Loan settlement is a much required process that ensures money lenders trust and authenticity. It is dependent on the credit score of a person. There are several methods to determine this score. But, different banking and account experts have invested their money in the credit score app development.

Additionally, it has benefitted them and helped to check the assets and liabilities that accounts for this credit score. The making of such applications has revolutionized the banking and finance industry in a much sophisticated manner.

To understand more about a credit score app, their features, development process, and cost, you should go through this blog. So, that you can get crisp and clear information to create one for your business.

What is a Credit Score App?

Users may monitor their credit ratings and make informed financial decisions with the aid of a credit score application. Additionally, a lot of apps let users apply for credit cards and get notifications if their credit history changes. So, investment in banking & finance software development services is beneficial to examine credit reports and offer tailored advice on raising credit scores.

Now you can see why a lot of banks are spending money on custom banking credit score app development. Both lenders and borrowers no longer have to deal with the aggravation of credit check procedures thanks to these apps, which have streamlined complicated procedures.

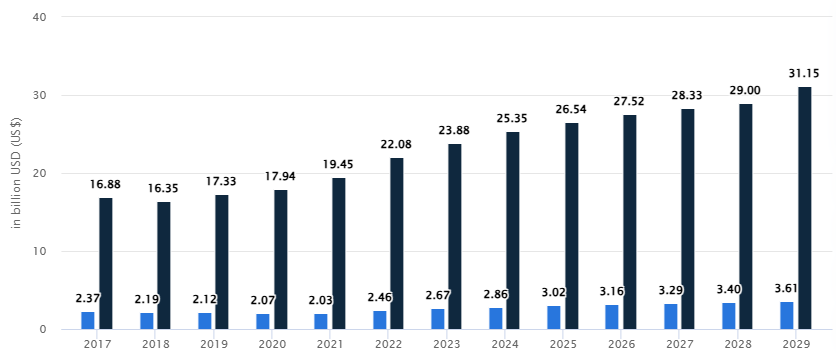

Market Stats of the Banking and Finance Industry

- The United Arab Emirates’ banking industry is predicted to generate US$29.56 billion in net interest income by 2025.

- With a projected market volume of US$26.54 billion in the same year, traditional banks are expected to dominate this market sector.

- The Net Interest Income is expected to expand at a 4.13% yearly pace (CAGR 2025-2029) through 2029, reaching a market value of US$34.76 billion.

- China is expected to produce the most Net Interest Income compared to other nations, with an estimated total of US$4,689.0 billion in 2025.

- The banking industry in the United Arab Emirates is seeing a boom in digital banking services as more and more clients choose online and mobile banking options.

Key Attributes of a Credit Score Application

These apps enable users to make well-informed financial decisions by utilizing real-time data, sophisticated algorithms, and AI/ML technology. So, here is a list of features that are necessary while developing a free credit score app.

1. Credit Score Tracking

An app to check credit score enables consumers to keep an eye on their financial health by displaying their current audit and how it has changed over time. Consider an app like remitly that aids users in tracking their progress and understanding what affects their score.

2. Credit Report Access

This feature offers comprehensive credit reports from major credit bureaus, including TransUnion, Equifax, and Experian. A best credit report app allows users to see their debts, payment patterns, and credit history.

3. Credit Score Simulator

A best free credit score app provides a tool to model the potential effects of various activities, such debt repayment, on a user’s credit score. enables visitors to see how their scores might alter depending on their financial choices.

4. Personalized Tips

You can build an instant loan app that offers consumers personalized guidance based on their present financial behavior to help them raise their credit score. offers doable actions, such as lowering credit card debt or making on-time bill payments.

5. Alerts and Notifications

A free credit score check app provides immediate notifications in the event that a user’s finance score fluctuates or that new activity is recorded on their credit file. Notifies users of significant changes or possible fraud.

6. Debt Management Tools

An insurance app offers information on repayment plans to assist consumers in managing their outstanding debts. provides resources for setting payment priorities according to due dates and interest rates.

7. Identity Theft Protection

Businesses should know the cost to build a banking app in the UAE that must include functions like identity theft and credit monitoring for questionable conduct. Notifies users in the event that their name is associated with any new accounts or credit queries.

8. Financial Goal Setting

There are various alternatives of credit score apps that help users to set and monitor financial objectives, such as saving for a home or vehicle. It is connected with consumers’ objectives with doable actions to raise their credit score.

