The process to develop an app like OPay encompasses various factors influencing the overall investment required. OPay is a multifaceted financial services platform that integrates mobile payments, ride-hailing, food delivery, and other essential services, necessitating a robust architecture to support its diverse functionalities.

The development journey begins with a thorough analysis of the app’s desired features, which may include user account management, secure payment processing, geolocation services, and real-time data analytics. Additionally, the choice of platforms—whether to build for iOS, Android, or both—can significantly impact the scope and complexity of the project.

Moreover, considerations surrounding regulatory compliance, security protocols for safeguarding user data and transactions, and the potential need for integration with various third-party APIs add layers of complexity to the development process. By carefully navigating these elements, stakeholders can create a successful app that meets user needs and stands out in a competitive market.

Understand The Motive Of OPay

OPay is a mobile payment and financial services platform similar to an e-wallet app like Phonepe that aims to simplify and enhance the way users manage their finances and conduct transactions in their daily lives.

Its primary motive is to provide a seamless, convenient, and secure solution for various financial activities, including money transfers, bill payments, ride-hailing, food delivery, and more.

By investing money to develop an app like OPay with multiple services into a single app, businesses seek to address the diverse needs of users. This is a rapidly evolving digital economy, particularly in markets with limited access to create banking application like OPay.

Additionally, its commitment to boost technology for financial aids drives its mission for mobile app development to foster economic growth.

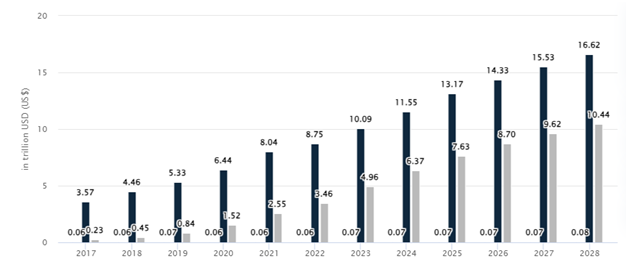

Future Predictions And Projections In FinTech Industry

- The largest market will be Digital Assets with a sum of US$80.08bn in 2024.

- The average AUM per user in the Digital Assets market is projected to amount to US$96.05 in 2024.

- The Digital Assets market is expected to show a revenue growth of 17.38% in 2025.

- In the Digital Payments market, the number of users is expected to amount to 4,805.00m users by 2028.

How Does An App Like OPay Works?

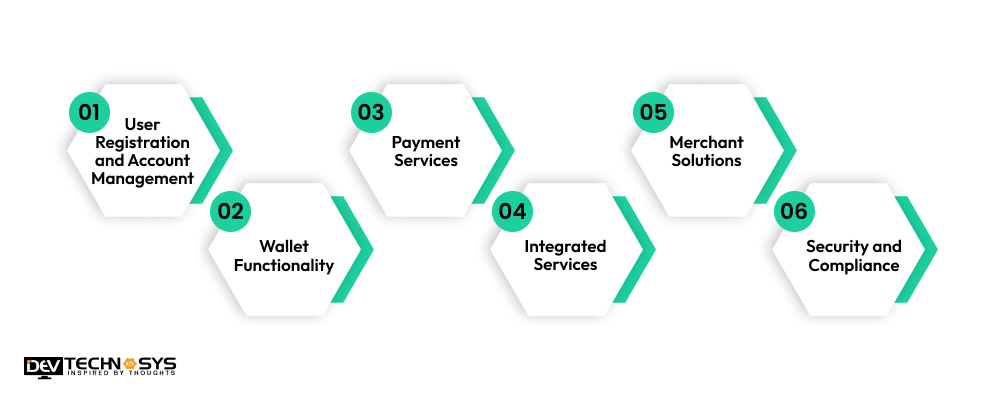

Here’s an overview of how an app like OPay operates. It is very important for the process to develop an app like OPay. They are broken down into six key points:

1. User Registration and Account Management

Users start by downloading the app and creating an account, which involves providing personal information such as name, phone number, and sometimes identification documents for verification. This registration process is crucial for ensuring security and compliance with financial regulations.

