“Convert your business success by developing a currency conversion app.”

Every country has its own currency in which trade, finance, and other activities are performed. As you know, the most widely used currency in the world is US Dollars. But the most expensive currency across the globe is Kuwaiti Dinar. So, here you need a smart exchange rate app.

Businesses are now investing their money to develop a currency converter app. An international money converter app has a 100% accuracy rate because they are governed by cutting-edge technologies like AI. So, entrepreneurs must invest in currency converter development to create an AI forex converter platform.

For that, you need to understand various topics like the development process, features, cost, and monetization. All these are discussed in this blog. So, let’s move on.

What is a Currency Converter App?

A digital tool that enables users to swiftly and precisely convert one currency into another based on current exchange rates is called a currency converter app. Travelers, companies and e-commerce platforms utilize international money converter apps to keep up with currency swings. A money rate checker app ensures precise conversions for global transactions by retrieving real-time data from financial sources.

Additionally the role of Artificial Intelligence in the financial industry with features like offline mode and cryptocurrency compatibility are also available in many pocket forex calculator apps. A currency exchange tool offers a smooth financial experience with their user-friendly layout and rapid computations, which facilitate cross-border transactions and travel budgeting.

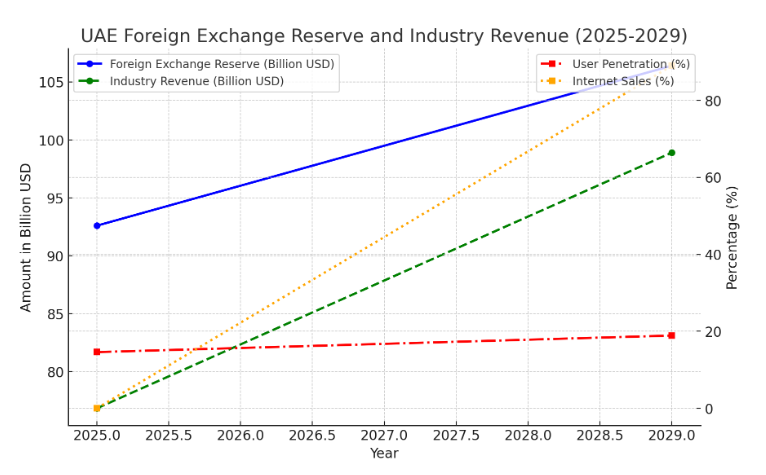

Market Stats on Middle East Currencies

- The United Arab Emirates’ (UAE) foreign exchange reserve increased from roughly $92.6 Billion in 2025 to $106.4 Billion in 2029.

- In 2025, various industries are expected to generate $76.84 Billion in revenue.

- By 2029, revenue is anticipated to expand at a rate of 33% CAGR, reaching a predicted market volume of $98.90 Billion.

- It is anticipated that there would be 38 Million customers in UAE by 2029.

- By 2025, user penetration is expected to reach 6%, and by 2029, it will be 18.9%.

- It is anticipated that the average revenue per user will reach $437.13.

- By 2029, internet sales will account for 89% of overall revenue in different sectors.

