Biometric Authentication

Enables secure and fast login using fingerprint or facial recognition, enhancing user safety and preventing unauthorized access to financial data.

Get A QuoteEnables secure and fast login using fingerprint or facial recognition, enhancing user safety and preventing unauthorized access to financial data.

Get A QuoteAllows users to monitor transactions instantly, ensuring transparency, up-to-date information, and improved financial control.

Get A QuoteUses artificial intelligence to analyze spending habits, categorize expenses, and provide personalized budgeting recommendations.

Get A QuoteSupports holding, sending, and receiving multiple currencies within one wallet, ideal for international transactions and travelers.

Get A QuoteFacilitates immediate money transfers between accounts or users, ensuring seamless and efficient financial operations.

Get A QuoteProvides tailored suggestions based on user behavior to improve savings, spending, and investment decisions.

Offers real-time support through chatbots or live agents, resolving issues quickly without leaving the app.

Get A QuoteFintech Android app development in Saudi Arabia allows users to upload sensitive documents securely for verification or compliance, using encryption and secure servers.

Get A QuoteProvides real-time data, KPIs, and financial metrics for better decision-making and operational insights.

Get A QuoteHandles onboarding, authentication, and KYC compliance, ensuring only verified users access the platform.

Get A QuoteMonitors all user transactions for irregular activity, helping prevent fraud and ensuring regulatory compliance.

Get A QuoteUtilizes algorithms to detect suspicious behavior, flag fraudulent activities, and mitigate financial risk.

Get A QuoteSends instant alerts for non-compliance issues, helping ensure adherence to financial laws and regulations.

Get A QuoteGrants users access only to necessary data/functions based on their role, enhancing security and internal control.

Get A QuoteSimplifies new customer registration with secure forms, automated KYC, and guided steps for a smooth onboarding experience.

Get A QuoteDisplays real-time commission, bonuses, and earnings with visual reports to help agents track income and performance efficiently.

Get A QuoteManages, tracks, and prioritizes potential clients, ensuring timely follow-ups and improved conversion rates through organized lead workflows.

Get A QuoteGenerates tailored performance and financial reports, giving agents flexibility to analyze specific data and make informed business decisions.

Get A QuoteAllows encrypted sharing of sensitive files with clients and admin, ensuring privacy, compliance, and data protection during transactions.

Get A QuoteFacilitates in-app messaging, email, and voice calls, enabling seamless communication between agents, users, and support teams.

Get A QuoteTracks KPIs, sales goals, and productivity stats to motivate agents and help them meet business objectives effectively.

Get A QuoteGives real-time updates on client actions and transactions, allowing agents to respond promptly and offer proactive support or services.

Get A Quote

Our peer-to-peer payment app development delivers secure, scalable, and innovative fintech solutions tailored to your business needs. From digital wallets to investment platforms, we build high-performance apps that streamline financial operations, ensure compliance, and enhance user experience across all devices.

Our e-wallet app development company builds tailor-made fintech applications designed to meet your specific business needs. Our solutions include secure transactions, real-time analytics, and compliance-ready architecture. Whether it’s a startup or enterprise-grade platform, our custom fintech apps offer seamless user experiences, scalability, and integration with modern financial technologies to help you stay ahead in a competitive market.

Our fintech app development company provides secure and user-friendly apps that support contactless payments, peer-to-peer transfers, and multi-currency functionality. With features like QR scanning, transaction history, biometric login, and fraud protection, we empower businesses to offer convenient financial services that enhance user trust, engagement, and revenue in today’s digital-first economy.

We create fully functional and compliant mobile and web banking apps with features like real-time account access, fund transfers, transaction history, and loan management. Our banking solutions ensure top-level security, intuitive UI, and smooth performance, allowing traditional banks and neobanks to deliver smarter, faster, and more accessible digital banking experiences to their customers.

Our Android or creates powerful on-demand fintech applications that provide instant financial services anytime, anywhere. Our apps feature real-time payments, quick loan approvals, seamless account management, and personalized user experiences. Designed for scalability and security, these solutions enable businesses to meet the growing expectations of customers for fast, reliable, and convenient financial transactions.

We provide end-to-end maintenance and dedicated customer support to ensure your app runs smoothly post-launch. Our services include performance monitoring, bug fixing, updates, security patching, and 24/7 support. We keep your fintech or real estate application-optimized, secure, and aligned with the latest tech trends for continued user satisfaction and business growth.

We have a team of experienced developers that has expertise to create high-quality fintech applications with custom features.

The personal finance management apps help users to track their daily expenses, income, budget, and savings in real time.

The investment and trading applications allow users to sell, buy, and trade stocks, EFTs, and cryptocurrencies, and they also offer a real-time stock portfolio, making it easy for investment.

With the help of insurtech apps, users can sort the insurance policy according to their requirements and process the claim.

In banking apps, users can access their account details, check their balance, transfer money, pay bills, and view transaction history via a mobile device.

We, as a blockchain development services in Egypt provider, offer cryptocurrency wallet apps that allow users to manage their digital cryptocurrencies, such as Bitcoin and Ethereum.

