Artificial intelligence (AI) is revolutionizing the financial industry and changing how businesses manage their financial operations. As per the study, the use of AI in financial industry is estimated to add $1.2 trillion in value by 2030. The data demonstrates how rapidly AI technology is changing the finance industry. AI in the financial sector has streamlined programs and processes, improved customer service experience, automated routine tasks, and helped businesses with their bottom line.

With previously unheard-of-level efficiency, insights, and precision, this emerging technology has transformed conventional procedures and created new opportunities. The integration of AI has brought forth several benefits of AI in financial industry and nowadays, numerous AI applications in the industry can prove to be game changers in the future.

Take a detailed look at this blog if you want to learn more about AI in finance industry, including its benefits, challenges, role, and future.

What is Artificial Intelligence (AI) in Financial Industry?

In the financial industry, artificial intelligence is a set of technologies that enable financial services companies to understand customers and the market better, analyze and learn from digital journeys, and engage in a way that mimics human intelligence. AI in industry assists in driving insights for performance measurement, data analytics, real-time calculations, predictions and forecasting, and much more.

In the financial industry, companies take help from an on-demand banking and finance software development company as they develop and implement a solution in financial organizations. These companies create intelligence systems that can understand and process a large amount of financial data, leading to more accurate and faster decision-making.

Market Statistics- Artificial Intelligence in Financial Industry

AI in financial industry is growing every day. Following are some stats that support the statement:

- By 2020, artificial intelligence has increased revenue for over one-third of global financial services companies by more than 20%. In addition, 20% of the participants mentioned a 5 – 10% rise in revenue.

- In 2021, most financial services organizations integrated artificial intelligence into their function or operation to a moderate extent. Roughly one-third of those surveyed said their organization has fully integrated AI.

- As per a survey in 2024, AI trends in the industry are at a 48% adoption rate, and businesses are using artificial intelligence the most. With 45%, compliance, and risk came next.

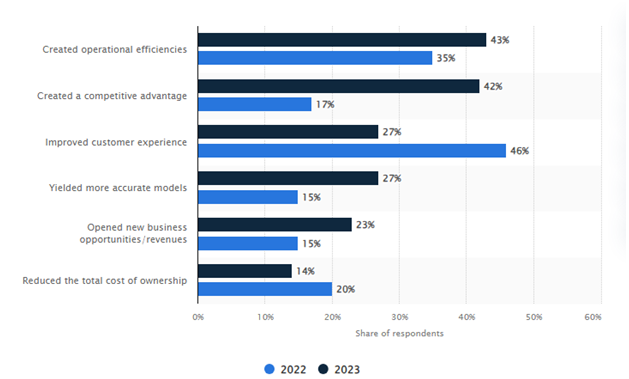

- In the financial service industry in 2023, operational efficiencies were the key benefits of AI. In 2024, 43% of participants said artificial intelligence had boosted operational efficiencies, a noteworthy rise from the previous year.

- On the other hand, in 2023, 27% of participants said artificial intelligence’s prime advantage was improved customer experience. A more accurately predicted model, a lower total cost of ownership, and a competitive edge were among the other benefits that were frequently mentioned.

Benefits of Artificial Intelligence (AI) In Financial Industry

As artificial intelligence is changing the financial industry’s working model drastically, it offers numerous benefits for the economic sectors and customers. For each finance software development company and their clients, implementing AI has improved operation, reduced error, enhanced automation, and so on. AI has numerous benefits in the financial industry, increasing their growth exponentially. Here are some of the impeccable benefits of implementing AI in financial industry.

1. Improved Operations

AI in financial industry efficiently optimizes and automates the procedures and helps improve operational efficiency. For instance, companies in the financial service industry use AI-powered document automation to foster digital collaboration and document verification tasks, streamline data entry, and reduce manual effort and processing time.

2. Fraud Detection

AI helps companies in detecting fraud in financial services. AI algorithms make it easy to analyze a large amount of data in real time and detect anomalies that indicate fraudulent activity. Hence, it is helpful for the financial institution to proactively identify and mitigate fraud risks that safeguard their customer’s data and financial assets.

