IT Mobile apps have become essential tools for financial organizations in the digital age. You may be curious about the cost of developing a banking application in the United Arab Emirates. This blog will explore the complexities of budgeting such a venture. It will take into consideration factors like regulatory Compliance, user experience, development and security.

So, you’ll know by the end how much it cost to build a banking app in the competitive and dynamic UAE landscape. Navigate the financial waters for app development in the UAE, one of the most dynamic markets in the world.

What is a Banking App?

The banking app is an application that financial institutions develop to give their customers convenient access to various banking services and features via smartphones and tablets.

So, the apps enable users to carry out various financial tasks and transactions, including checking their account balances, paying bills, transferring money, depositing checks and managing investments.

These apps often include advanced security features such as biometric authentication and encryption to protect users’ financial data. Modern banking apps have evolved to be an essential part of the industry, allowing customers to manage their finances anywhere and anytime. They’ve revolutionized the way people interact with their banks.

Market Stats To Look At!

- The Digital Banks Market is expected to generate Net Interest Income of US$94.55m by 2023.

- The Net Interest Income (CAGR, 2023-2028) is expected to grow at a rate of 16.29% per year. It will result in a volume of US$201.10m for the market by 2028.

- Comparatively, the United States will generate most of the Net Interest Income (US$151.400.00m by 2023).

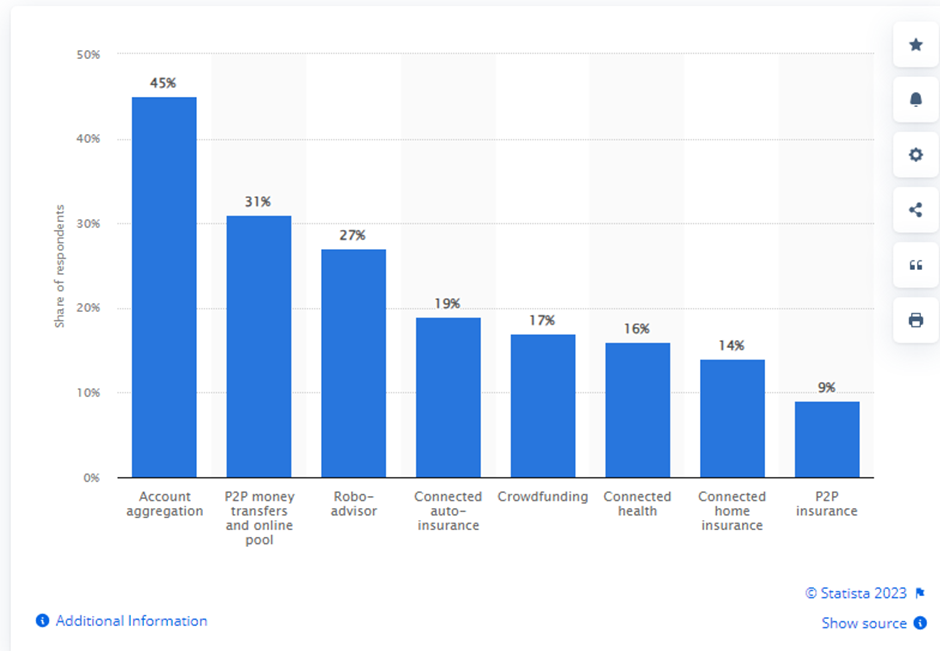

- A survey of the Middle East and North Africa region (MENA) in 2020 found that 45 per cent of respondents in the United Arab Emirates used account aggregation.

- Financial technologies are important players in the emerging ecosystem of the Middle East and North Africa (MENA) region, but banks must deploy them.

What is the Average Cost To Build a Banking App in the UAE?

The cost to build a banking app in the UAE varies significantly depending on a number of factors. So, a basic cost to build a banking app anywhere between $8,000 and $16,000. More complex, feature-rich applications may range from $16,000 up to more than $25,000.