It enables users to apply for a personal loan, check their credit score, monitor their loan application, and improve their credit health.

Blockchain in a fintech app enhances security, transparency, and efficiency by enabling decentralized, tamper-proof transaction records. It reduces fraud, lowers operational costs, and accelerates cross-border payments. Smart contracts automate processes like lending or insurance. By removing intermediaries, blockchain empowers users with greater control over financial data and transactions, fostering trust and innovation in the financial ecosystem.

Cloud computing delivers on-demand computing services, like storage, processing, and networking, over the internet. It enables fintech apps to scale efficiently, reduce infrastructure costs, and offer real-time data access. With enhanced security, backup, and collaboration tools, cloud platforms support innovation, business continuity, and faster development cycles in the evolving digital financial landscape.

AR/VR enhances user experiences by overlaying digital elements onto real-world environments (AR) or creating immersive virtual spaces (VR). In fintech, these technologies can provide engaging interfaces for financial planning, virtual banking branches, or interactive data visualization, making complex financial information more accessible, intuitive, and engaging for users and clients.

IoT connects physical devices to the internet, enabling real-time data collection and automation. In fintech, IoT can support usage-based insurance, fraud detection, and personalized financial services. Integrating smart devices allows for more precise risk assessment, transaction monitoring, and improved customer insights, transforming how financial services are delivered and managed.

AI enables fintech apps to analyze vast data quickly, automate decisions, and personalize services. It powers chatbots, fraud detection systems, credit scoring, and investment recommendations. By learning from user behavior and financial trends, AI enhances operational efficiency, reduces risk, and improves customer experience in a highly competitive and data-driven market..

In every type of business, there are always two sides: challenges and opportunities. We provide both sides to explore and understand what type of challenges occur and what opportunities you need to grab. So, let’s explore the challenges and opportunities:

Data security and privacy are one of the most crucial challenges, protecting the user's sensitive financial data from third-party members is a major concern. Need to implement various security measurements such as encryption, two-factor authentication, and biometrics.

Convincing users to convert their traditional finance services to fintech solutions can be a challenge. Provide me with robust services regarding fintech solutions such as better UI/UX, good customer support services, and credibility.

For startups or small businesses, funding is one of the most common and major challenges to start a fintech solution. Limited resources, rapid technological shifts, and investor expectations make it challenging to stand out and achieve long-term sustainability.

The fintech solution expands to a wide range of digital payments and provides convenience to various industries such as e-commerce, healthcare, and more. Rising e-commerce and cashless payments drive faster transactions and offer convenient payment solutions.

Open Banking enables secure data sharing between banks and fintechs through APIs, fostering innovation and personalized financial services. It empowers users with greater control over their financial data, driving competition and transparency.

AI and Data Analytics empower fintech apps to deliver personalized experiences, detect fraud, automate decisions, and optimize risk assessment. These technologies enhance customer service, improve accuracy, and drive smarter, faster financial insights and operations.

Dev Technosys is a reliable fintech app development company in UAE that offers a robust development process, with each step defined in detail. We observe the market analysis to check the trending and successful solutions, and analyze the existing fintech solutions. After that, we identify the core and premium features that must be integrated and design a user-friendly interface to easily interact with them. Begin the real coding and test the app under various conditions, and finally publish the app on selected platforms.