3. Improved Efficiency

Artificial intelligence allows financial companies to expand their operations and avoid bottlenecks that hinder human processes. AI technology automates repetitive and time-consuming operations, freeing up banking personnel and providing more excellent customer value.

4. Improved Risk Management

AI in financial industry analyzes a vast amount of the data available in banks to assist them in better manage risk. The bankers use predictive intelligence to protect their assets, overcoming obstacles and taking benefits of market opportunities rather than jumping to a conclusion.

5. Faster Decision Making

Artificial intelligence provides real-time data and insight, enabling financial organizations to make informed and quicker decisions. Through AI-powered analytics and predictive modeling, financial companies can quickly assess risk, grab investment opportunities, and optimize effective business strategies. With such real-time and automation in the financial industry, owners can easily make informed and quick decisions, resulting in increased profitability and efficiency in business.

Challenges of Using Artificial Intelligence in Financial Industry

You have seen several innovative applications of AI in financial industry. Still, it’s equally important to understand some potential challenges related to using AI and machine learning in the financial sector.

1. Data Security Concerns

Due to unlimited users, the banking industry has a large amount of financial data. So, looking for a perfect technology partner who can easily understand banking and artificial intelligence and offer security options is significant. It will ensure that customers’ data is carefully handled.

2. Biased Result

A specific concern is that AI-generated systems with explainability challenges could produce inaccurate and biased results. As per a study, they could affect, and are not limited to customer protection considerations such as fair leading.

3. Addressing AI and Ml Limitation

While AI and MI in financial industry can process and analyze data quickly compared to human capabilities, they are full of limitations and errors. Identifying and addressing the mistakes in datasets is crucial, as flawed data can bring faulty outcomes.

4. Data Quality and Availability

AI and machine learning requires a vast amount of high-quality data to function effectively. However, financial companies often need help and availability challenges, limiting technological effectiveness.

5. Regulation Issues

If machine learning and artificial intelligence are integrated, regulations in the financial industry will face a dynamic obstacle. Regulations must keep pace with technological development to ensure ethical practices and avoid system risk.

To overcome the challenges mentioned above, you should hire dedicated software developer who is an expert in AI and has an in-depth understanding of the financial industry to address the challenges and ensure a successful implementation of AI in financial industry or services.

Top 3 Apps Owing the Market in the Banking and Financial Industry

Several applications and organizations use artificial intelligence in the banking and financial industry. Could you have a look at them?

1. Capital One

In 2017, the company released a virtual assistance-based ENO that users can communicate with the help of email, desktop, and text and take care of tasks like taking account balances, viewing available credits, paying credit cards, and checking transactions.

2. The Goldman sachs group inc.

To provide summaries for bankers to inform consumers, the company is experimenting with artificial intelligence to learn how to extract valuable information for a large amount of data, such as publicly available regulatory filing and corporate databases.

3. Vectra AI

Financial institutions benefit from Vectra’s AI-enabled technology for cyber threat detection. The program uncovers stealth attackers who target banks in specific, expedites incident investigations, and automates threat detection. Vectra’s software prevented the attack by identifying actions such as an attacker looking for security holes in a healthcare organization’s footprint.

Role of AI in Transforming the Finance Industry

Artificial intelligence is revolutionizing the financial sector, impacting everything from risk management and fraud detection to trading algorithms and customer services. This blog section will examine the significant impact of AI on the industry.

1. Trading and Investment Decisions

Trading algorithms are driven by artificial intelligence that can analyze market data, historical trends, and news in real-time, allowing for a wise and faster investment decision. Machine learning also identifies profitable trading opportunities and executes transactions at breakneck speed. It dramatically increases a more significant ROI.

2. Customer Service and Personalisation

Natural language process-based chatbots and virtual assistance facilitate a personalized customer experience. Such AI technologies provide a smooth customer experience by managing routine inequities and helping with account management. Moreover, AI can also foresee customers’ needs through data analysis and predictive modeling. It offers financial advice and financial solutions as per the situation.

