These days, convenience is the ultimate luxury. This is particularly valid when it comes to managing our finances. Because they make things simpler and give us more control when we’re on the go, banking apps like Muscat Mobile Banking have revolutionized the way we manage our accounts. Have you ever thought, nevertheless, how to build an app like Muscat Mobile Banking?

This site has tutorials on how to create an excellent banking app. We’ll go over a detailed approach that involves creating prototypes, conducting market research, designing, and building. In conclusion, you’ll know how to create an entertaining game similar to Muscat Mobile Banking on your own.

Now let’s get started!

What is a Muscat Mobile Banking App?

The Muscat National Bank provides a mobile banking app called the Muscat Mobile Banking App. You may easily complete a variety of banking operations from your smartphone at any time or place. Without going to a branch, you can pay bills, deposit checks, locate Muscat Mobile Banking ATMs, check account balances, transfer money, and deposit checks.

An app for money transfering is made to be both safe and easy to use. The app is a useful tool to help you manage your banking if you’re a Muscat Mobile Banking customer. Thus, you need to work with an ewallet app development company if you want to build an app like Muscat Mobile Banking.

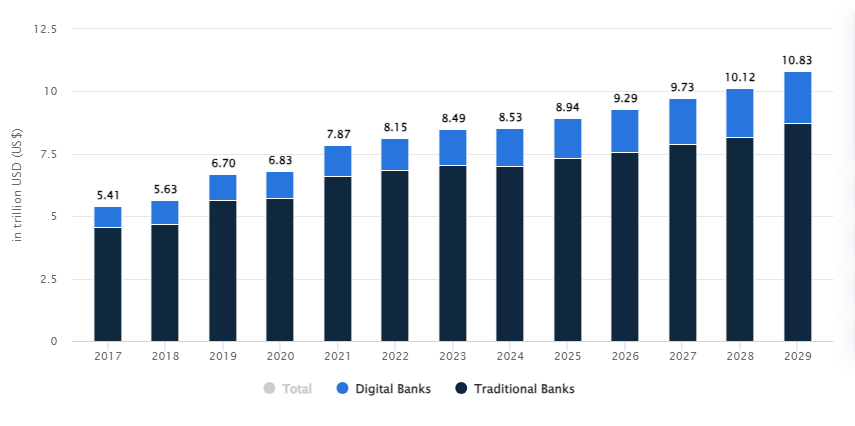

Future Predictions And Projections

- In 2024, the United Arab Emirates’ banking industry is expected to generate US$28.21 billion in net interest income.

- This market segment is anticipated to be led by traditional banks, with a projected value of $25.35 billion in the same year.

- In 2029, Net Interest Income is projected to expand at an annual pace of 4.26%, creating a market with a value of US$34.76 billion.

- In comparison to other nations, China is predicted to have the highest Net Interest Income, reaching US$4,332.0 billion in 2024.

- In the MENA region, the UAE and Saudi Arabia had the highest number of 5G service subscribers.

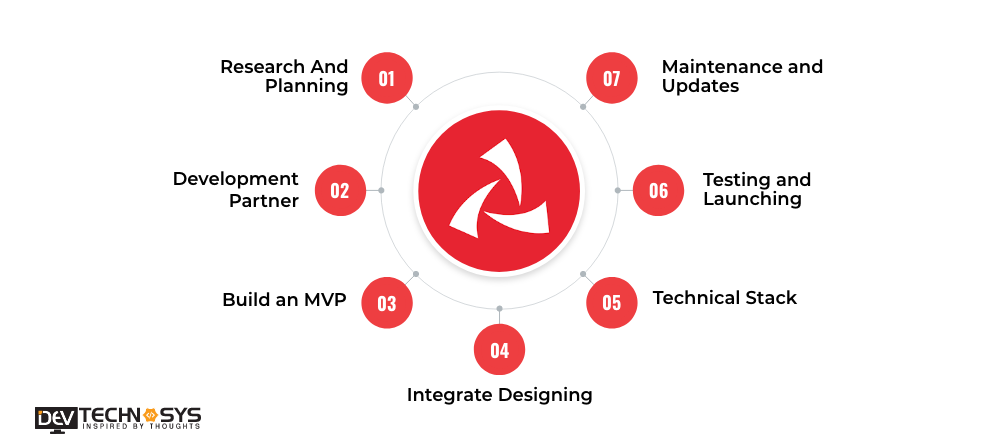

How to Build an App Like Muscat Mobile Banking?

Do you wish to build an app like Muscat Mobile Banking in order to enter the expanding market for digital banking changes? It’s critical to comprehend that creating a mobile banking app involves more than just coding. View the Muscat Mobile Banking app development process below.

1. Research And Planning

Researching the market, your competitors, app development trends, the users of your apps, and their unique demands should be your first step when creating apps for banks. All of these factors are crucial for developing a distinctive and profitable business model.

