TDo you want to develop an app like Mobily Pay, however, are not familiar with the Cashless payment app development process? If yes, you have reached the right palace.

Mobile wallet apps have gained popularity recently, offering customers a quick and safe way to handle their financial activities. The popularity of these software packages stems from their user convenience and increased security, which make mobile wallets safer than traditional payment methods such as cash or credit cards. As per a study, the worldwide mobile wallet industry was valued at USD 7.42 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 28.3% from 2023 to 2030. This data depicts room for business growth.

Mobile wallet app development from scratch can be rather difficult. If you also want to develop an app like Mobily Pay, this blog is for you. It will explore the easiest way of building an iOS or Android app for Mobily Pay, as well as must-have features, cost, etc.

What is The Mobily Pay– An Ewallet App?

Mobily Pay is a digital wallet regulated by the Saudi Central Bank. It is an excellent alternative for everyday financial activities, purchases, and local and international transfers. Users can pay their bills with this app with just one click. Mobily Pay prioritizes ease and security. It advertises a user-friendly interface and claims to prioritize the consumer experience. The app is available for free on both iOS and Android.

So, if you’re looking to develop app like Mobily Pay, seek assistance from eWallet app development companies. These professionals have deep knowledge of UI/UX design, backend development, security implementation, payment integrations, and regulatory compliance to provide a flawless user experience.

What are the Top eWallet Apps?

To create ewallet app like Mobily Pay and become the best in the market, you must learn from the market leader. So, this blog section will discuss the most popular digital wallet apps driving industry innovation.

- Taptap Send

- Al Ansari Exchange

- Apple Pay

- Payit

- Slice

1. Taptap Send

This app may be geographically focused, limiting its worldwide accessibility. Depending on your area, it may be a key player. To develop an app like Taptap Send, it’s essential to look into its specific features or offerings.

2. Al Ansari Exchange

Al Ansari Exchange is a UAE-based financial services company that provides currency exchange, money transfers, and bill payments. Their e-wallet app is anticipated to include these features for a convenient one-stop financial hub.

3. Apple Pay

It is a popular contactless payment method that was built for Apple devices. It enables users to securely save credit and debit card information and make payments in-store, online, and through apps.

4. Payit

Based on your location, Payit may be a regional player. It could be a bill payment platform or an e-wallet solution. If you are entering the market, develop An Ewallet App Like Payit, taking your business to the next level.

5. Slice

Slice, like Taptap Send, could target a certain market. Slice seeks to ease financial management for young Indians by combining digital banking, rapid credit access, bill payment capabilities, and spending data into a single app.

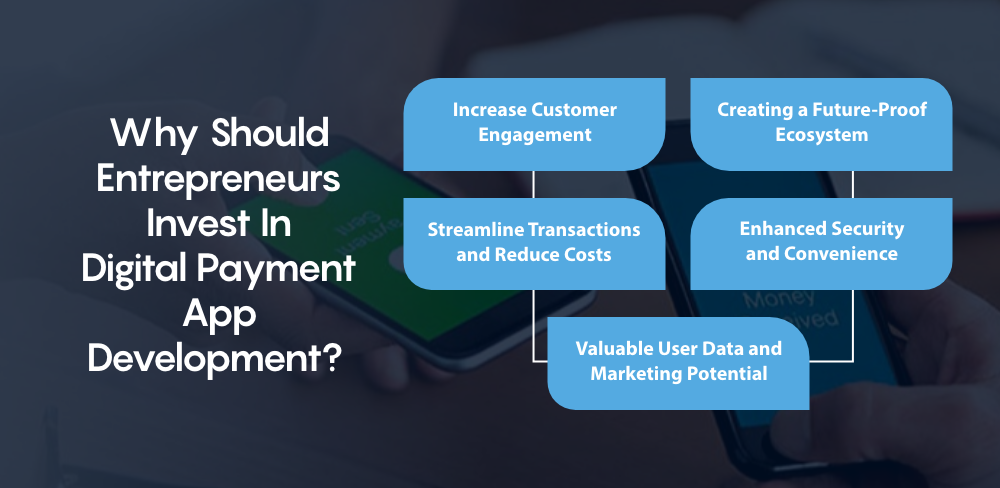

Why Should Entrepreneurs Invest In Digital Payment App Development?

