Are you wondering how to build an app like Al Ansari Exchange? If yes, this blog is for you. It will provide you with a complete overview of the development of the money transfer app like Al Ansari Exchange.

The finance industry is a dynamic one. With only one click, people can send and receive money worldwide. Unlike traditional banks, users can quickly and easily open new accounts, complete transactions, and carry out various other online banking tasks via mobile banking.

Furthermore, the size of the global digital remittance market was estimated at USD 19.65 billion in 2022 and is expected to increase at a compound annual growth rate (CAGR) of 15.6% from USD 22.72 billion in 2023 to USD 72.45 billion by 2031. For this reason, many businesses are considering how to develop a currency transfer app like AI Ansari Exchange to take their business one step ahead.

If you’re one of them, read this blog. Here, you will learn how to develop a money transfer app, its features, cost, and many other things that you need to build an app like Al Ansari exchange.

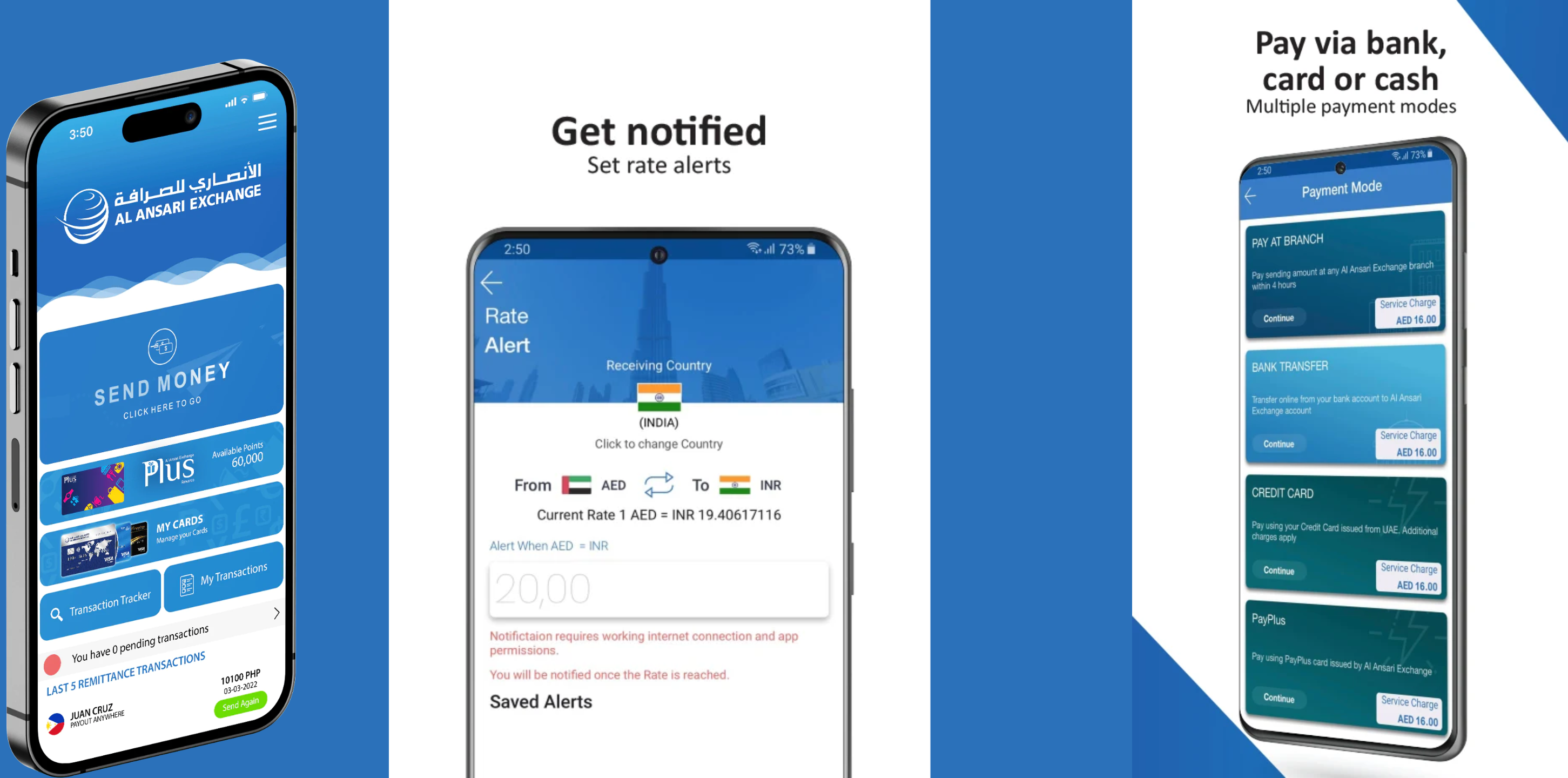

What Is The Al Ansari Exchange App?

Al Ansari Exchange is an online platform founded by Mohamed Al Ansari. Through this banking app development, users can send mzoney anywhere and at any time. In addition to several features, users can select from multiple payment options and enjoy the best exchange rate for money transfers. The app offers a smooth online registration, remittance, and payment process for transactions with Al Ansari Exchange.

Developing a currency transfer app could be an excellent way to earn more money, but it depends on factors such as competition, market demand, and regulatory requirements. Hence, businesses can stay competitive in the market by taking assistance from an ewallet app development company. The mobile app development company will share its experience with you to survive in the industry by developing a high-quality and rich-featured money transfer app.

Market Stats of Al Ansari Exchange App

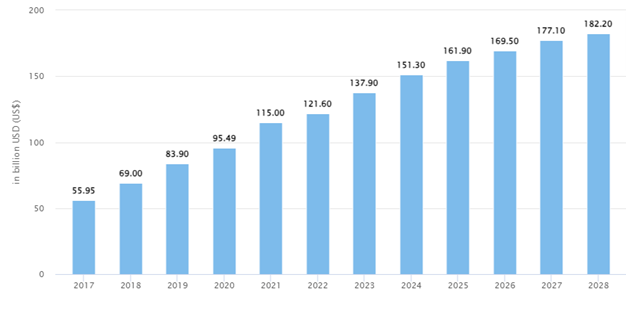

- In 2024, it is anticipated that the total transaction value in the digital payments sector would be US$11.55 trillion.

