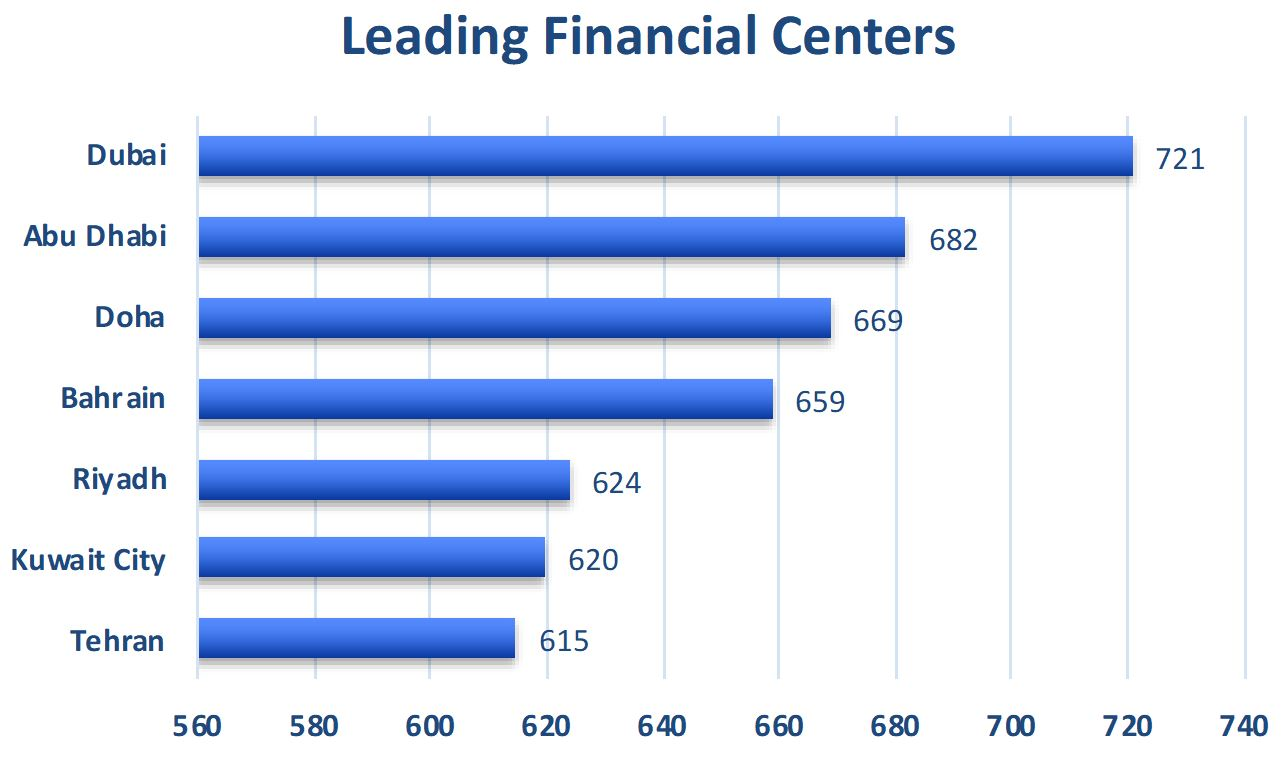

Market Stats For the Fintech Industry

- Between 2020 and 2030, the fintech market in the United Arab Emirates is anticipated to expand at a compound annual growth rate of 30% CAGR.

- By 2022, fintech companies in the UAE had raised over $1Billion, demonstrating the high level of investor interest in the industry.

- Through 2030, the market is anticipated to be dominated by the digital payments segment, which is projected to rise by 25%

- Financial services are expected to use blockchain technology widely; by 2030, the UAE government wants50% of government transactions to be blockchain-based.

- A flourishing fintech ecosystem has been facilitated by initiatives like the UAE’s “Fintech Hive”and regulatory frameworks like the Dubai International Financial Centre (DIFC).

- As the fintech industry continues to grow, it is anticipated that the number of fintech experts in the UAE would rise by 40%by 2030.

- With the UAE serving as a global center for crypto innovation and regulation, cryptocurrency and blockchain-based fintech solutions are anticipated to account for a sizable share of the industry.