2. Development Partner

It takes a lot of work to develop with the cost to develop bank app like Muscat Mobile banking, so hiring the right personnel is the best approach for a bank to ensure that it is done correctly. Numerous businesses are investing in fintech app Like Mashreq to create banking apps; however, you should choose the one that does everything correctly, from agreeing to an NDA to providing you with a system that has all the features you need to support you after the app is launched.

3. Build an MVP

An app prototype that displays the structure, logic, design components, content, and appearance of the final product is created by developers to bring a concept to life. When building a prototype, it is less expensive to fix design errors than when developing a final product. One of the best aspects of creating a prototype is this.

4. Integrate Designing

One of the best practices for creating a mobile banking app’s UI/UX design is to personalize the experience for each user, make the app as simple to use as possible, assist users in managing their bank accounts, and ensure that the app is clear and safe. A hybrid app development company provides a key piece of advice for creating a visually appealing mobile app is to make sure the app’s navigation aligns with the system’s logical layout.

5. Technical Stack

The most crucial aspect of designing mobile banking is selecting the appropriate tool stack. You can receive online passbooks, push notifications, customer support, and more with the correct technology. The time, money, and effort required to develop and market an app similar to Muscat Mobile Banking can all be reduced with a well-chosen tech stack.

6. Testing and Launching

Next, a team working internally or through a banking app development business should assist in creating an app similar to Muscat Mobile Banking. After the tech stack has been selected, this can be completed. Additionally, app like Al Ansari Exchange can only accomplish this if it has the resources and time to engage experts in the field of banking app development.

7. Maintenance and Updates

After the successful launch of the mobile application it is the last and important step to provide maintenance and updates to the online banking app like Muscat Mobile banking. To do so you can contact an Android app development company which can offer good services and solutions post development.

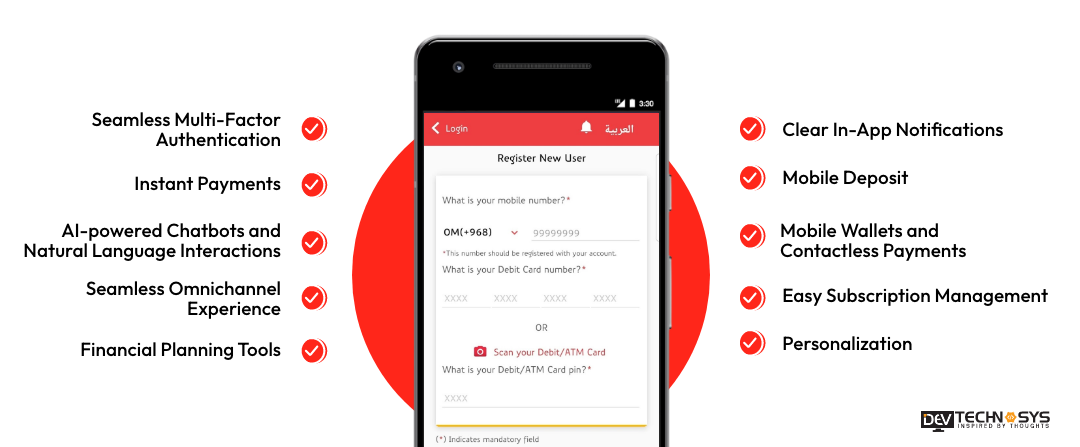

Vital Features to Create an App Like Muscat Mobile Banking

Let’s imagine for a moment that you wish to build an app like Muscat Mobile Banking that is unique. Next, consider some unique features that will enhance the product’s worth. And you ought to consider including the following elements at the very least if you want to succeed.

1. Seamless Multi-Factor Authentication

Security is paramount for any banking app. Multi-factor authentication adds an extra layer of security by requiring users to verify their identity through multiple methods, such as a password, fingerprint scan, or a code sent to their phone.

2. Instant Payments

Transfer Money through app like Muscat Mobile banking! Instant payments allow users to send and receive money instantly, making it easier to split bills, pay rent, or send a quick gift.

3. AI-powered Chatbots and Natural Language Interactions

Chatbots can answer users’ questions about their accounts, help them resolve issues, and even initiate transactions. Natural language interaction allows users to interact with the app using conversational language, making it easier and faster to get things done.

4. Seamless Omnichannel Experience

A seamless omnichannel experience ensures a consistent user experience across all the bank’s touchpoints, whether it’s the mobile app, website, or branch. This means users can easily switch between channels without having to re-enter information or start over.

5. Financial Planning Tools

Budgeting and financial planning tools can help users track their spending, set goals, and make informed financial decisions. Some apps offer features like expense categorization, bill trackers, and savings calculators.

6. Clear In-App Notifications

Real-time notifications keep users informed about their account activity, such as deposits, withdrawals, and transfers. This helps users stay on top of their finances and identify any suspicious activity.

