The days are gone when people need to wait in line at the bank to open an account. Now, people do not need to leave their homes and wait for hours at banks. And all that is possible because of the banking app. Hence, with more and more people opting for online banking services, creating a secure and user-friendly banking app has become significant for financial business.

In a study, I found that globally, 73% of people use Internet banking at least once a month, compared to 59% who use mobile banking apps. While 59% of people utilize mobile banking apps, 73% of users worldwide use online banking at least once a month. Hence, this depicts room for growth in banking app development.

If you are also an entrepreneur and want to develop an app like Mada Pay, this blog is for you. Read it until the end to find answers to your queries regarding banking app development.

Quick Summary: Learn how to build an app like Mada Pay, what features it must have, what cost is involved, and how it can benefit businesses.

What is Mada Pay – A Banking App

Mada Pay is a digital payment app that offers various banking services, including receiving and sending money, managing finances, and making payments. It’s a secure and convenient tool for handling financial transactions. It’s the best app for money transferring to family and friends, shopping online, and paying bills.

Online banking app like Mada Pay also integrated with Android devices and streamlines financial transactions, making payments more accessible. The app protects user’s personal and financial information through advanced security measures.

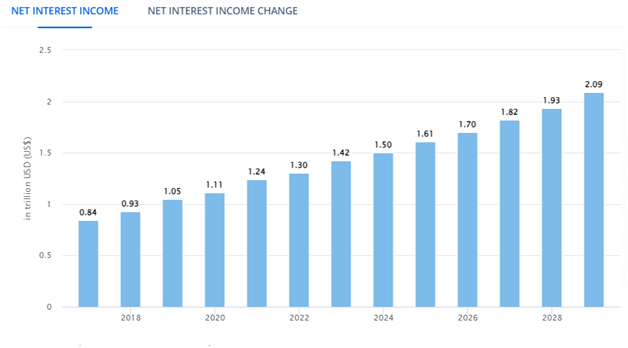

Market Analysis of Online Banking

Digital Banks – Worldwide

- The global net interest income for digital banks is predicted to reach US$1.50 trillion by 2024.

- Net Interest Income is predicted to increase at a compound annual growth rate (CAGR) of 6.86% from 2024 to 2029, reaching a market size of US$2.09 trillion by then.

Top 5 Banking Apps

The banking landscape is evolving rapidly, and the emergence of banking apps is majorly contributing to this transformation. So, if you are also investing in mobile app development, first, you must understand the relevant landscape. For this, study the following key competitors and learn how they operate:

- Mashreq

- E 20

- SNB Mobile

- Liv Bank

- Al Ansari Exchange

1. Mashreq

The app is known for its comprehensive features and user-friendly interface. From transferring money to managing investments and loans, an app like Mashreq caters to diverse financial needs while ensuring a seamless user experience.

2. E 20

This digital-only bank provides a paperless and streamlined banking solution. The app has attracted many customers with its competitive interest rates and innovative features. Hence, to create banking application like Mada Pay or E20, you also need to offer such services.

3. SNB Mobile

Whether checking your balance or making payments to access personalized financial advice, SNB mobile provides a comprehensive banking experience. To build an app like SNB mobile, you must offer a reliable and secure platform for managing finances.

4. Liv Bank

This banking app has gained huge popularity for its contemporary approach to banking. Liv Bank offers personalized features and an intuitive interface, facilitating an engaging and seamless banking experience.

5. Al Ansari Exchange

The app is known for its money exchange services and convenient banking app. An app like Al Ansari Exchange enables users to exchange currencies, send money, and access other financial services.

How Do Banking Apps Work?

As you are going to build banking app like Mada Pay, do you know how exactly the apps work? Here is a deep explanation of how online banking platforms work. So, to understand the working process, have a look at the following steps for a successful Islamic app development:

- Download and Installation

- Registration and Login

- Account Overview

- Transactions

- Security Features

- Customers Support

1. Download and Installation

First, users download the banking application from their smartphone’s app store and install it on their devices.

2. Registration and Login

After installing the app, users can create an account using existing banking credentials. This involves providing the user’s account number, customer ID, and secure password.

3. Account Overview

After logging in, users will be presented with a dashboard that provides a snapshot of their financial conduction. This includes information regarding the user’s account balance, outstanding dues, and recent transactions.

4. Transactions

Online banking platforms offer numerous transaction options. Users can transfer money through app like Mada Pay between their accounts or to external accounts, make purchases, and pay bills using their mobile devices.

5. Security Features

Banking apps incorporate robust security measures to protect users’ financial information. These measures include facial or fingerprint recognition, encryption, and two-factor authentication.

6. Customers Support

Mobil banking applications offer customer support features, such as phone support, live chat, or in-app messaging. Hence, they allow users to get assistance with questions or issues they may face.