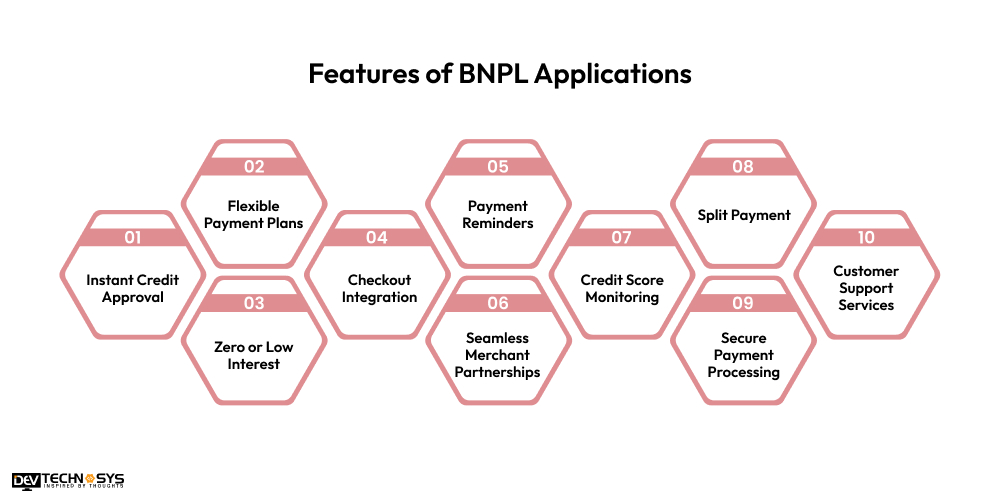

Interesting Features of BNPL Applications

As BNPL applications provide flexible payment choices, they are revolutionizing the way people shop. These ten intriguing qualities contribute to the popularity and ease of use of these apps.

1. Instant Credit Approval

Purchases are made easy with applications having Buy Now Pay Later service, which offer rapid approval without requiring complicated documents. Depending on their past purchases and financial background, users can receive quick credit.

2. Flexible Payment Plans

A BNLP app like Tamara provides weekly, monthly, or bi-weekly payment plans to users. Customers are able to effectively manage their cash flow because of this flexibility.

3. Zero or Low Interest

When paid on time, an app like Tamara provides interest-free payment plans, which makes them affordable. Users only incur late penalties if they fail to meet payment deadlines.

4. Easy Checkout Integration

Users can choose payment plans with ease thanks to the direct integration of BNPL choices into the checkout process. Investors should build an Ecommerce website so that the amount of friction can be reduced when purchasing online.

5. Customizable Payment Reminders

To help users avoid missing deadlines, apps like Tamara alert users before payments are due. User preferences can be used to customize notifications.

6. Seamless Merchant Partnerships

Users have greater shopping alternatives because of the large range of merchants that BNPL platforms partner with. Customers can now enjoy BNPL services in more places thanks to this.

7. Credit Score Monitoring

Tools for monitoring customers’ credit scores are available in certain BNPL apps. You can develop a Shop Now Pay Later app helping consumers to prevent adverse effects on their credit.

8. Split Payment

In addition to individual purchases, a buy-now-pay-later app like Tamara enables users to split the entire cost of several things into installments. This makes bigger shopping carts easier to use.

9. Secure Payment Processing

Advanced security features like two-factor authentication and encryption guarantee secure transactions for both customers and retailers. This lowers fraud and increases trust.

10. Customer Support Services

24/7 customer service by chatbots, phone, or email is provided by BNPL applications. So, it is important to use blockchain app development services assisting users to find solutions to problems related to account information and terms of payment.

Top Alternatives to Tamara Application

The Tamara BNPL application features a number of excellent substitutes that provide various payment options for both in-person and online transactions. So, businesses can invest in mobile app development company to guarantee a seamless and safe buying experience while enabling users to divide payments into installments .