Category |

Cost Range |

|

Planning and Design |

$2,000 – $5,000 |

|

Development |

$10,000 – $30,000 |

|

Testing and QA |

$5,000 – $8,000 |

|

Deployment |

$3,000 – $7,000 |

|

Security and Compliance |

$5,000 – $8,000 |

|

Maintenance and Support |

$5,000 – $10,000 |

|

Marketing and Launch |

$10,000 – $15,000 |

Here’s a tabulated overview of the estimated expenses for developing a banking app. With this cost breakdown, you can now strategize your budget effectively for the banking app development process.

App functionality, security, Compliance with UAE financial regulations, interface design and development complexity are key cost factors. Also, costs for updates, maintenance and servers should be considered. In the UAE, data privacy and regulatory Compliance is strict, so it’s important to work with mobile app development company in UAE.

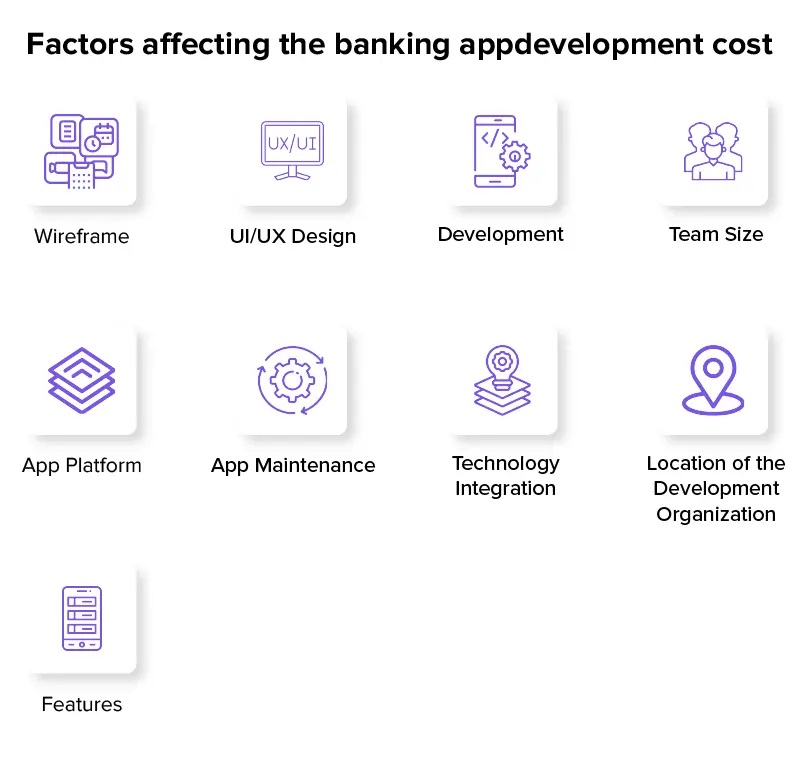

What Are the Main Factors that Determine the Cost to Build a Banking App in the UAE?

The cost to build a banking app UAE is affected by several factors. But you should ensure a successful launch and development of a compliant and secure banking app, these factors must be carefully considered. The following are the main factors that determine the cost to develop a mobile app in the UAE.

1. App Features and Functionality

The complexity and features of your banking app determine costs. So, standard functionalities include checking balances and transferring money. So, if you want to include advanced features such as investment management, currency conversion, or financial planning, then the cost to build a banking app will be higher.

2. Security and Compliance

UAE financial institutions and banking applications are subject to strict security regulations. It is essential to comply with these standards and implement robust security measures in order to protect the user’s data. So, cost to build a banking app will vary depending on the security level required. It includes features such as two-factor authentication and encryption.

3. User Interface (UI) and User Experience (UX)

User Interface (UI) and User Experience (UX) are two terms that describe the interfaces of a computer system. For a banking application to be successful, it must have a user-friendly and visually appealing interface. So, investing in a smooth UX and a well-designed UI can increase customer satisfaction. However, a sophisticated UI/UX can increase the cost to build a banking app.

4. Mobile Platforms and Devices

Cost to build a banking app will rise if you develop for different mobile platforms such as iOS or Android. So, compatibility with different devices, screen sizes and operating systems can also increase the cost and complexity of development.

5. Customization and Branding

The cost to build a banking app will be affected by the customization of the app in order to reflect the branding and features unique to your bank. So, the higher the cost to build a banking app that is tailored to your needs.