Benefits of Developing the Banking Apps

In today’s digital landscape, the banking app has become a powerful tool with a growing demand. Hence, if you invest in a mobile banking app development, it will provide you with the following benefits along with a great ROI (return on Investment)

- Strengthened Brand

- Improved Competitiveness

- Improved Operational Efficiency

- Increased Customer Engagement

- Security and Fraud Prevention

1. Strengthened Brand

Online banking platforms offer a personalized and direct connection with customers. Hence, if you develop an app like Mada Pay, which provides a user-friendly and seamless experience, you can also enhance your brand reputation and loyalty.

2. Improved Competitiveness

Banks must adapt to meet customers’ evolving needs. According to the React Native app development company, building a robust banking app gives businesses a competitive edge. This is possible by offering significant features like bill payments, mobile payments, and account management.

3. Improved Operational Efficiency

Mobile banking apps streamline different operations, reducing the world and bank employees’ workloads. They also ensure automated processes, such as minimal bill payment and transfer errors, and improve overall efficiency.

4. Increased Customer Engagement

Banking mobile platforms can foster stronger customer relationships by offering an interactive and user-friendly interface. Moreover, personalized features like recommendations and notifications can enhance customer engagement.

5. Security and Fraud Prevention

A well-curated banking app incorporates robust security measures that protect customer data. Encryption, fraud detection systems, and biometrics authentication can help prevent unauthorized access and financial losses.

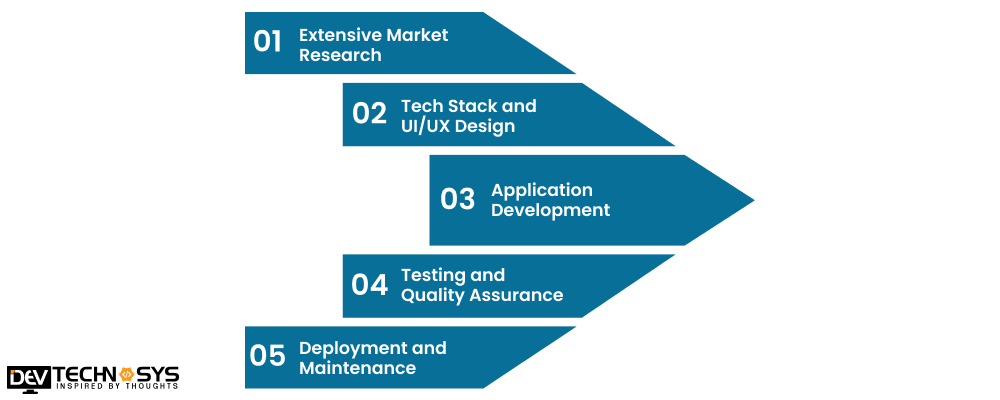

Key Steps to Develop an App Like Mada Pay

Do you know how to develop an app like Mada Pay? Well, here is the answer to help you develop a successful banking app. Apply all the following critical steps and create an exceptional banking app:

- Extensive Market Research

- Tech Stack and UI/UX Design

- Application Development

- Testing and Quality Assurance

- Deployment and Maintenance

1. Extensive Market Research

Before you start the journey of banking app development, you are advised to dive deep into the mobile banking landscape. With existing apps, you need to understand your target audience, their digital habits, financial needs, and paint points, if any. Moreover, by analyzing competitors like MadaPay, you can identify strengths and lacking area. Hence, this research will guide to the development of an app meeting user’s expectations.

2. Tech Stack and UI/UX Design

Now that you know what you need in your app, you must choose the most suitable technology stack per the project’s requirements. You can consult a mobile app development company if you do not know the right tech stack. Furthermore, after having the right stack, focus on designing an intuitive user interface. You must invest in a user-friendly and aesthetically pleasing design while attracting the user’s attention.

3. Application Development

Now that you have a solid foundation, you can develop your banking app. Ensure that the chosen tech stack can handle large databases and secure transactions. At this phase, you must focus on significant features and set up your banking parts, such as biometric authentication, personalized recommendations, and gamification elements. Additionally, when developing a banking app, consider factors like security, performance, and scalability for the desired outcome.

4. Testing and Quality Assurance

Now, let’s come to the most critical phase: ensuring the app is ready to launch. However, for this, you have to conduct different tests, including functional testing, security testing, and usability testing. Here, the banking app development company guarantees that all the technical issues, errors, or bugs have been resolved and can be introduced to the market for a seamless user experience.

5. Deployment and Maintenance

Now that your app is ready, you can launch it on app stores such as the Google Play Store and Apple Play Store. You must also create a market strategy to create a buzz around your banking app. Furthermore, if you want to stay ahead of the competition, update your app regularly based on users’ feedback. New features should also be added according to market trends or new technologies to keep users engaged for a long time.