Top 5 Alternatives of Tamara Application |

Supported Devices |

Downloads |

Ratings |

| Snapmint | Android|iOS | 10M+ | 4.6 |

| Simpl | Android|iOS | 10M+ | 4.5 |

| LazyPay | Android|iOS | 10M+ | 4.4 |

| ZestMoney | Android|iOS | 10M+ | 4.4 |

| Tabby | Android|iOS | 5M+ | 4.7 |

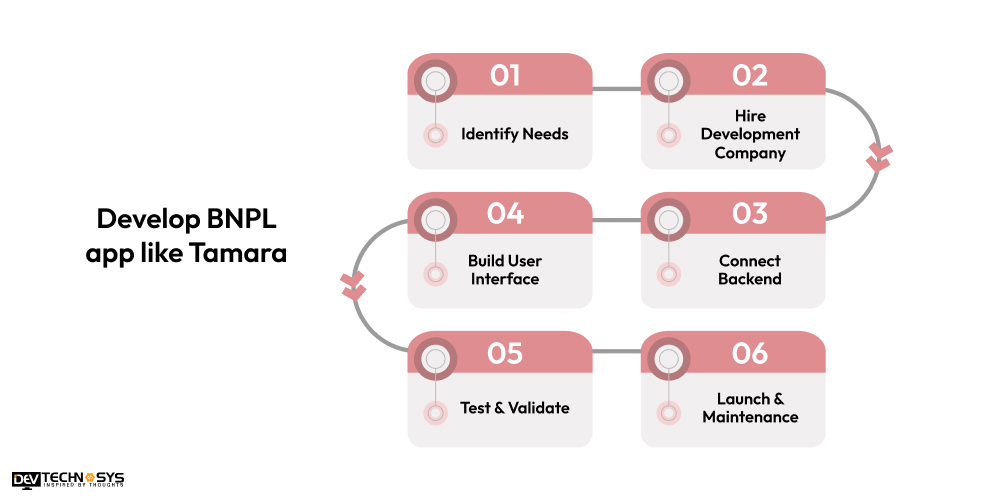

What is The Process to Develop BNPL App like Tamara?

For understanding a precise method to develop BNPL app like Tamara, we will discuss generalized money management app development stages. So, let us go in depth of this section:

1. Identify Needs

Initially, businesses should understand the motive to create BNPL app like Tamara. Additionally, there are multiple things that you need to know before investing assets and resources in a Tamara app development company. It is important to target specialized Ewallet app development services in Dubai to get reliable infrastructure for application development.

| · What are the market requirements?

· How much budget is required? · Who are your target audience? |

2. Hire Development Company

To continue with the wallet application development process, you need to hire a Buy Now Pay Later app development company in UAE. So, it is crucial to follow a suitable hiring method to avoid time consumption and loss of business resources. You should start with performance analysis. Additionally, conduct technical interviews to judge knowledge and dedication.

| · Is it important to hire a development partner?

· How to hire an ewallet application development company? · What assistance will they provide? |

3. Build User Interface

A mobile application needs an interactive frontend to display information attractively to pull people towards the platform. So, along with the investment of money in Fintech app development to develop money lending mobile apps, you should ensure to use specialized UI/UX tools. Additionally, apply different themes based on the application category.

| · Which UI/UX tools to be used?

· Know about HTML, CSS, and JavaScript. · Use designing AI tools like Shopify to save time. |

4. Connect Backend

If you want users to get responses to their queries timely, then to develop an app like Tamara implementing backend services is a must. So, first aim your motive to hire mobile app developers who can work with APIs and databases. Additionally, make special arrangements to keep your platform safe and reliable during the development process.

| · Importance of iPhone app development services in backend implementation.

· Which tools are necessary for building APIs? · How can your user data be stored? |

5. Test & Validate

Now, it is the time to test and secure mobile applications from digital threats and malware. So, you should use custom Android app development services to implement testing models for error identification. Additionally, use suitable security algorithms to remove mistakes in the generated code. At this stage, by creating an app like Tamara you can set your platform for sale.

| · What testing tools are required?

· What are the benefits of this stage? · Security of applications is mandatory at every level. |

6. Launch & Maintenance

Launch of mobile applications is a business process which requires complete industrial knowledge and helps businesses in getting market presence. But, for platform maintenance it is necessary to approach a mobile app development company in Dubai. So that you can provide regular updates and features to users.

| · Know the process of application launch.

· Why is mobile app maintenance important? · What is necessary to maintain mobile applications? |

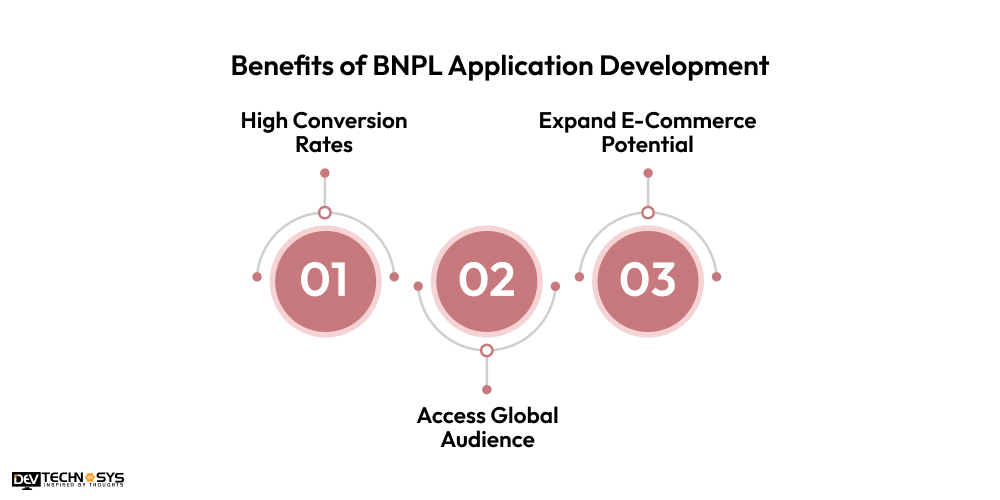

Benefits of BNPL Application Development

There are several benefits to creating a BNPL application for both customers and businesses. The following are some main advantages of developing a BNPL app.