- By 2028, the total transaction value is predicted to have grown at an annual rate of 9.52% (CAGR 2024–2028), or US$16.62 trillion.

- Digital commerce is the market leader, with a projected $7.63 trillion in total transaction value in 2024.

- The transaction value is predicted to grow at a pace of 4.76% per year (CAGR 2024–2028), with a projected total value of US$182.20 billion by 2028.

- By 2028, there are projected to be 18.85 million users in the digital remittances market.

Steps To Build an App Like Al Ansari Exchange

It is vital to know every best cashless payment app is different; there are some critical stages that you need to take to build an app like Al Ansari Exchange. Considering the following steps, you may not miss anything, helping to build a p2p payment app with successful functionality.

- Conduct Market Research

- Choose Technology Stack

- Design UI/UX

- Development of App

- Testing and Quality Assurance

- Launch and Monitor

- Update and Improve

1. Conduct Market Research

Before diving into the process of banking mobile app development, conduct thorough market research. It’s a critical step to build a p2p payment app. This market research will help you identify the target audience, analyze competitors, and understand emerging market trends that ensure your app addresses specific user needs.

2. Choose Technology Stack

At this phase to build a p2p payment app you must choose a suitable technology stack to build an app like Al Ansari exchange based on security, scalability, and platform compatibility. Moreover, decide whether to develop a native application for Android or iOS or opt for cross-platform development. Hire Android or iOS app development company as per requirements.

3. Design UI/UX

You are supposed to build a p2p payment app with user-friendly and visually appealing capabilities that enhances user engagement. Ensure a user-centric approach, employ prototypes and wireframes, and use testing to optimize navigation and data presentation. This will help provide an enjoyable experience and also boost app adoption. For this process, you can take help from a mobile app development company to ensure a desired outcome.