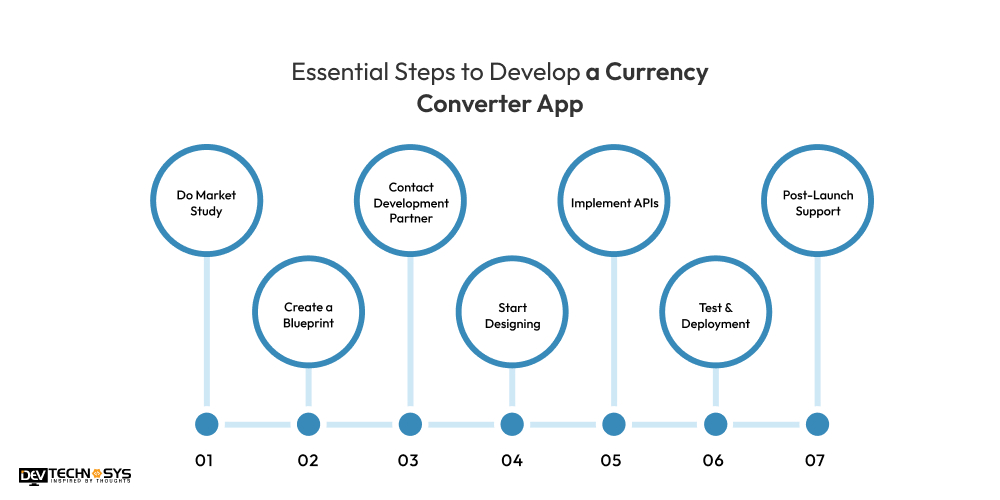

Essential Steps to Develop a Currency Converter App

Let’s discuss the process to develop a currency converter app in this section. So, you can easily manage the rate and make profit through marketing of the tourist FX calculator platform:

1. Do Market Study

A crucial initial step in creating a currency converter software is carrying out a market analysis. This aids in determining the target audiences, business requirements, and evaluating the competition. Finding popular features and potential areas for improvement can be accomplished by examining similar apps.

Additionally, using custom software development services in UAE is important to analyze pricing schemes and user reviews. It can yield insightful information about user expectations.

- Avoid overlooking particular markets.

- Ensure reliable data sources.

- Don’t rely on just quantitative data.

2. Create a Blueprint

Outlining the main functions, features, and user flow of the application is part of creating a blueprint. Choosing the app’s design, architecture, and features such as offline conversion, multi-currency support, and real-time exchange rates are all part of this process.

The design and development teams use the blueprint as a reference and visual roadmap. So, having clear documentation guarantees that everyone involved in the project has the same objectives and vision.

- Be flexible with changes.

- Consider long-term scalability.

- Don’t overcomplicate features.

3. Contact Development Partner

Selecting the ideal Android app development company in UAE is essential to guarantee that the app is built with exact requirements. An internal team, independent developers, or a specialist agency can all be considered development partners.

It’s critical to assess their experience, portfolio, and level of expertise in creating comparable apps. The development process can be made to run smoothly by establishing clear communication channels.

- Verify experience and portfolio.

- Ensure clear communication.

- Review legal agreements.

4. Start Designing

One of the most important phases in app development is designing the user interface (UI) and user experience (UX). With an emphasis on providing an outstanding user experience, the design should be simple to use, intuitive, and aesthetically pleasing.

To depict the app’s flow and user interactions, wireframes, mockups, and prototypes are created as part of the design process. Additionally, it is crucial to test designs with consumers’ preferences.

- Prioritize user experience.

- Test designs with real users early.

- Keep platform guidelines in mind.

5. Implement APIs

Providing precise and up-to-date currency conversion data requires integrating trustworthy APIs. These APIs link the application to other resources that offer current currency rates and other financial information. Businesses can hire dedicated wallet app developers to use well-known APIs.

The number of currencies supported, cost, and data accuracy all play a role in selecting the best API service. The features of the app are guaranteed to perform flawlessly through integration and testing.

- Check API reliability and uptime.

- Account for latency and speed.

- Plan for API changes.

6. Test & Deployment

To make sure the app functions as intended across all platforms and devices, testing is a crucial step. To find and address errors or problems, it uses functional, usability, and performance testing. Furthermore, security testing is essential, particularly when working with financial data.

The app is released to the appropriate app stores after passing all testing phases. Preparing the software for public distribution like improving app store listings is known as deployment.

- Test across multiple devices and platforms.

- Don’t skip security testing.

- Ensure compliance with app store policies.

7. Post-Launch Support

Support for the app after launch is essential for preserving its functionality and resolving any problems that may come up. So, you must approach a custom web development company in UAE for bug fixing, track customer feedback, and to provide updates for enhanced functionality or add new features.

To comprehend user behavior and make data-driven decisions for upcoming updates, it’s also critical to monitor app analytics. Continuous support guarantees safe and competitive user experience.