1. High Conversion Rates

By motivating clients to finish their purchases, BNPL options can increase conversion rates. Customers are more inclined to purchase more expensive goods and services when they have flexible payment choices. Businesses should target digital wallet app development solutions to get a sharp rise in sales.

2. Access Global Audience

A broader range of consumers, including younger ones and those with less extensive credit histories, can be reached through BNPL apps. Businesses can develop a Buy Now Pay Later app like Tamara to reach new client groups for traditional finance by providing more easily accessible payment choices.

3. Expand E-Commerce Potential

Regardless of the shopping channel, Buy Now Pay Later app development enables merchants to provide flexible payment alternatives in both physical and online establishments. This growth serves a wider range of customers and boosts overall sales potential.

What is The Cost to Build BNPL Apps?

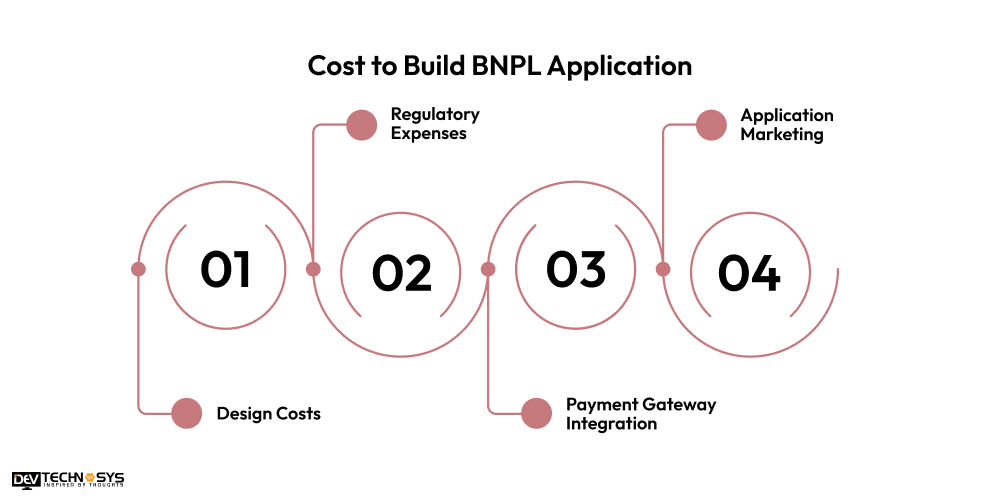

The process to make BNPL app like Tamara involves several key mobile app development cost factors that contribute to development and operational expenses. Here are four important factors influencing development cost of a buy-now-pay-later like Tamara discussed:

1. Design Costs

Coding, UI/UX design, and feature integration can all add up to a substantial app development expense. Expense management app development costs are increased by complex features like secure user login and payment gateway integration. So, you can approach a banking and finance software development company for iterative upgrades and quality testing.

2. Regulatory Expenses

Data protection rules and financial standards must be followed to build BNPL app like Tamara, which can be expensive. Legal advice and outside audits are frequently needed to make sure the app complies with industry standards, such as PCI-DSS for safe payments.

3. Payment Gateway Integration

There is an Ecommerce app development cost associated with integrating secure payment processing solutions. Depending on the number of users and transactions, payment gateway fees might mount up. Payment gateway fees are assessed for each transaction.

4. Application Marketing

Attracting users requires marketing initiatives like influencer collaborations, digital advertising, and referral schemes. Particularly in a market with intense competition it is necessary to hire dedicated developers for managing customer acquisition costs.

The average market cost ranges between $8,000-$14,000 for making simple BNPL applications. But, if you are targeting advanced Ewallet app development services, then the price may increase to more than $25,000.

App Structure |

Development Time |

Estimated Cost |

| Simple | 5-8 months | $8000-$14000 |

| Moderate | 8-12 months | $14000-$20000 |

| Complex | More than 12 months | $20000-$25000 |

This is an estimated pricing table which can be influenced by market factors. So, you should contact an MVP app development company in Dubai to get the exact cost.