4. Development of App

Here you need to hire an on demand banking app development company to bring your app to life. Choose a programming language and start building the frontend and backend of your app. At this stage, you are supposed to regularly test and iterate your app during the development procedure. This will enable you to identify and address any issues.

5. Testing and Quality Assurance

This development phase includes functional testing, performance testing, security testing, and compatibility testing. It ensures a smooth experience to users and trustworthy financial management tools for users. Hire Al Ansari Exchange app developer who can conduct rigorous testing to identify and resolve glitches and bug issues, ensuring the app’s seamless functionality and stability.

6. Launch and Monitor

Once the app’s testing is completed, launch your app on different platforms. Here, you are responsible for monitoring your app’s performance, user feedback, and app analytics to assess the app’s success and find out where improvements are required. Monitoring will allow you timely updates, feature enhancements, and bug fixes, ensuring your app stays competitive.

7. Update and Improve

Last but not the least stage to create money transfer app in which you need to update and improve your app continuously to keep it at its best. Here, you can ask a banking software development solutions UAE to address the users’ feedback and pain points. The app development company will give advice on adding new features and enhancing usability, helping you stay updated with emerging technologies.

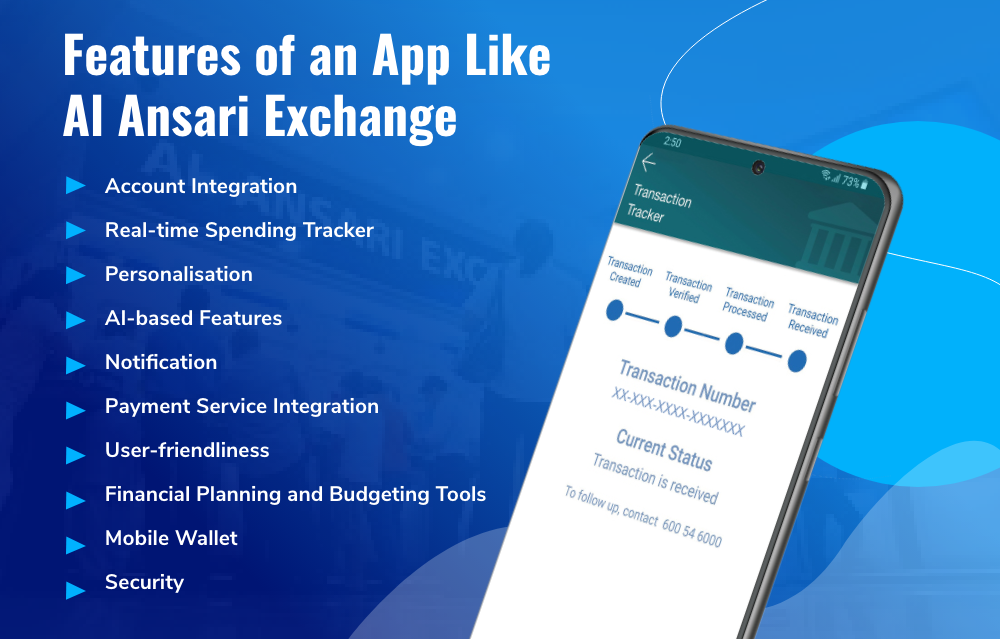

Must-Have Features of an App Like Al Ansari Exchange

There could be a range of features that your money transfer app offers to its users, depending on your idea and the purpose of your future fintech application. According to Wallet app development services provider, to get success, ensure to offer the following features in your app:

- Account Integration

- Real-time Spending Tracker

- Personalisation

- AI-based Features

- Notification

- Payment Service Integration

- User-friendliness

- Financial Planning and Budgeting Tools

- Mobile Wallet

- Security

1. Account Integration

User’s financial accounts, including mutual funds, bank accounts, debit cards, credit cards, and loans should be collected by your app like Al Ansari Exchange app.

2. Real-time Spending Tracker

Allow users to track their expenses in real time. So that they can save their time and money is quite helpful.