6. Third-party Integrations:

The cost to build a banking app integrating third-party APIs or services such as payment gateways, credit score services, blockchain technology or other services can be significantly affected if you plan to do so. So, consider the licensing and integration complexity.

7. Testing and Quality Assurance:

For a mobile banking application project, rigorous testing and quality assurance are essential. It is especially true in terms of functionality and security. Testing is necessary to ensure a secure and bug-free app, but this can be expensive.

8. Regulatory Compliance:

It is important to comply with UAE financial regulations. It may require extra development. Legal consultations, Compliance with Know Your Customer (KYC), Anti-Money Laundering Regulations (AML), and implementation of data security standards may be included in the banking app development cost.

9. Localization and Multilingual Support:

For a country as diverse as the UAE, the ability to offer the app in different languages and with localization can be vital for reaching a larger audience. So, it may also increase the cost to build a banking app.

10. Scalability:

To accommodate future growth, it is important to plan for future scalability. A scalable architecture can increase the initial cost to build a banking app but save money over time.

11. Project Timeline:

Cost to develop a banking app can be affected by the timeline of app development. Rushing projects can require more resources, which will increase the cost. A reasonable timeline for development can help you manage costs more effectively.

12. App Maintenance and Updates:

After the initial launch of the banking mobile app development, it is necessary to continue updating and maintaining the app to ensure its security and to stay up-to-date with the changing technologies and regulations. So, it is important to budget for these ongoing cost to build a banking app.

13. Infrastructure and Hosting:

To ensure that the mobile banking development is available and performs well, consider the cost of maintaining servers and infrastructure. Cloud-based solutions are cost-effective but require ongoing cost to build a banking app.

14. Marketing and Promotion:

Promoting the app to attract users is as important as building it. Budgeting is crucial to the success of an app in a highly competitive market.

15. Legal and Compliance costs:

Get in touch with the best mobile banking app development cost in the UAE that can help navigate the regulatory environment and ensure Compliance. So, it can be an expensive process. Obtaining licenses and approvals is part of this.

16. User Support and Training:

Customer support and training materials for users can be an additional cost to build a banking app. But the users must be able to navigate and use your mobile banking application development effectively.

17. Data Storage and Management:

The cost of storing and managing user data securely is high, especially when you consider privacy regulations. So, data centre costs and encryption methods can be included in the cost to build a banking app.

18. Insurance and Contingency:

The risks of building a financial application are inherent. Budget for insurance and create a contingency fund to deal with unexpected issues.

19. Consultation and Expertise:

It can be expensive to hire mobile app developers in the UAE, but they are invaluable for ensuring that your app is successful and meets all security and regulatory requirements.

20. The Cost of Acquiring and Onboarding Users:

Onboarding users and attracting them to your app can be done with incentives and marketing spending.

21. Feedback and iteration:

The feedback from users may require updates and iterations after the app has been launched. Budgeting for continual improvement is crucial for long-term success.

How to Build Banking Apps in UAE at a Low Cost?

The cost to build a banking app in the UAE is high, but you can save money during the development phase and generate revenue after the app has been launched. So, this section will explore seven cost-saving and monetization strategies for cost to make a banking app.

1. Cost-Saving Strategies

- Prioritise Features Wisely:

Prioritizing features is one of the best ways to reduce costs when developing an on demand app development solutions. Start with a minimum viable product (MVP), which only includes essential functionality.

So, you can launch your app quicker and collect user feedback while keeping the initial development costs low. You can add advanced features to your app as you gather feedback from users.

- Open Source and Third Party Solutions:

Reduce development costs and time by leveraging open-source libraries. Fintech companies have developed APIs and SDKs to help you quickly integrate payment gateways and security features. So, ensure that the third-party solution is compliant with UAE laws and meets your security standards.

- Cross-Platform Development:

It can be expensive to build a banking application for iOS and Android due to the requirement for separate iOS & Android App Development Company in UAE and codebases. So, consider using cross-platform frameworks such as React Native or Flutter.