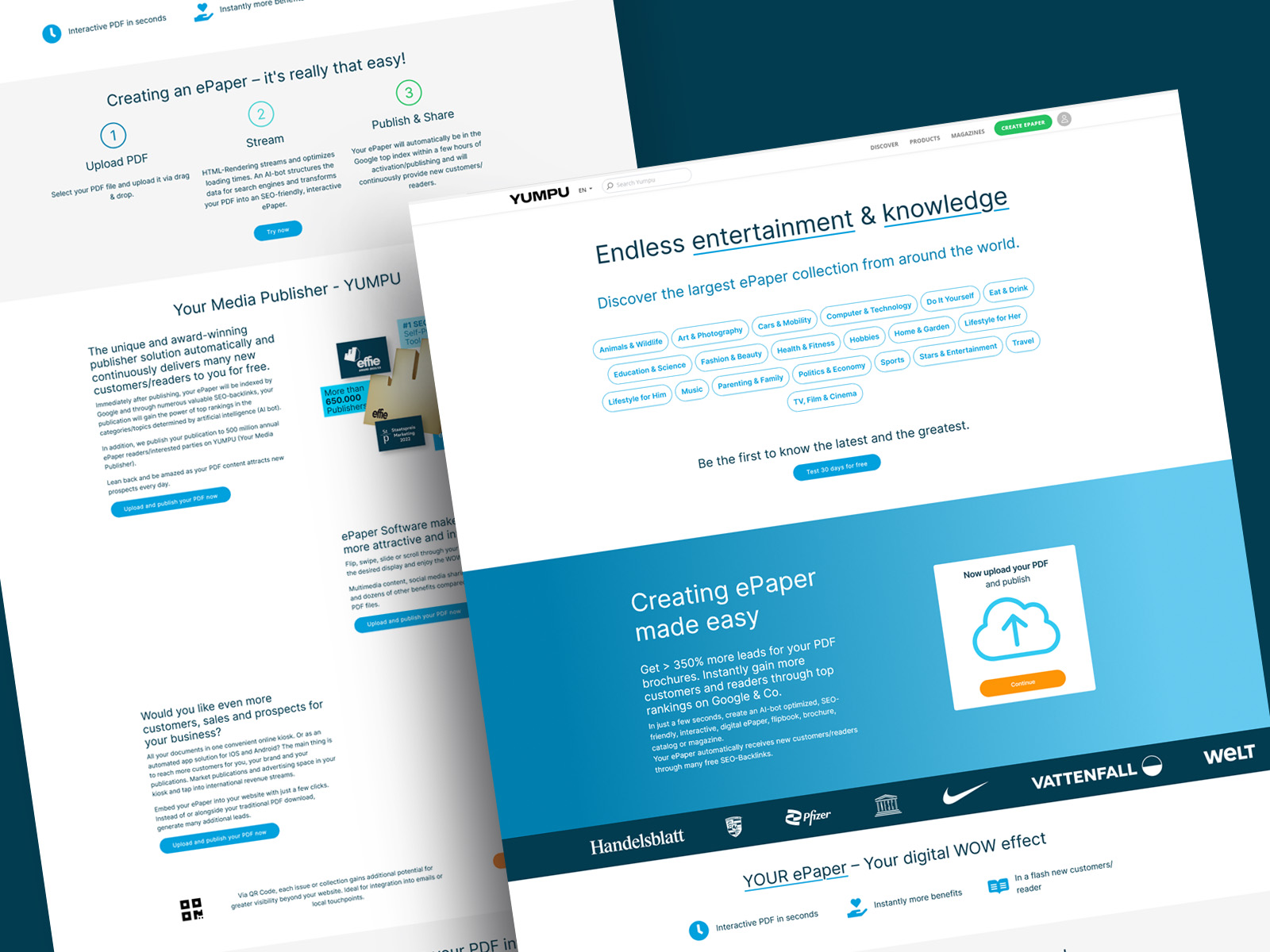

Check out our portfolio of magazine applications, specially designed with advanced features and the latest technology. Every solution we built is tailored to assist the publishing sector more effectively, fulfill requirements, and support a better future.

Find and read the premium magazines and newspapers that you know and hundreds more.

The cost to build a fintech app is around $8,000 to $25,000, ddepending on the unique project requirements. The cost can be changed as per the various factors such as app complexity, premium features, infrastructure, deployment platforms, development team, security measurements, and more. Are you looking to know the exact fintech app development cost? Connect with our fintech mobile app development company in UAE to provide accurate costs in detail.

Get a Cost EstimateThe cost to maintain a fintech app is approximately 15% to 20% of the initial end-to-end fintech app development cost in UAE. The maintenance can fluctuate due to several reasons and factors such as a higher number of features, networking, upgrading OS versions, fixing bugs or glitches, regular updates, performance optimization, and more. Businesses can also make a list of updates, such as custom maintenance, and pay only for specific updates.

Book a Free ConsultationDiscover the robust tools and cutting-edge technologies powering modern fintech app development, delivering secure, scalable, and user-centric solutions that drive innovation, efficiency, and competitive advantage in the financial industry.

Dev Technosys is a market-leading fintech app development company in UAE that has a team of experienced developers to build successful applications and websites.

We have a team of professional and skilled developers that has expertise in robust technologies such as Python, Java, C++, PHP, and more.

Our company has expertise in different fintech app development solutions such as banking apps, digital wallets, and more.

Our dedicated developers can create customized fintech solutions that meet specific requirements and demands.

Our AI development company in Dubai provides support and maintenance services to monitor daily operations and keep the app up to date.

Request A Quote About Our Fintech App Development Services

Get a QuoteThe fintech app development cost lies between $8,000 and $25,000, or is based on the unique project needs or requirements. The overall cost of blockchain-based fintech app development can fluctuate due to several factors, including project complexity, premium features, size, functions, deployment platforms, infrastructure, and the development team.

The digital banking app development can take around 3 to 6 months, with overall development. The timeline is based on various factors such as developers' working hours, project size, high numbers of features, and more.

The cost to hire fintech app developers UAE is around $15 to $25 per hour, depending on project complexity. The developers' hiring can be changed due to various crucial factors such as the developers' living location, working experience level, rich skill set, and more.

Yes, our company prioritizes your privacy and security by providing a comprehensive Non-Disclosure Agreement (NDA) to protect your project idea. This ensures complete confidentiality, safeguarding your intellectual property throughout the investment and trading app development process and beyond, giving you peace of mind.

Yes, our fintech app development company specializes in developing fintech apps for both iOS and Android platforms. Using native languages like Swift and Kotlin or cross-platform frameworks such as Flutter and React Native, we deliver high-quality, secure, and seamless apps tailored to your business needs across all devices.

Yes, our fintech app development company in UAE offers reliable maintenance and support services to ensure your fintech app runs smoothly. We provide regular updates, bug fixes, performance optimization, and technical assistance, helping you maintain seamless functionality and adapt to evolving business needs for long-term success.