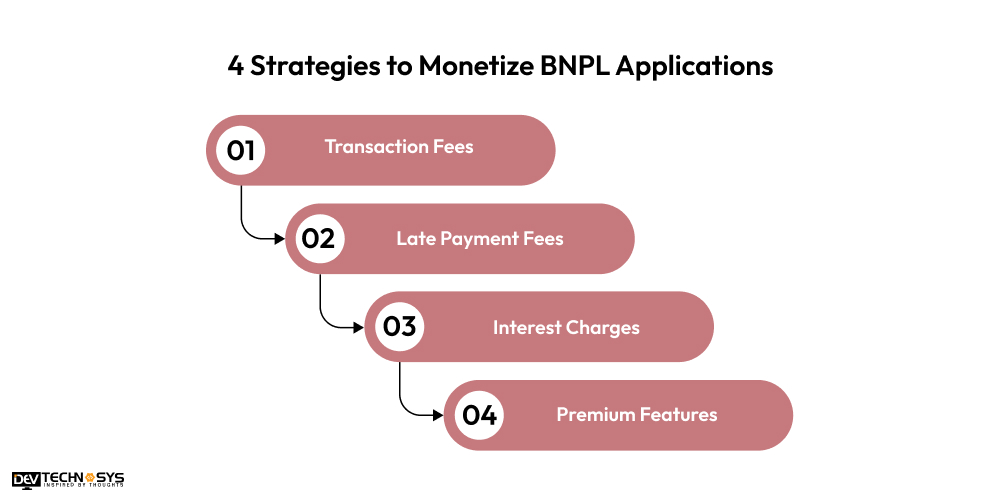

4 Strategies to Monetize BNPL Applications

A BNPL application can be monetized to provide several revenue streams. Here are four successful BNPL platform monetization techniques to think about.

1. Transaction Fees

For every transaction done on their platform, you can create BNPL app like Tamara and have the ability to charge merchants a fee. So, as more customers make purchases, this fee provides a steady stream of income between 1 and 6%.

2. Late Payment Fees

By imposing late payment fees to customers who miss their payment dates, BNPL providers can make money. Businesses should use digital wallet development services to encourage on-time payments by implementing this model.

3. Interest Charges

The software may charge interest to customers who choose lengthier installment plans, which would bring in more money. So, you can build BNPL app like Tamara for consumers to access more payment alternatives and make money.

4. Premium Features

The user base can be made more profitable by providing premium options like longer payment periods. Additionally, to raise the profitability of the app you should hire dedicated developers and use subscription models.

Summing Up!!

The need to develop BNPL app like Tamara is increasing on a daily routine because these applications are highly popular and widely used across the world. So, it will be a nice move for businesses to invest in fintech app development services and get access in the banking sector. The majority of the people are looking into this industry to experience more efficiency in money management.

Additionally, to get specific outputs businesses should also target Tamara app development services to implement specific features and functionalities. So, you need to get access to modern resources for resolving various issues regarding application technicalities. It is important to find out different market trends to apply them in your business model for income generation.

Frequently Asked Questions

1. What is BNPL And How Does it Work in Applications Like Tamara?

Customers can make purchases and pay for them in installments with BNPL (Buy Now, Pay Later). Payment gateways are integrated into apps like Tamara so that customers may choose a payment plan. Easy credit checks, clear payment terms, and smooth transactions are all guaranteed by the app.

2. How Can I Integrate BNPL Payment Options in Tamara Like Applications?

You must collaborate with payment processors that provide adjustable installment plans in order to implement BNPL. The payment flow of your app must incorporate APIs from these processors. For efficient operation, make sure that payments are handled securely and that financial standards are followed.

3. What Features Should I Include in a BNPL Application Like Tamara?

Important characteristics include:

- Account management and user registration.

- The selection and administration of payment plans.

- A successful app must provide transaction history and payment reminders for fraud prevention and customer service.

4. What are the Key Technologies Required to Build a BNPL Application Like Tamara?

- Payment Gateway Integration: Secure API integration for seamless transaction processing.

- Data Security & Encryption: To protect sensitive user financial data.

- User Authentication & Authorization: Multi-factor authentication for safety and compliance.

5. How is Security Ensured in BNPL Apps?

- Protect all data transactions.

- Implement machine learning to detect suspicious activities.

- Use trusted and secure third-party services for payment processing.

6. What are the Main Challenges in Developing a BNPL Application?

- Keeping up with financial regulations in different regions.

- Implementing accurate credit scoring systems.

- Ensuring a smooth and intuitive app interface to drive adoption.