7. Mobile Deposit

Mobile deposit allows users to deposit checks quickly and easily by taking a picture of the check with their phone’s camera. This eliminates the need to visit a branch or ATM.

8. Mobile Wallets and Contactless Payments

Mobile wallets allow users to store their debit and credit card information securely on their phone. They can then use their phone to make contactless payments at stores and other merchants.

9. Easy Subscription Management

Many professionals subscribe to various banking app development services with recurring fees. Mobile banking apps can help users track their subscriptions and easily cancel them if needed.

10. Personalization

The best mobile banking apps allow users to personalize their experience. This may include features such as customizing their dashboard, setting up spending alerts, and choosing their preferred notification methods.

What are the Benefits to Invest in the Development of an App Like Muscat Mobile Banking?

There are two possible interpretations of what “Muscat Mobile Banking” means in your query. Taking into account both interpretations, the following are some advantages for organizations who want to build an app like Muscat Mobile Banking:

1. Customers Convenience

Customers can bank whenever and wherever they choose with the use of a Muscat Mobile Banking wallet app. More freedom is offered, and individuals who favor mobile banking over conventional ways are catered to.

2. Productive And Efficient

Owners of businesses can handle the best app for funds transfer on the go. With their cellphones, they may approve transactions, make payments, transfer money, and check account balances. Time is saved, and financial activities are streamlined.

3. Secure Platform

Strong security measures like fingerprint authentication and two-factor verification can be found in mobile apps. Customers’ trust is increased and sensitive financial data is safeguarded.

4. Interactive And Engaging

Muscat Mobile Bankings and their clients can communicate directly thanks to fintech apps like Slice. Companies may strengthen their relationships with customers by offering promotions, sending tailored notifications, and providing real-time account updates.

What is the Cost to Build an App Like Muscat Mobile Banking?

Before you go out and gather funds to create banking application like Muscat Mobile banking, let’s talk about the estimated amount you’ll need. What is the approximate cost to develop a Banking app in UAE? That’s about what it would cost to start from scratch with a mobile app.

Moreover, to build an app like Muscat Mobile Banking should cost no more than $10,000–25,000 for a fintech business aiming to meet a specialized client requirement.

The following table illustrates the cost to develop a mobile app like Muscat Mobile Banking:

|

App Structure |

Development Time | Estimated Cost |

| Simple | 5-8 months |

$8000-$14000 |

|

Moderate |

8-12 months | $14000-$21000 |

| Complex | More than 12 months |

$21000-$26000 |

Therefore, you should speak with a mobile app development services provider to find out the precise cost to build money transfer App like Muscat Mobile banking.

Quoting The Blog!!

It takes careful planning, extensive development, and rigorous testing to build an app like Muscat Mobile Banking. The procedures listed below will help you build banking App like Muscat Mobile banking in the United Arab Emirates.

Recall that the cost to maintain an app with the competitiveness in the ever changing mobile market requires keeping up with the Muscat Mobile banking app development in both trends and technology. Are you considering making the move to online banking?

Working with a knowledgeable provider of iOS app development services, such as Dev Technosys, could be really beneficial. Reach out to us, and together, let’s create an amazing banking app.

FAQs

1. What is the Cost to Build an App Like Muscat Mobile Banking?

The precise cost of developing an app similar to Muscat Mobile Banking can differ greatly based on how sophisticated the features you wish to incorporate are. However, as a rough approximation, it can vary from $10,000 to $25,000 or more. You can develop a banking app with in your budget when you hire dedicated developers.

2. What is the Time To Develop an App Like Muscat Mobile Banking?

The characteristics to build an app like SNB Mobile similar to Muscat Mobile Banking determine how long it takes to construct. It could take two to four months for a simple version with account viewing and transfers; it might take up to seven months for more complicated features like credit score or investing tools.

3. How Muscat Mobile Banking App Development Benefits Businesses?

Developing an app similar to Muscat Mobile Banking offers numerous advantages:

- Enhanced Convenience: Use your phone to manage funds anywhere, at any time.

- Boost Security: For peace of mind, take advantage of the security features of mobile banking.

- Enhanced Productivity: Utilize the app to finish work more quickly than with conventional ways.

- Increased Accessibility: Bank when it suits you, not during branch hours.

- Potential Cost Savings: Lower fees could result from a less reliance on physical branches.

4. How to Earn Money From an App Like Muscat Mobile Banking?

Here are several strategies for making money off of a mobile banking app, similar to Muscat Mobile Banking:

- Transaction Charges: Fees for P2P transfers or bill payments.

- Monthly fees: Charge a price for premium accounts that come with additional services.

- Interest on loans: Provide credit cards and loans to make interest.

- Investment products: Provide choices for investing directly within the app.

- Partnerships: To share revenue, form partnerships with other financial services.