9. Credit Utilization Insights

An algorithm evaluates and offers suggestions for efficiently controlling credit card use. A language based credit score checker app provides consumers with information on how to raise their credit usage rate as well as the proportion of available credit they are currently using.

10. Financial Education Resources

Various resources like videos, guides, and articles about enhancing credit health, financial literacy, and credit ratings are offered. Know the role of Artificial Intelligence in the financial industry in improving financial habits and comprehending the elements affecting the credit score.

How to Build a Credit Score Application?

There are multiple stages in credit score app development. It needs a thorough planning and a group of skilled app developers who understand your concept and adjust their work accordingly. So, let us discuss them:

1. Market Research

Market research is the first step in developing an effective credit-scoring app. Finding your app’s fundamental value and identifying market gaps can be accomplished by using mobile app development solutions. So, you may simply overcome any obstacle in the process to create a credit score app for the UAE people by doing competition and SWOT analyses.

|

2. Decide Features & Tools

Choose essential elements now, such as the credit score checker that lets users see their credit scores. You can also employ a banking & finance software development company that track changes over time and offer advice based on user data. So, iOS app developers utilize Swift and Kotlin, Android app developers employ React Native and Flutter for the front end to make an app for credit score.

|

3. Design UI/UX

The designing stage should now begin. Making an app that is easy to use is essential, so you may begin by planning how the app will appear and function using basic sketches. A user-friendly interface with simple navigation will be produced by the UI/UX design team.

To see how the app will work, you can hire dedicated hybrid app developers from a credit score app development company to make wireframes and prototypes.

4. Backend Development

Once the app design is complete, start developing the credit score mobile app, which entails building the app incrementally. For a financial app to be successful, you must adhere to agile approaches.

You can adjust the agile strategy by contacting an E-wallet app development company in response to feedback. A variety of technologies are employed in the process, including backend technologies like Node.js, Python, and Ruby on Rails.

5. Application Testing

The program must be tested once the development process is over. To get rid of bugs and performance problems, the QA team will run a number of tests. To find defects, usability problems, and security flaws, use Artificial Intelligence development services to carry out a variety of tests.

The many forms of testing, including automated testing, usability testing, and beta testing, will assist you in fixing any problems that may arise.

6. Launch & Maintenance

When the app is complete, launching it entails enhancing its visibility in the app store and putting a marketing plan in place to advertise it on social media and through partnerships. Moreover, analytics tools can be used to track KPIs’ user engagement, downloads, and retention rates.

Last but not least, hire dedicated wallet app developers who can update your platform to ensure your app remains successful over time. They can also suggest you to invest in credit score checker website development to expand online.

|

Significant Advantages of Developing Credit Score Apps

The increased financial literacy of consumers today has led to a surge in demand for the creation of digital credit score apps. Both financial institutions and borrowers gain from it simultaneously.

Let’s examine the advantages of creating a digital credit score app:

1. Streamlined credit assessment process

The procedures used by a software development company to check a person’s credit score are complicated. Lenders need less time to review applications because the credit score app automates the assessment of creditworthiness.

2. Real-time credit monitoring

Users can take prompt action by using a credit scoring app, which provides instant notifications on changes to their credit scores or reports. It is beneficial to hire on-demand app developers to lessen the possibility of adverse effects by enabling people to actively manage their credit scores.

3. Enhanced customer experience

This increases user happiness by providing personalized insights and suggestions based on unique credit profiles. Additionally, chatbots driven by AI can be implemented with iOS app development services to offer users round-the-clock support and help them raise their credit scores.

4. Risk mitigation

Lenders can take preventative action by using real-time monitoring to assist uncover any hazards before they become more serious. Additionally, a credit report app for free gives lenders useful data to more precisely evaluate borrower risk.

5. Personalized financial recommendations

Business experts need to connect with an E-wallet app development company in the UAE that provides individuals with personalized guidance. So, people can raise their credit scores and successfully handle their money. It should use data analytics, to show consumers appropriate financial products.

What is the Credit Score App Development Cost?

Your credit score app development cost for the rudimentary app with fewer features, such a credit score, a straightforward dashboard, and notifications is less. Additional services like credit monitoring, user-specific tools, bank connections, and a robust security system will increase the cost to develop a mobile app.

1. App Features

The credit score web app development cost is directly impacted by the quantity and complexity of features. Advanced options like AI-based insights or credit score simulators would cost more than basic ones like credit score tracking and notifications.