Must-have Features of a Banking App

In today’s digital banking landscape, it’s tough to survive. Hence, if you want to overcome this challenge, here is a list of the top significant and unique features. These features will help you survive and stand out in the entire market. So, for a successful Android or iOS app development solutions, have a look at these important features.”

|

Features |

Descriptions |

| Secure Login |

Protect user accounts from unauthorized access by implementing robust facial recognition or fingerprint authentication. |

|

Bill Payment |

Develop an app like Mada Pay that enables users to pay their bills directly via the app. |

| Money Transfer |

Ensure your banking app facilitates easy transfer between accounts within the external or same bank. |

|

Real-time Alerts |

Banking apps send instant notifications to users for low balances, transactions, or suspicious activity, if any. |

|

Investment Tools |

This feature lets users easily track their investments, manage portfolios, and make trades. |

| Card Management |

Develop an app like Mada Pay that allows users to block or unblock cards, request new cards, or change PINs. |

|

Financial Education |

Online banking platforms offer different resources like videos, calculators, or articles to educate users about |

| Loan Applications |

With the help of a Hybrid app development company, install this feature so that With real-time status updates, users can easily apply for loans using your banking app. |

|

Customer Support |

Ensure your app integrates live chat features to provide efficient and quick customer support and a seamless user experience. |

| Personalzied Recommendations |

Develop an app like Mada Pay that offers tailored financial advice and product recommendations on user preferences and behavior. |

Cost Analysis to Develop an App Like Mada Pay

If you are searching for the banking app development cost. In that case, first, you need to understand that it’s impossible to determine the exact cost to develop bank app Mada Pay without the project analysis. A range of factors, including the app’s features, design, functions, and many more, impact the overall cost of banking app development.

However, on average, you can estimate $8000 to $27000 as the cost to develop a banking app in UAE. In case your project has some complies or special requirements the cost can fluctuate as per the table below:

Cost to Develop an App Like Mada Pay

Banking App Development |

Estimated Cost |

Time Frame |

| Simple Banking App Development | $8000 – $13000 |

3 to 6 Months |

|

Medium-Complex Banking App Development |

$13000 – $21000 | 6 to 9 Months |

| High-Complex Banking App Development | $27000+ |

10+ Months |

Now that you know the mobile banking app development cost, you must also learn the maintenance cost. On average, the cost to maintain an app could be 15 to 20% of the overall cost to build money transfer app like Mada Pay. This cost includes fixing bugs, adding new features, and other updates. It ensures your app remains functional and competitive in the long run.

Tech Stack for Banking App Development

It’s significant to choose a suitable technology stack for your banking app because different projects have different requirements and not a one-size-fits-all stack for app development. Hence, here is a table of many tech stacks to help you choose the best one for your iOS and Android app development:

|

Component |

Technologies |

| Frontend |

React Native, Flutter, Swift, Kotlin |

|

Backend |

Node.js, Java (Spring Boot)

Python (Django/Flask), |

| API Integration |

GraphQL, RESTful APIs, SOAP |

|

Database |

SQLite, PostgreSQL,MySQL, MongoDB, Firebase |

| Analytics |

Google Analytics, Firebase Analytics |

|

Authentication |

OAuth, JWT |

| Push Notifications |

Apple Push Notification Service, Firebase Cloud Messaging |

|

Version Control |

Git, GitHub, Bitbucket |

| Deployment |

Apple App Store, Google Play Store, TestFlight, Firebase App Distribution |

Wrapping Up!

This blog has figured out that investing in Mada Pay app development is a smart business move for entrepreneurs. If businesses create a secure and user-friendly app, they can streamline operations, attract and retain customers, and increase their bottom line. So, if you also operate a finance business, it’s the right time to invest in making a cutting-edge baking app with this growing trend for your business.

If you are thinking the same and want to develop an app like Mada Pay, grab the opportunity and reach new business heights. If you require any help, consult an on demand app development company like Dev Technosys, which has years of experience in the field. Professionals will help you develop a banking app and attain all your business goals.

Frequently Asked Questions

1. How Much Does It Cost to Develop an App Like Mada Pay?

If you are considering mobile banking app development, the cost to develop a mobile app could be between $8000 and $27000, depending on various elements. These include the app’s design, features, development team, functionalities, etc.

2. How Long Does It Take to Create an App Like Mada Pay?

The timeframe for developing banking apps like Mada depends on the project’s requirements. If you want to create a basic app, it will take 3 to 6 months. However, if you want to create a feature-rich app, it will take around 11 months.

3. What are the Latest Mobile Banking Trends?

Here is a list of engaging mobile banking app trends that you must consider for a successful banking app development:

- Voice control

- Mobile-only banking g

- AI-fraud prevention

- Machine learning

- Biometric security

4. How can I Ensure Privacy and Security During the Development of My Mobile Banking App?

If you develop an app like Mada Pay, you can ensure security and privacy in the following ways:

- Data encryption

- Secure coding practices

- User authentication

- Session management

- Compliance with regulations

5. How Much Does Hiring Mobile App Developers for Banking App Development Cost?

If you want to hire dedicated developers, then you have to pay around $15 to $25 as per developer’s skills, talent, experience, and location.