These frameworks let you write code once and then deploy it across multiple platforms. So, it reduces development costs and time. To ensure compatibility and an optimal user experience, it is important to thoroughly test.

- Cloud Services:

Cloud services is crucial for infrastructure and hosting. Cloud providers such as AWS, Azure and Google Cloud provide scalable solutions, which can help you avoid investing in servers and data centres. But you must know it’s flexible, allows you to scale resources according to the growth of your app. It can be an effective way to reduce costs.

- Agile Development Methodology:

Agile development can increase productivity and decrease development time. Agile encourages frequent testing and continuous feedback. It can help you identify issues and minimize costly rework by encouraging iterative development.

- Offshore or Nearshore Development:

Outsourcing development to countries that have lower labour costs is a good idea. For example, India or Eastern European nations. It is possible to reduce costs while maintaining high quality. It’s important to select a on demand app development company in UAE who has a proven track record.

- App Maintenance and Updates:

Budget for maintenance and updates to be performed on a regular basis. Regular updates are crucial for improving user experience, Compliance and security. But, you can avoid unanticipated costs by planning these expenses and ensuring that your app is successful in the long term.

2. Monetization Techniques

You can use a variety of monetization methods to generate revenue once your app has been developed.

- Subscription Model:

Subscription-based services or premium features are available. Subscribers can enjoy ad-free experiences, advanced functionality, personalized financial advice or access to advanced features. So, this model generates a constant stream of revenue.

- Transaction Fees:

Charge specific transaction fees, like international money transfers, currency exchanges or bill payments. Transparency is key. Make sure these fees are competitive and transparent with other financial service providers in the UAE.

- Merchant Services:

Offer integrated payment solutions to businesses and merchants in the UAE. So, you can earn a fee or commission for each transaction that is processed via your app. But, it can be a particularly profitable approach if your app is popular with consumers and businesses.

- Advertisement and Sponsorships:

Display targeted ads within your app to generate revenue. So, you can also look into sponsorships or partnerships with businesses and financial institutions that interested in reaching your app users. Ads should not affect the user’s experience or the security of your app.

- Data Monetization:

You can anonymize and aggregate data from users to gain valuable insights about consumer trends and financial trends. These insights provide knowledge to businesses, financial institutions or market research firms. So, prioritizing user privacy and adhering to data protection regulations is essential.

- Cross-Selling Financial Products:

Cross-sell and promote financial products and services from your bank or other partner institutions. But, earn referral fees or commissions for successful transactions or sign-ups. So, make sure that your offerings aligned with the financial goals and needs of your users.

- White-Label Solutions:

White-label your banking app and offer it to other financial institutions within the UAE or nearby regions. So, it allows other banks the opportunity to customize and rebrand their app for their clients, allowing you to earn licensing fees.

In A Nutshell!

Developing a banking application in the UAE requires careful consideration of many factors. From feature complexity to strict regulatory Compliance, many things which you must keep in focus with the help of mobile banking app dvelopment company. So, cost to build a banking app can vary greatly depending on the project, but it is important to focus on security, user experience, and scalability.

However, financial institutions can successfully navigate the complex landscape of app development within the UAE by making informed decisions, managing costs efficiently and exploring viable monetization options. So, if you are someone who wants to know how to create a banking app then esnure to get in touch with the best dedicated developer team.

Frequently Asked Questions

1. What are the main factors that influence the cost to build a banking application in the UAE?

Costs vary depending on the complexity of your app, security requirements, regulatory Compliance and customization. So, costs can range from $8,000 up to $25,000.

2. How can I lower the development costs of my banking app?

Consider cross-platform development and open-source software, as well as outsourcing to countries with lower labour costs.

3. What are the costs of a banking application in the UAE?

Maintenance, updates, server host, security, regulatory compliance and marketing are all ongoing costs.

4. What are the most popular monetization methods for banking apps in the UAE?

There are many options, including subscription models, transaction charges, merchant services and advertising.

5. What is the importance of regulatory Compliance in building a banking application in the UAE

Compliance with regulatory requirements is essential. So, to avoid legal issues, ensure that you adhere to UAE financial regulations, data privacy laws and security standards.