- Don’t neglect user feedback.

- Provide timely updates.

- Plan for long-term maintenance.

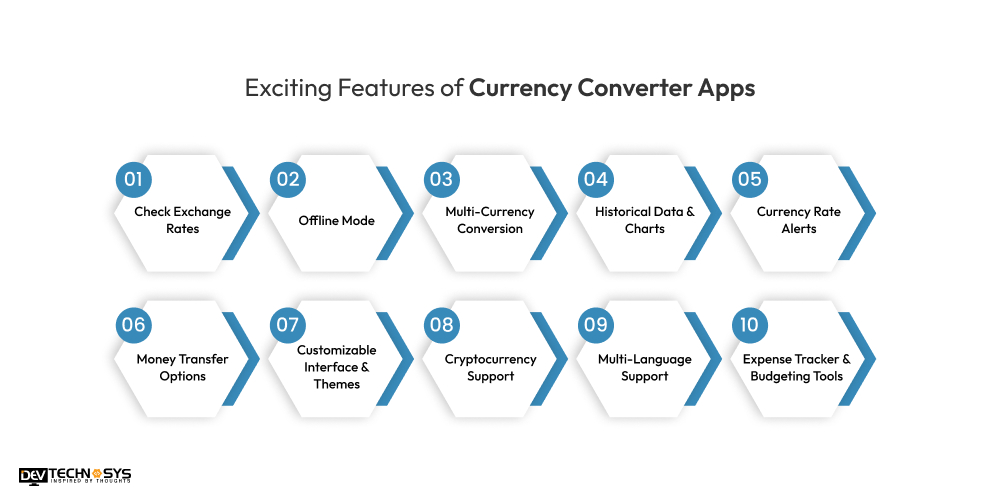

Exciting Features of Currency Converter Apps

Because they provide real-time exchange rate updates, currency converter applications have become indispensable resources for merchants, enterprises, and tourists. These ten fascinating characteristics make these apps essential.

1. Check Exchange Rates

Apps that convert currencies retrieve current exchange values from forex markets and financial institutions. An Ewallet app development company in UAE can help you to implement this feature.

2. Offline Mode

A currency converter app stores the most recent currency rates so they may be used offline. Travelers who need to convert currencies while on the go but may not always have internet connection will find it helpful.

3. Multi-Currency Conversion

A currency exchange app shows the difference between various currency pairs. So, users can convert many currencies at once. For dealers and multinational corporations handling several currencies at once is especially helpful.

4. Historical Data & Charts

Apps give customers access to historical exchange rate trends so they can examine previous swings. Businesses can develop an E-wallet app like JumiaPay to make foreign exchange decisions through interactive graphs.

5. Currency Rate Alerts

Users can establish alerts for particular exchange rates with currency exchange software. Travelers and forex traders who wish to exchange money at the best rates would benefit from this option.

6. Money Transfer Options

Users can send money abroad using certain real-time currency converter apps that interact with payment gateways. A currency calculator app eliminates the need for third-party services and streamlines transactions.

7. Customizable Interface & Themes

An app like Taptap Send offers adaptable themes to improve user experience with an intuitive UI. Numerous forex exchange apps provide customizable dashboards, font changes, and dark mode for convenient access to preferred currencies.

8. Cryptocurrency Support

Best currency exchange apps currently facilitate bitcoin conversions due to the growth of digital currencies. Users may follow the real-time prices of Bitcoin, Ethereum, and other cryptocurrencies.

9. Multi-Language Support

Exchange rate tracker apps support many languages, serve users from around the world and facilitate effective navigation. A multi-currency converter app guarantees a number of formats and currency symbols.

10. Expense Tracker & Budgeting Tools

An expense tracker is one feature of forex exchange apps that aids users in managing their money while on the road. Using wallet app development services is necessary to incorporate exchange rate computations.