2. Wallet Functionality

OPay money transfer app offers users a digital wallet that enables them to store funds for various transactions. Users can add money to their wallets through bank transfers and cash deposits. An app like Al Ansari Exchange provides a wallet for managing finances and making payments.

3. Payment Services

A motive to develop an app like Taptap Send is to facilitate a wide range of payments. Users can send money to friends or family, pay bills, and make purchases at partnered merchants. The app typically supports QR code scanning for quick transactions, as well as traditional payment methods.

4. Integrated Services

OPay is the best app for funds transfer that stands out by offering a suite of integrated services beyond payments. This includes ride-hailing and food delivery with multiple functionalities. These integrations are for user convenience and encourage the use of Islamic app development services in different regions.

5. Merchant Solutions

The app also provides tools and features for merchants and service providers, enabling them to accept payments, manage transactions, and access customer analytics. Merchants can use the app to process payments via QR codes or through a point-of-sale (POS) system linked to OPay payment app.

6. Security and Compliance

Security is paramount in a financial services OPay lite app. The platform employs advanced encryption technologies to protect user data and transaction information. Partnering a banking app development company for compliance with local and international regulations, including standards, is also crucial.

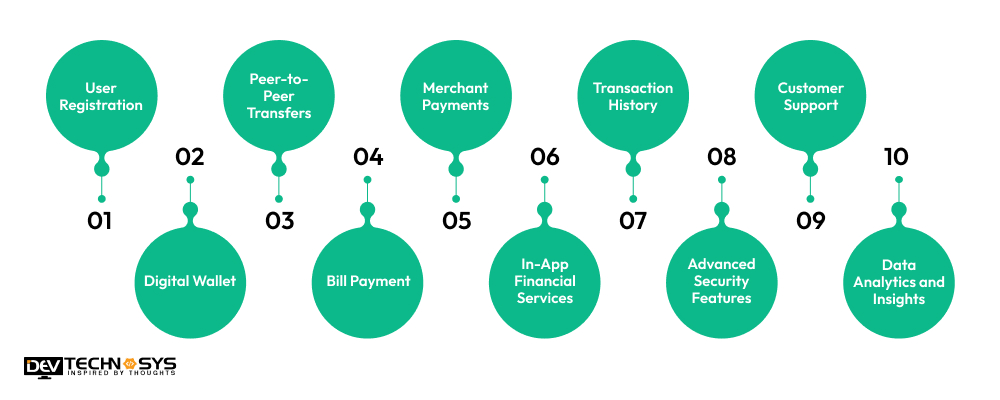

Significant Features Of A FinTech App Like OPay

Here are the top 10 significant features to easily develop an app like OPay. They are as follows:-

1. User Registration

A secure and straightforward registration process allows users to create accounts easily, often incorporating identity verification for enhanced security.

2. Digital Wallet

This feature enables users to store funds digitally, facilitating quick transactions without the need for cash or physical cards.

3. Peer-to-Peer Transfers

A fintech app like STC Pay allows users to send and receive money instantly from friends and family, making it convenient to split bills or share expenses effortlessly.

4. Bill Payment

The app allows users to pay utility bills, subscriptions, and other services directly, streamlining the payment process and enhancing convenience.

5. Merchant Payments

Integration with local businesses enables users to make purchases directly through the app, often utilizing QR codes or in-app payment options.

6. In-App Financial Services

Users can access loans, insurance, and investment options within the app, providing a comprehensive solution for various financial needs.

7. Transaction History

A detailed transaction record allows users to track spending, manage budgets, and monitor their financial health over time.

8. Advanced Security Features

Multi-factor authentication, encryption, and fraud detection mechanisms ensure user data is protected and transactions are secure. It is beneficial for iOS app development that offer privacy related services.

9. Customer Support

In-app customer support through chat bots or live agents helps users resolve issues quickly, enhancing overall user satisfaction.

10. Data Analytics and Insights

The app provides insights into spending habits and financial trends, empowering users to make informed decisions and improve their financial management.