The rise of mobile wallets creates a tempting opportunity for entrepreneurs. Here’s how investing in e-wallet app development can help your business:

- Increase Customer Engagement

- Streamline Transactions and Reduce Costs

- Valuable User Data and Marketing Potential

- Enhanced Security and Convenience

- Creating a Future-Proof Ecosystem

1. Increase Customer Engagement

Ewallet apps are popular among tech-savvy, mobile-first customers. You can tap into this increasing market sector by providing a convenient and secure payment method. Furthermore, e-wallet apps extend beyond simple purchases. They enable loyalty programs, targeted discounts, and in-app features, which can boost customer engagement and brand loyalty.

2. Streamline Transactions and Reduce Costs

Ewallet apps eliminate the need for cash handling and physical point-of-sale devices, resulting in faster transactions and lower operational costs. As per Android and iOS app development services providers, linking your ewallet app with a reliable payment gateway helps simplify the payment process, reducing errors and transaction fees.

3. Valuable User Data and Marketing Potential

Ewallet apps offer valuable user data for marketing purposes, including buying habits and preferences. Use this information to personalize marketing efforts, offer targeted promotions, and create new products or services that cater to your target audience. This data-driven approach can give you a huge advantage over competition.

4. Enhanced Security and Convenience

Ewallet apps use robust security features like multi-factor authentication and encryption to safeguard user trust and sensitive financial information. Furthermore, they provide clients with a streamlined payment experience by eliminating the need to carry cash or cards. This convenience can dramatically boost consumer happiness and brand reputation.

5. Creating a Future-Proof Ecosystem

Ewallet apps can form the foundation of a larger financial ecosystem. Integrate bill payment, money transfer, and micro-investment capabilities to provide your users with a one-stop financial hub. This builds long-term client relationships and puts your business at the forefront of the digital payments revolution.

Key Steps to Develop An App Like Mobily Pay

Creating mobily Pay app for fintech requires various technical skills and experience, including software development, security, and financial systems expertise. In this post, we will review the banking mobile app development procedures, from idea to launch.

- Deep Dive into the Market

- Design for Usability and Delight

- Building the App Engine

- Rigorous Testing is Key

- Launch and Continuous Improvement

1. Deep Dive into the Market

Conduct rigorous market research before launching development efforts. To develop an app like Mobily Pay, learn about your target audience’s demands, behaviors, and preferred mobile wallet features. Analyze apps like Mobily Pay to understand what works well and where you can fill holes. This research will help you build your app’s features and unique selling proposition.

2. Design for Usability and Delight

After defining your app’s vision, create a visually appealing UI and UX. Prioritize the user’s needs. Create a clear, intuitive design that enables users to easily navigate features. Don’t overlook aesthetics; with the help of a wallet app development services provider, create a visually appealing design that fits your brand identity. Create wireframes, mockups, and prototypes to test your design with potential consumers and get valuable feedback.

3. Building the App Engine

This is where the magic occurs. The hired banking app development company will implement your design by creating the app’s capabilities. Because security is critical in a financial app, ensure that your developers emphasize strong security methods. It safeguards user data and financial information—partner with reputable payment gateways to facilitate secure transactions within your app.

4. Rigorous Testing is Key

After mobile banking development, rigorous testing is crucial. The QA (Quality Assurance) team will thoroughly test the app on various devices and operating systems to discover and resolve any issues or glitches. Conduct usability testing with real users to develop an app like Mobily Pay successfully. It helps to enhance the app and ensure a smooth and intuitive experience

5. Launch and Continuous Improvement

After comprehensive testing and polishing, you can launch an eWallet application in Morocco anywhere. However, the development process continues beyond there. To develop an app like Mobily Pay, continue to monitor user comments, app performance metrics, and industry developments. Use this data to discover areas for growth and add new features to keep your app fresh and competitive in the ever-changing mobile wallet landscape.

Must-have Features of An Ewallet App Like Mobily Pay

Digital wallets worth considering must have a set of core functions. Naturally, the more features they provide, the better the user experience. However, understanding the fundamentals is critical to develop eWallet app in minimum budget:

- Seamless Transactions

- Secure Login

- Top-Up possibilities

- Bill Payment Integration

- P2P Transfers

- Budget Management Tools

- Loyalty Programs & prizes

- Fund Management

- User-Friendly Interface

- Multi-lingual Support

1. Seamless Transactions

Secure contactless techniques such as NFC or QR codes allow rapid and easy money transfers, bill payments, and in-store transactions.

2. Secure Login

Make eWallet apps with high security features that prioritize security by safeguarding user data and financial information with multi-factor authentication.

3. Top-Up possibilities

Develop an app like Mobily Pay that offers consumers a variety of ways to fill their e-wallets, such as debit/credit card linkages, and prospective cash deposit possibilities via partner networks.

3. Bill Payment Integration

Work with bill providers to provide an easy platform for users to pay utility bills, phone bills, and other expenses directly from the app.