Top Currency Converter Apps

Users may easily convert currencies for trading, business, and travel with the use of retail exchange applications. Advanced features like multi-currency support are available on many forex calculator apps. These are a few of the best business forex calculator apps for currency conversion that offer precise and effective financial solutions:

10 Leading Currency Converter Apps |

Supported Devices |

Downloads |

Ratings |

| Currency Converter Plus | Android|iOS | 10M+ | 4.7 |

| Wise | Android|iOS | 10M+ | 4.7 |

| Xe Money Transfer & Converter | Android|iOS | 10M+ | 4.7 |

| Currency converter offline | Android|iOS | 10M+ | 4.4 |

| Easy Currency Converter | Android|iOS | 10M+ | 4.3 |

| All Currency Converter | Android|iOS | 5M+ | 4.4 |

| Currency Converter | Android|iOS | 5M+ | 4.4 |

| xCurrency | Android|iOS | 1M+ | 4.5 |

| CoinCalc | Android|iOS | 100K+ | 4.6 |

| FX Rates | Android|iOS | 100K+ | 4.4 |

What is the Cost to Build a Currency Converter Application?

Numerous factors like app’s complexity and team’s experience affect the cost to develop a currency converter app. Businesses may make better judgments by having a thorough understanding of these aspects. Major factors that influence the total currency exchange app development cost are listed below:

1. App Complexity

The forex app development cost is mostly determined by its complexity. A more suitable software with features like currency prediction tools, bank APIs, and multi-currency capability will have high cost. But, a basic app with capabilities like real-time exchange rates and basic conversion may have less rate.

App Complexity |

Development Time |

Estimated Cost |

| Simple | 2-5 months | $5000-$10000 |

| Moderate | 5-8 months | $10000-$15000 |

| Complex | 8-12 months | $15000-$20000 |

| Premium | More than 12 months | $20000-$25000 |

2. Location

The Ewallet app development cost with currency converter features is influenced by the development team’s location. Developers in high-cost areas like the US and Western Europe charge more per hour than those in low-cost areas like Eastern Europe, India, and Southeast Asia. The overall currency converter app development cost may change significantly as a result.

Location Factor |

Estimated Cost |

| USA | $25000-$30000 |

| Australia | $20000-$25000 |

| India | $5000-$12000 |

| UK | $15000-$20000 |

| UAE | $8000-$15000 |

| Brazil | $12000-$16000 |

3. Development Platform

The cost to build a currency converter app is directly impacted by the platform like iOS, Android, or cross-platform. Because each platform necessitates independent development or the usage of cross-platform frameworks, developing for several platforms raises the cost to create a currency converter app.

Development Platform |

Estimated Cost |

| Flutter App | $15,000-$20,000 |

| Native App | $20,000-$25,000 |

| Hybrid App | $25,000-$30,000 |

4. Experience Level

Both the quality and the cost to build a banking app in UAE depend heavily on the experience level of the developers working on it. Additionally they frequently charge more, highly skilled developers or specialists who have worked on related projects can provide quicker and more effective solutions.

Experience Level |

Cost Estimation (USD) |

| Junior/Entry-Level | $8000-$12000 |

| Mid-Level/Experienced | $12000-$16000 |

| Senior/Expert | $16000-$20000 |

| Professional | $20000-$24000 |

5. Hiring Model

The currency converter app cost estimation can be greatly impacted by the employment approach. It includes an in-house team, a development firm, or a freelance developer. Additionally they might charge more, freelancers might not have the resources for bigger jobs.

Hiring Model |

Estimated Cost |

| In House Team | $5,000-$8,000 |

| Full-Time Freelancers | $3,500-$5,000 |

| Developer Outreach | $8,000-$15,000 |

6. Tech Stack

The app’s chosen technology stack has an effect on the cost to develop an app like Zain Cash Jordan. For example, employing advanced frameworks or including complex back-end technology, such machine learning for exchange rate forecasting, may lengthen the development period and raise costs.