3. Personalisation

Develop an ewallet app like Payit that increases user appeal for fintech apps by tailoring the user experience to the user’s needs.

4. AI-based Features

Use AI algorithms in your app to increase app efficiency, generate analytical-prognostic datta,and interact with customers online around-the-clock.

5. Notification

To give users fast updates on transactions, investment performance, account activity, and bill payment, notification is a critical component of your app.

6. Payment Service Integration

To facilitate safe and flawless transactions, payment service integration is a critical element of the Ewallet app like AI Ansari Exchange

7. User-friendliness

Ensure that your fintech app is user friendly. With an easy-to-use layout that suits users of all experience levels.

8. Financial Planning and Budgeting Tools

These features empower users to take control of their finances and make wise financial decisions.

9. Mobile Wallet

Offer seamless mobile payment solutions. By integrating mobile wallets and streaming the payment process, you can attract and retain users.

10. Security

Strong security measures, including two-factor authentication, data encryption, and biometric authentication should be included in your app, protecting user data.

Know the Cost To Build An App Like Al Ansari Exchange

The cost to develop a banking app varies depending on whether it’s an Android or iOS app. The cost of app design also depends on the UI complexity and availability of tiny things like micro animations. Developing a simple app design doesn’t take much time, reducing its cost.

However, if you want animation and custom elements in your app, then it adds to the complexity and app design cost.

Still, if you have any confusion about the payment app development cost, look at the given table, demonstrating the cost-based app’s complexities:

|

Based On Complexity |

Estimated Cost |

| Simple App with essential features |

$9000 – $16000 |

|

Moderately to Complex Fintech App |

$16000 – $20000 |

| High-end (highly) Complex Fintech App |

$25000+ |

Always remember that the cost of Al Ansari Exchange app or other fintech app can be changed based on different factors. The factors include developer’s team, chosen platform for app development, app design, and many more. Hence, collaborating with banking software development services providers will help you in determining an exact cost to build an app like Al Ansari Exchange.

How Much Does It Cost To Maintain An App Like Al Ansari Exchange App?

Once your app is live on platforms, such as the Apple app and Google Play Store, you need to track key metrics, highlighting the number of app installations and engaged users. The maintenance phase comes after development and publication in the Al Ansari Exchange app development lifecycle.

It often incurs additional costs. The cost to maintain an app can fall between 15 to 20% of the overall development cost. For instance, if the payment app development cost is $10000, the maintenance cost of the app would be $1500 to $ 3000 annually.

Furthermore, like the app development cost, the maintenance cost also depends on factors such as the app’s complexity, number of users, platform and operating system, and frequency of updates.

How Dev Technosys Can Help You to Build an App Like Al Ansari Exchange?

Fintech applications are in high demand as they offer a one-stop solution for money management. Developing such an app is an exciting endeavor. The market for fintech applications has grown exponentially, with increasing users regularly making investing in Fintech app development profitable.

If you want to build an app like Al Ansari Exchange, look at Dev Technosys. It’s an ewallet app development company uae. We have more than 12 years of experience in the IT market. Our team has numerous FinTech software solutions including software for investment, banks, loans, digital wallets,and many more. So what are you waiting for? Share your project’s requirements with us, and let us show our expertise in Fintech.

Frequently Asked Questions

1. How Much Does It Cost To Build An App Like Al Ansari Exchange?

The cost to create an App Like Al Ansari Exchange varied but generally ranged from $9000 to $25000, depending on features.

2. How Long Does It Take To Build An App Like Al Ansari Exchange?

Depending on complexity and development resources, developing an app like Al Ansari Exchange may take 3 to 10 months.

3. How Often Do Fintech Apps Need Maintenance?

The fintech app requires regular maintenance, generally every 2 to 3 months. It ensures performance, security, and compliance with regulations.

4. How Can You Make Money From A Currency Transfer App?

The currency transfer app can earn money through exchange rate markus, transaction fees, premium features, and investment decisions.

5. How Much Does It Cost To Hire Dedicated Ewallet App Developers?

If you hire dedicated app developers, they charge around $15 to $25 per hour.