2. Platform Development

The cost is greatly increased when building for various platforms. Development of native apps for iOS and Android must be done separately. It is good to approach a mobile app development company to use cost-cutting cross-platform development frameworks like Flutter or React Native.

3. API Integrations

A credit score software must integrate APIs from credit bureaus such as Equifax, TransUnion, or Experian to retrieve credit data. Usually, there are subscription or licensing costs associated with these third-party connections.

4. Data Security and Compliance

A credit score software must have strong encryption and safe data storage because it manages private financial information, which raises cost to maintain an app. Legal requirements such as GDPR, CCPA, or PCI-DSS must be complied with by the app, necessitating extra development work.

The average market cost to build credit score apps ranges between $8,000–$14,000, if the application is having less features. But, this may extend to more than $25,000 due to additional features.

App Structure |

Development Time |

Estimated Cost |

| Simple | 5-8 months | $8000-$14000 |

| Moderate | 8-12 months | $14000-$20000 |

| Complex | More than 12 months | $20000-$25000 |

You will get an idea of the exact cost with the help of this table. Additionally, you can also approach a custom Android app development company for discussing the price.

4 Crucial Methods to Earn Money from Credit Score Apps

Using the financial services ecosystem and providing customers with value is the key to making money with a credit score app. Here are a few doable strategies to make money:

1. In-App Subscriptions

Investors must hire dedicated mobile app developers to provide subscribers with access to premium features including real-time credit monitoring, and comprehensive credit reports. For these extra advantages, many customers are prepared to pay a monthly or yearly charge.

2. Affiliate Marketing

Collaborate with financial organizations to make a credit score checker app for Arabic banks. Additionally, you can promote their loans, credit cards, and other financial goods. Each time a user registers using your app, you get paid.

3. Freemium Model

Offer free basic products but fee for more sophisticated ones, such as budgeting tools, credit use analysis, or instructional courses. Implement full stack development services to draw attention of a large user base and turn someone into paying clients.

4. Advertisements

Within your app, show customized advertisements from financial advisers, banks, and credit card firms. You can make money from ads without detracting from the user experience if your layout is well-designed.

Let us Wind Up!!

Already, the banking and finance sector is providing multiple benefits to people. Additionally, through digitization the rate of modernizing credit score app development services in the UAE has increased. So, there is a lot of scope for business investors in this domain where they can target users from different classes in millions. You can experience following changes:

- Users are able to improve their credit scores and settle loan amounts.

- You will get conditional access to different technologies to add more features to your platform.

- The market of these apps are booming and creating multiple opportunities for generating business revenue.

- It will be easy for you to select appropriate banking & finance software development solutions in the UAE to create such app clones.

So, to become a leader in the finance industry, it is beneficial for you to take a step forward in the development of credit score apps. This will turn your venture into an only choice for users.

FAQs

Q1. What is a Credit Score App?

- Users can monitor their financial health and check their credit score with a credit score app.

- It offers information on credit conduct, aids in comprehending credit reports, and offers suggestions for raising credit ratings.

- Additionally, some apps provide alerts for possible fraud or changes in credit ratings.

Q2. How do Credit Score Apps work?

- They collect credit information via integrating with banking institutions.

- To obtain and examine their credit score, users enter their personal information.

- To deliver updates, the app usually makes use of APIs from credit bureaus such as Equifax, Experian, and TransUnion.

Q3. What Features Should be Included in a Credit Score App?

- Tracking credit history and credit score.

- Individualized advice for raising credit scores.

- Notifications of any modifications or questionable activity pertaining to the credit score.

Q4. How can I Monetize a Credit Score App?

- Provide premium features like in-depth reports and insights through subscription models.

- Offering basic capabilities for free and charging for more sophisticated analytics or credit-improvement plans is known as the freemium model.

- Collaborate with banks to provide credit cards or loans via the app.

Q5. What Technologies are Needed to Develop a Credit Score App?

- Frameworks for mobile development, such as Kotlin for Android and React Native or Swift for iOS.

- APIs to retrieve credit score information from major credit bureaus, for example.

- Backend technologies, such as Ruby on Rails or Node.js, are used to manage users and process data.

Q6. How do I Ensure the Security of Users’ Data in a Credit Score App?

- Encryption: Verify that all private information is encrypted while it’s in transit and at rest.

- Secure APIs: Make use of authentication and authorization mechanisms in secure API communications.

- Compliance: When managing personal data, follow data protection laws such the CCPA or GDPR.