Tech Stack |

Estimated Cost |

| Artificial Intelligence | $30,000-$40,000 |

| Blockchain | $35,000-$50,000 |

| Cloud Computing | $40,000-$45,000 |

| Cyber Security | $45,000-$50,000 |

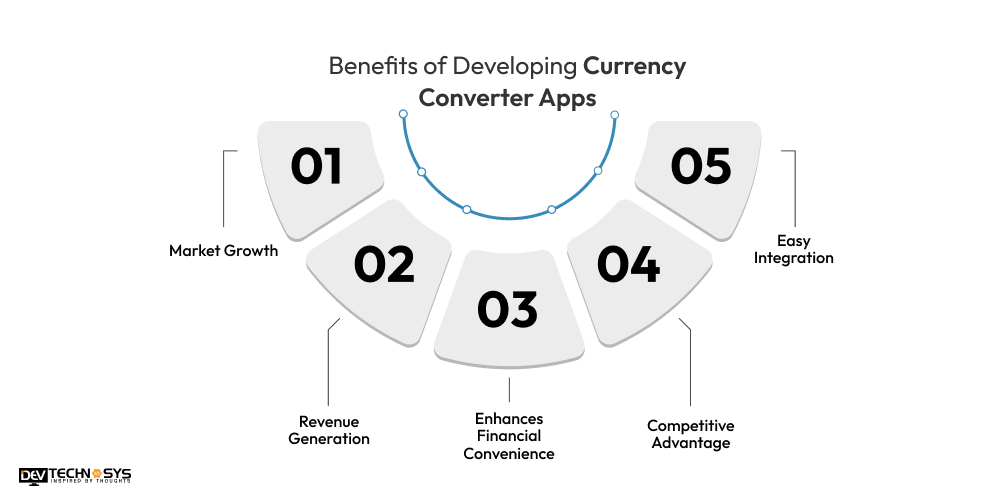

Benefits of Developing Currency Converter Apps

In today’s global economy, currency converter apps are vital resources that help forex traders, travelers, and enterprises alike. These are the top five benefits of creating an app that converts currencies.

1. Market Growth

As digital payments and globalization increase, there is a growing need for a mobile currency converter application. A large user base is created by the ongoing need for real-time currency rate updates by businesses, tourists, and forex traders.

2. Revenue Generation

Numerous revenue streams, including in-app purchases, premium subscriptions, and affiliate relationships with forex platforms, are available on money converter apps. Many Ewallet app development companies in Dubai provide services like currency trading tools to improve monetization.

3. Enhances Financial Convenience

These applications facilitate financial transactions for both enterprises and passengers by offering fast currency conversion. Users can get real-time data in a matter of seconds rather than having to manually search for exchange rates, increasing efficiency and lowering the possibility of inaccurate conversions.

4. Competitive Advantage

Currency conversion tools can be implemented by a mobile app development company to enhance business offerings. To draw in foreign customers and obtain a competitive advantage, fintech applications that provide digital wallets or remittance services can incorporate integrated currency conversion.

5. Easy Integration

Travel agencies, e-commerce sites, and banking apps can all be easily connected with currency converter apps. Businesses can increase client interaction and diversify their service offerings by partnering with international financial institutions or providing API access.