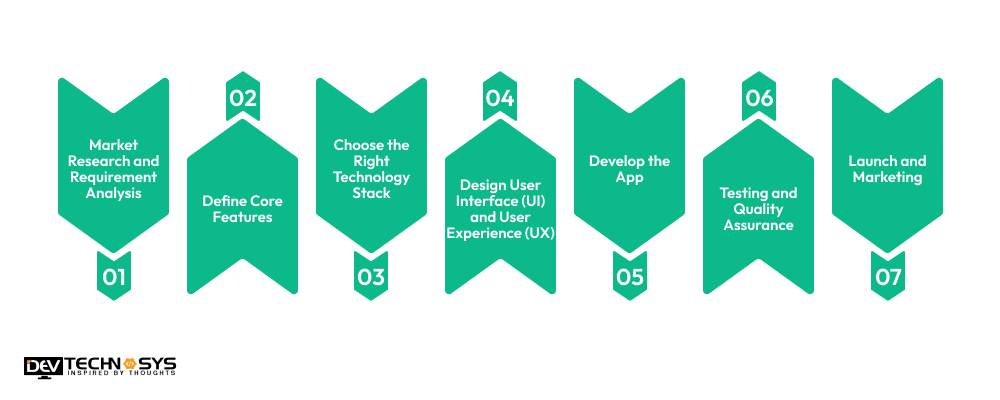

Major Steps To Develop An App Like OPay

The process to develop an app like OPay involves several critical steps to ensure functionality, security, and user engagement. Here are seven major steps to guide you through the development process:

1. Market Research and Requirement Analysis

Before initiating development, conduct thorough market research to understand your target audience, their needs, and the competitive landscape. Identify key features that users expect from a fintech app, such as payment processing, wallet functionalities, and integrated services. It is crucial to contact a mobile app development company with immediate effect for OPay app development.

2. Define Core Features

Based on your research, outline the core features of your app. Essential functionalities to build banking app like OPay include user registration and authentication, a digital wallet, payment processing capabilities, bill payments, peer-to-peer money transfers, and integrated services such as ride-hailing and food delivery. Prioritize features based on user needs and technical feasibility.

3. Choose the Right Technology Stack

Selecting an appropriate technology stack is crucial for the app’s performance, scalability, and security. Decide on the programming languages, frameworks, and tools you’ll use for both front-end and back-end development. Additionally, hire dedicated developers that could offer cloud services for hosting and data storage, as well as APIs for payment processing and third-party integrations.

4. Design User Interface (UI) and User Experience (UX)

Creating a user-friendly and visually appealing interface similar to an app like Mashreq is vital for user retention and engagement. Work on wireframes and prototypes that focus on intuitive navigation and a seamless user experience. Ensure that the design reflects your brand identity and is responsive across various devices. Incorporate feedback from potential users during the design phase to fine-tune usability and aesthetics.

5. Develop the App

With a clear roadmap and design in place, proceed to the development phase. This involves writing the code for both the front-end and back-end functionalities. Establish a robust database to manage user data, transaction records, and service integrations. During the process to develop an E-wallet app like Payit, prioritize security measures, like encryption and authentication, to protect sensitive financial information.

6. Testing and Quality Assurance

After development, conduct thorough testing to ensure the app functions correctly and meets quality standards. Perform various types of testing, including functional testing, usability testing, security testing, and performance testing. Focus to manage the cost to develop bank apps like OPay with less vulnerabilities. Gather feedback from beta testers to gain insights into the app’s performance.

7. Launch and Marketing

Once testing is complete and necessary adjustments have been made, prepare for the app launch. Develop a comprehensive marketing strategy for managing the cost to develop a mobile app. Utilize social media, email campaigns, and partnerships with influencers or affiliate marketers to reach your target audience. Ensure that your app is optimized for app store listings with appropriate keywords and appealing visuals.