4. P2P Transfers

Build an app like Slice that enables quick and secure peer-to-peer (P2P) money transfers between friends, family, and businesses.

5. Budget Management Tools

Include budgeting tools to help customers track spending habits, set financial objectives, and manage their money more effectively.

6. Loyalty Programs & prizes

Create loyalty programs or partner with businesses to give customers unique discounts, cashback prizes, or points for using the e-wallet app.

7. Fund Management

Create an app like Al Ansari Exchange that lets users quickly add, maintain, and track their e-wallet balances using a clear transaction history and categorization choices.

8. User-Friendly Interface

Create a simple, intuitive interface for users with all technical backgrounds. It will keep users engaged and retained.

9. Multi-lingual Support

Provide the app’s interface and functionalities in several languages to reach a larger audience, especially if targeting overseas markets.

How Much Does It Cost To Develop An App Like Mobily Pay?

An eWallet App Development costs between $8,000 and $30,000, depending on criteria such as the app platform, tech stack, feature set, complexity, etc.

A simple eWallet app with basic features and a standard design will cost between $8,000 and $20,000. A more comprehensive model, with enhanced features, will cost between $20,000 and $30,000.

It is difficult to provide a precise estimate when discussing the cost of fintech app development. As a result, you are strongly advised to visit an iOS or Android app development company for a more Mobily Pay app cost estimate.

How Much Does It Cost to Maintain An Ewallet App?

The cost to maintain an app like Mobily Pay is about 20% of the initial online wallet app development cost annually. For example, if establishing an e-wallet app costs $30,000, expect to pay roughly $6,000 yearly for maintenance. This includes bug patches, security updates, server maintenance, and new features to keep your software competitive in the ever-changing mobile wallet landscape.

Tech-stack Used In Building An Ewallet App

If you wish to develop an app like Mobily Pay, you must carefully go through the tech stack requirements mentioned in the table below:

|

Component |

Technologies |

|

Frontend |

React Native, Flutter, Swift, Kotlin |

| Backend |

Node.js, Python (Django/Flask), Java (Spring Boot) |

|

Database |

SQLite, MySQL, PostgreSQL, MongoDB, Firebase |

| API Integration |

RESTful APIs, GraphQL, SOAP |

|

Authentication |

OAuth, JWT |

| Push Notifications |

Firebase Cloud Messaging, Apple Push Notification Service |

|

Analytics |

Google Analytics, Firebase Analytics |

| Version Control |

Git, GitHub, Bitbucket |

|

Deployment |

Google Play Store, Apple App Store, TestFlight, Firebase App Distribution |

Wrapping Up!

People now use eWallet apps daily. Though most appear to be content with current platforms such as Taptap Send, Slice, and Al Ansari Exchange, you can grab an opportunity for development and capturing new markets.

Digital wallets have repeatedly disrupted the market with their distinct value propositions and usage of cutting-edge technologies. BNPL and Cash Advances are all based on eWallet solutions.

If you want to develop an app like Mobily Pay, now is the time to collaborate with an ewallet app development company to make it a reality. Dev Technosys is a top full stack app development services provider that offers comprehensive eMoney app development Services. Our specialized developers have the knowledge and experience to offer high-quality eWallet software solutions adapted to your individual needs.

Frequently Asked Questions

1. What Is An EWallet App?

The eWallet apps, also known as digital wallets, mobile wallets, or payment apps, are smartphone applications. The apps allow users to transfer funds (including internationally), manage bank accounts, carry virtual cards, pay bills, apply for financial products, and much more.

2. How Much Does It Cost To Develop An App Like Mobily Pay?

The cost to develop Mobily Pay ranges from $8,000 to $30,000 depending on the criteria. It includes app platform, tech stack, feature set, complexity, etc.

3. How Long Does It Take To Develop An App Like Mobily Pay?

The typical time to build a wallet app like Mobily Pay is between 3 and 11 months. Apps with complex designs and rich functionality require more development time. On the other hand, simpler apps are less expensive and faster to construct.

4. How Does Mobily Pay App Work?

The steps to how a Money transfer app like Mobily Pay Works are mentioned below:

- User registration and account creation

- User Authentication

- Bank Account/Card Linking

- Support Various Transaction Types

- Transaction Authorization & Processing

- Transaction Confirmation

- Transaction History

5. How Do I Monetize My eWallet App?

Several monetization methods exist for eWallet apps, including charging transaction fees, selling premium features or subscriptions, cooperating with businesses for sponsored content, and adopting targeted advertising. Choose a strategy appropriate for your app’s aims and intended audience.