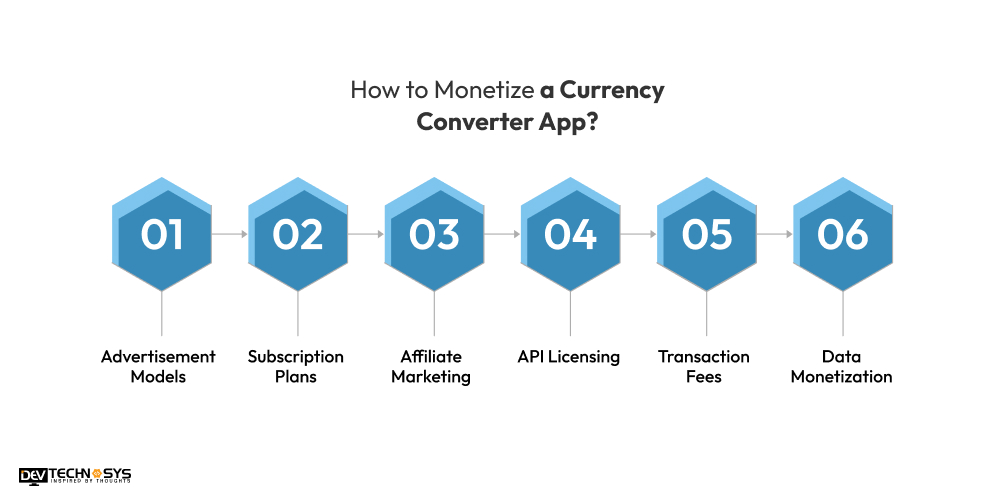

How to Monetize a Currency Converter App?

Through a variety of monetization techniques, a well-designed currency converter app can bring in a sizable sum of money. These six strategies can help you make your app a successful business:

1. Advertisement Models

Consistent revenue can be produced by displaying native ads and banner ads through ad networks like Google AdMob. An iOS app development company in UAE can help you to add impressions and clicks which guarantee that customers will continue to have a flawless experience.

2. Subscription Plans

Paying customers can be drawn in by providing a premium edition with cutting-edge features including historical data, real-time rate notifications, and an ad-free experience. Long-term app viability is ensured by recurring revenue streams from monthly or annual subscriptions.

3. Affiliate Marketing

You can hire dedicated software developers in UAE to generate commission-based income by collaborating with travel agencies and currency trading platforms. Additionally, affiliate links and recommending reliable financial services within the app can increase revenue.

4. API Licensing

Fintech firms and e-commerce platforms might pay for API access if your app offers extremely precise and up-to-date currency data. You can increase the reach of your app and generate a steady income stream by licensing your API to other developers.

5. Transaction Fees

Users can send money across borders while you receive a modest commission for each transaction. An on-demand banking & finance software development company may help you to integrate international money transfer options. So, revenue can be increased by partnering with financial institutions.

6. Data Monetization

It can be profitable to provide premium users with access to financial reports and in-depth currency on a FX converter app. Businesses and traders frequently look for data-driven insights, which makes this a desirable premium offering.

Blog Summarization!!

Targeting banking software development solutions in UAE at affordable rates must be the goal for businesses. Investment of money in currency conversion app development may be a right move for businesses because of its high demand. But, you must consider the following points before starting the process to make a currency converter app:

- Gain proper knowledge through various use cases.

- Contact reliable partners at lowest possible money exchange software development cost.

- List necessary features that can provide productivity to users.

- Use profitable money-making models for constant earning.

By executing all the above checkpoints, you can easily build a currency converter app. So, it is the right time for entrepreneurs to initiate the digital currency converter development process.

FAQs

1. Which are the Best Currency Convert Apps in UAE?

XE Currency, Currency Converter Plus, and UAE Exchange Rate Converter are the top currency converter applications available in the United Arab Emirates. These applications offer accurate AED conversions, support for numerous currencies, and real-time currency rates.

2. How Does a Currency Converter Application Work?

- The app retrieves live currency rates.

- Users select the currencies to convert and enter the amount.

- The app calculates the converted value.

- The converted amount is shown to the user.

- Many apps include historical data, offline mode, and rate alerts.

3. How to Reduce the Cost to Develop a Currency Converter App?

- Integrating existing currency exchange APIs.

- List essential features to test the market before scaling.

- Target cost-effective regions for high maintaining quality.

4. What is the Cost of Hiring Currency Converter App Developers?

Expertise, location, and project complexity all affect how much it costs to hire developers for a currency converter software. Freelancers often charge between $20 and $40 per hour, whereas agencies charge between $10,000 and over $15,000 for a whole job.

5. How Much Does it Cost to Maintain Currency Converter Applications?

Depending on server expenses, security upgrades, and feature additions, maintaining a currency converter app can cost anywhere from $1,000 to $6,000 per month. Bug patches, API upgrades, data security, and speed enhancements are all part of routine maintenance.