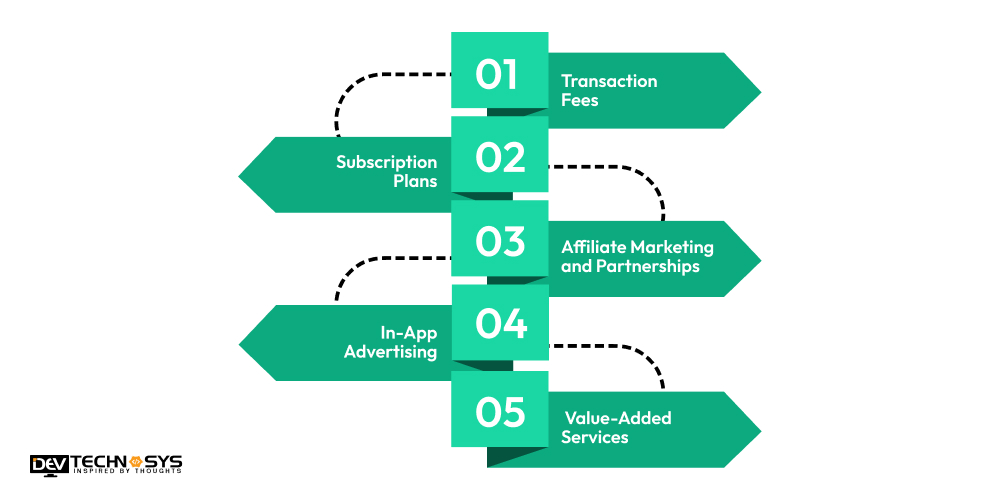

How To Monetize A FinTech App Like OPay?

Monetizing a fintech app like OPay requires a strategic approach that balances investment of money to develop an app like OPay. Here are five effective monetization strategies:

1. Transaction Fees

One of the most common ways to monetize a fintech app is by charging transaction fees for services like money transfers, bill payments, and merchant transactions. For every transaction processed through the app, you can build an app like SNB Mobile for a small percentage or a flat fee.

2. Subscription Plans

Offering premium subscription plans is another effective monetization strategy. Users can pay a monthly or annual fee for accessing services to transfer money through app like OPay, such as enhanced analytics, premium customer support, or lower transaction fees.

3. Affiliate Marketing and Partnerships

Establishing partnerships with other financial service providers, merchants, or brands can open additional revenue streams. You can earn commissions by promoting development of an E-Wallet application in Morocco with services like loans, insurance products, or investment opportunities.

4. In-App Advertising

In-app advertising can be a lucrative revenue source if executed thoughtfully. Displaying targeted ads for relevant products or services can provide an additional income stream without overwhelming users. But, it’s crucial to manage the cost to develop a banking app in UAE to increase monetization.

5. Value-Added Services

Offering value-added services can further enhance your monetization strategy. These might include financial planning tools and investment advice for users looking to manage their finances more effectively. You can approach an on demand app development company to add charging services.

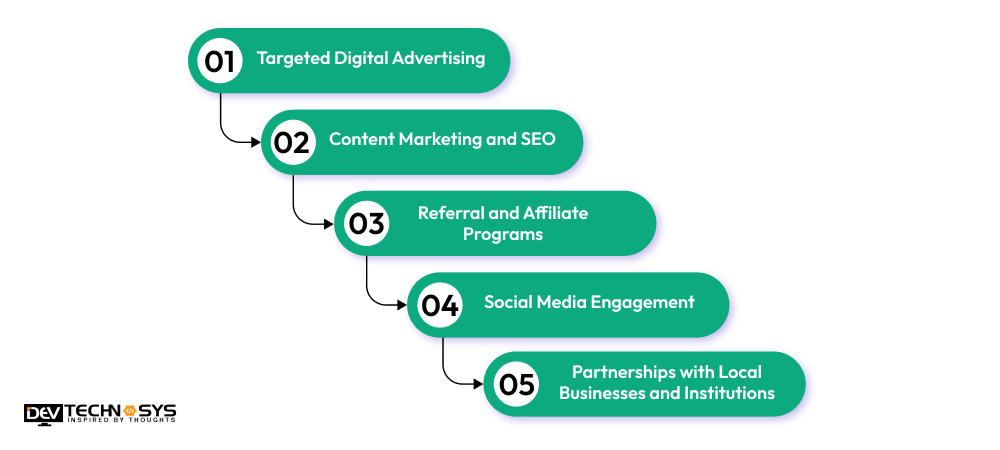

What Are The Marketing Strategies Of An App Like OPay?