3. Risk Management and Fraud Detection

With the advanced AI algorithm, financial companies can better manage risk assessment by analyzing extensive data, spotting new trends, and delivering real-time insights. Then again, machine learning models consist of a high degree of accuracy in estimating market movements and identifying creditworthiness.

Future of Artificial Industry in Finance

As AI has become a crucial part of every organization and industry, it’s no wonder it is taking off in the financial sector, especially since the COVID-19 outbreak, which has changed human interaction. According to a study, AI has significantly impacted the banking sector. By 2030, it will save the industry almost $1 trillion by simplifying and combining tasks and processing data and information far faster than humans.

The future of AI in financial industry looks promising, with advances expected in different areas such as risk assessment, customer services, automation of repetitive tasks, and investment management. Financial software development services will play a vital role in implementing AI solutions tailored to the specific needs of financial institutions.

Following are some critical areas where AI in the financial industry is forecasted to make significant impacts

1. Risk Assessment and Management

Financial companies can analyze extensive data in real-time through AI algorithms to identify and mitigate risk. This includes credit risk assessment, compliance monitoring, and market risk analysis.

2. Customer Service and Personalisation

AI-powered virtual assistance and chatbots can provide personalized recommendations, answer customer inquiries, and help with account management, improving the overall customer experience.

3. Fraud Detection and Prevention

AI-driven systems can detect unusual transaction patterns, helping avoid fraud and financial crimes more efficiently than traditional methods.

If we talk about the UAE, the future of AI in financial industry, specifically in eWallet app development company UAE, holds immense potential for innovation and transformation. eWallet apps can leverage AI-predictive analytics to anticipate customers’ future financial needs and behavior, enabling proactive notifications and personalized discounts or offers from partnering merchants.

Moreover, AI-powered analytics can analyze users’ spending habits and financial goals to offer personalized recommendations and insights, allowing users to make quicker and more informed financial decisions tailored to their needs. Here, by taking help from any financial software development company, financial institutions can integrate AI technologies into their eWallet application to improve customer experience, enhance security, and provide personalized financial Services.

How Dev Technosys Can Help You Integrate AI in Your Financial Services?

AI in financial industry has brought significant benefits and advancements, revolutionizing the customer experience, risk assessment, and automation, among other vital areas. Whether you want to develop a banking app in UAE or software developers, financial software development companies are instrumental in helping financial organizations have the power of AI. Hence, implementing AI in financial industry can offer customers a novel experience, mitigate risk in various departments, and improve revenue costs.

If you are looking for AI development services, connect with Dev Technosys. It’s a mobile app development company that provides custom software development services. Dev Technosys is a reliable partner to financial service companies that want to deploy artificial intelligence at their workplace.

Frequently Asked Question

1. What Is Artificial Intelligence In Finance?

AI in financial industry is an application of AI technologies techniques, involving use of machine learning and algorithms to analyze a large amount of the financial data to perform various financial tasks.

2. What Are the Uses Of AI In Finance?

In financial, AIis used for different purpose:

- fraud detection

- Automate routine tasks,

- Analyze data for insights

- Personalized customer experience

- Enhance risk assessment and management

3. How Much Does It Cost To Develop An Ewallet App?

On-average cost of e-Wallet app ranges from $8000 – $25000. For precise cost implication, it’s crucial to consider elements impacting the cost of an e-Wallet application.some of them including, developer’s location, app’s complexities, app’s platforms, and many more.

4. How Is AI Transforming The Banking Industry?

Through real-time data, artificial intelligence is changing the banking industry to automate decisions. It enables us to boost customer services through detect fraud, chatbots, optimize investment, reduce costs, and more.

5. What Are the Top 5 Use Cases of AI in Financial Industry?

Here are some use cases of AI in financial industry

- Customer services

- Credit risk assessment

- Generating financial reports

- Algorithm trading

- Forecasting and management of bad debts