Marketing and branding to develop an app like OPay requires a comprehensive approach to reach and engage potential users effectively. Here are five key marketing strategies to consider:

1. Targeted Digital Advertising

Utilizing targeted digital advertising is crucial for attracting the right audience for an app like Mobily Pay. Platforms such as Google Ads, Facebook, and Instagram offer robust targeting options that allow you to reach specific demographics based on age, location, interests, and online behavior.

2. Content Marketing and SEO

Building an app for money transfering with strong online presence through content marketing can significantly enhance visibility and credibility. This could take the form of blog posts, infographics, or videos that provide value to users while integrating relevant keywords to improve search engine rankings.

3. Referral and Affiliate Programs

Implementing referral and affiliate programs can leverage your existing user base and help in E-Wallet app development cost management. Encourage satisfied users to refer friends and family by offering incentives, such as cash rewards, discounts, or premium features for both the referrer and the new user.

4. Social Media Engagement

Active engagement on social media platforms can be increased by react native app development for building community with your users. Create profiles on platforms such as Twitter, Facebook, and LinkedIn to share updates, respond to user inquiries, and engage with your audience.

5. Partnerships with Local Businesses and Institutions

Establishing partnerships with local businesses and financial institutions can significantly boost your android app development process. Collaborate with retailers and banks to offer integrated services or co-promotions. You could create incentives for users who pay for goods or services using your app.

Cost To Develop An App Like OPay

The cost to develop an app like OPay varies widely based on the features implemented, the complexity of the application, and the expertise of the development team. For a simple version of the app, the mobile app development cost could range from $8,000 to $14,000 which may include basic functionalities.

In contrast, an advanced version of the app might see the cost to build a money transfer App like OPay escalate to between $14,000 and $26,000 or more which would incorporate a broader range of features such as payment processing, transaction tracking, integrated services like food delivery.

|

Structure Of A FinTech App |

Development Time | Estimated Cost |

| Simple App | 5-8 months |

$8000-$14000 |

|

Moderate App |

8-12 months | $14000-$20000 |

| Complex App | More than 12 months |

$20000-$26000 |

Maintaining a fintech app like OPay app for merchants incurs annual costs ranging from 15-20% of the original development cost. This cost to maintain an app includes expenses for regular updates, security enhancements, server hosting, customer support, and compliance with regulatory standards.

Obtain Your Business Growth Through OPay App Development!!

Investing money to develop an app like OPay can significantly enhance your business growth by providing a robust platform for hybrid app development services tailored to meet the evolving needs of consumers.

As digital payments continue to gain traction, leveraging the capabilities of a comprehensive online banking app like OPay positions your business at the forefront of the fintech landscape.

By offering features such as seamless money transfers and integrated payment solutions, you not only enhance customer satisfaction but also attract a wider user base.

Additionally, the app’s potential for data analytics allows you to gain insights for personalized offerings that can drive engagement and loyalty. Embracing this technology not only meets the current demands of consumers but also positions your business to develop an E-Wallet app for future success in the rapidly evolving financial services sector.

FAQs

1. What Is The Development Time Of An App Like OPay?

It may take up to 5-8 months to build a simple mobile app. But, it may take up to more than a year for an innovative mobile app.

2. What Is The Cost To Develop An App Like OPay?

The development cost starts from $8000 for a simple payment application. But it can go up to a maximum of $26000 for an advanced mobile app.

3. How OPay App Development Benefits Businesses?

There are multiple benefits from the development of payment mobile apps. They are as follows:-

- Attract large user engagement on the platform.

- Generate high revenue through multiple transactions.

- Access to mobile app development services for business growth.

4. How To Earn Through A FinTech App Like OPay?

Monetizing a fintech app like OPay requires a strategic approach that balances investment of money to develop an app like OPay. Here are five effective monetization strategies:

- Allow transaction charges and fee concessions.

- Provide memberships and allow subscriptions.

- Conduct affiliate marketing and partnerships.

- Implement advertisements on your mobile app.

5. Why Is Dev Technosys Important To Develop An App Like OPay?

Our payment mobile app development company help investors in the following manner:-

- Suitable mobile and web app development approach.

- Potential payment mobile app developers with excellent track record.

- Updated management of the development resources.

- Extensive technical support with targeted satisfaction.