“Touch your business future by creating an app like Touch ‘n Go eWallet.”

Make fast payments with one touch. Various platforms like Touch ‘n Go eWallet provide easy payment services helping users to transfer money within a few seconds. It has created a door for businesses to build an app like Touch ‘n Go eWallet by easily managing the resources as the fintech sector has a lot of potential for modern entrepreneurs.

Commonly, in the UAE, the market of such applications is huge contemplating the traditional payment methods. So, you can make an app like Touch ‘n Go eWallet by following a precise development process that we will discuss in this blog.

Additionally, we are also going to see various cost affecting factors, features, monetization, and top alternatives. So, let’s move forward.

What is Touch ‘n Go eWallet App?

One of the top digital wallet apps in Malaysia is Touch ‘n Go eWallet, which enables users to conduct smooth cashless transactions using smartphones. This platform allows users to pay with QR codes, shop online, pay their bills, pay for parking and tolls, and more.

By availing banking & finance software development services, you can provide a safe and practical digital payment option for daily needs. This includes extra features like peer-to-peer transfers, prizes, and interaction with financial services.

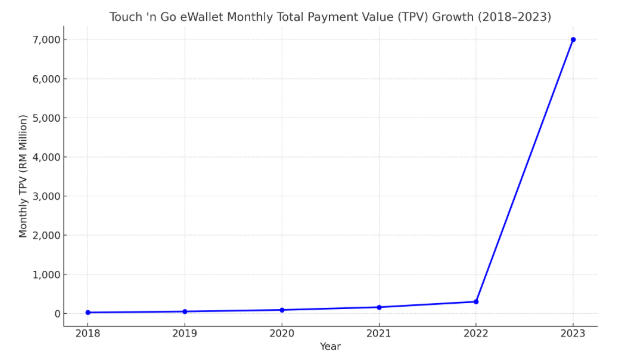

- Revenue: As of 2023, Touch ‘n Go eWallet’s Total Payment Value (TPV) exceeded RM 7 billion per month, marking a substantial increase from RM 25 million in 2018.

- Growth Rate: The app has demonstrated at a growth rate of over 10.62% CAGR in TPV from 2018 to 2023, showcasing rapid adoption and expansion.

- App Downloads: Touch ‘n Go eWallet has achieved over 29 Million downloads on Android devices alone, indicating widespread user adoption.

- Verified Users: The platform boasts approximately 21 Million verified (eKYC) users, solidifying its position as Malaysia’s leading eWallet service.

- Merchant Network: With over 2 Million domestic merchant payment points, Touch ‘n Go eWallet offers the largest merchant network in the country.

What are the Benefits of Developing Smart Payment Apps?

It is beneficial to develop an app like Touch ‘n Go eWallet as they provide speed, security, and convenience. These apps strengthen financial ecosystems with improved management and easy access:

1. User Satisfaction

You can build an app like Touch ‘n Go eWallet with capabilities like one-tap payments and round-the-clock accessibility. This ease of use promotes repeat business and increases user loyalty. Additionally, personalized deals and user-friendly navigation also increase satisfaction and engagement.

2. Improved Security

Tokenization, biometric login, and encryption are used by these apps to safeguard user information and transactions. To guarantee financial security, you must target ewallet app development solutions in the UAE. Trust and safety are further improved by regular updates and fraud detection systems.

3. Faster Transactions

Transactions are processed instantly using smart payment apps preventing delays that come with traditional banking. Businesses must know the cost to build an app like Touch ‘n Go eWallet to easily manage high volume. In both digital and physical settings, it also shortens wait times and lines.

4. Data-Driven Insights

Payment apps gather important user information, such as past transactions and spending patterns. To analyze this data, you must approach an ewallet app development company in Dubai. Companies obtain useful information to improve their product and marketing strategy.

5. Increased Financial Inclusion

Those without access to traditional banking can now use digital financial services. Users can safely send, receive, and keep money using just a smartphone. This aids in managing the cost of build an app like Touch ‘n Go eWallet closing the economic divide in underserved or rural areas.

How AI is Helpful in Ewallet App Development?

The creation of eWallet apps is greatly improved by artificial intelligence (AI), which makes apps more intelligent, safe, and user-focused. AI enables developers to make an app like Touch ‘n Go eWallet that is responsive, adaptive, and effective in real time.

The use of ewallet app development services in Saudi Arabia enhances customer trust and operational efficiency in the process. This includes fraud detection and personalized user experiences.

- Fraud Detection: AI identifies suspicious activities and flags potential fraud using real-time behavior analysis.

- Personalized Recommendations: Offers tailored deals and promotions based on user spending habits.

- Chatbots & Virtual Assistants: Provides 24/7 customer support and query resolution through conversational AI.

- Risk Assessment: Analyzes creditworthiness or transaction risk for services like micro-lending.

- Transaction Categorization: Automatically sorts user expenses for better financial tracking and insights.

How to Build an App Like Touch ‘n Go eWallet?

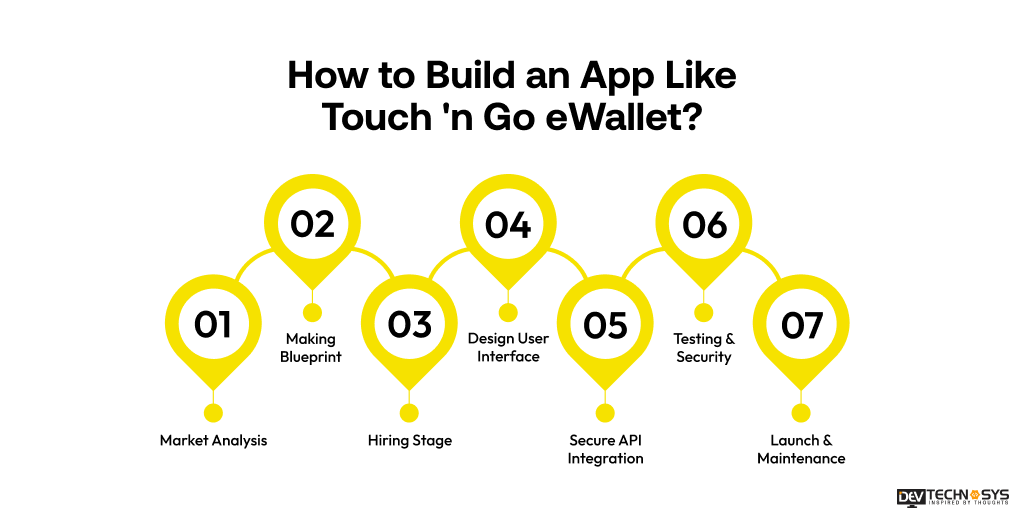

Businesses must know a generally used process to build an app like Touch ‘n Go eWallet. So, they can easily adjust the cost requirements and implement suitable monetary methods:

1. Market Analysis

To create an app like Touch ‘n Go eWallet, you must start by conducting market research on digital wallets, paying particular attention to customer expectations, rivalry, and local laws. Examine leading rivals like Payit, Apple Pay, and Careem Pay to find possibilities and feature gaps.

It is important to study user conduct, payment patterns, and favored financial instruments. Use ewallet app development services for accurate user insights, use analytics, focus groups, and surveys.

2. Making Blueprint

Make a thorough project roadmap that includes features, schedules, workflows, and cost projections. Additionally, contact a banking app development company to describe essential elements like transaction history and security. Create a feature matrix to rank advanced versus MVP capabilities.

Create wireframes and user journey maps to build a smart payment app like Touch ‘n Go eWallet. Record the backend architecture, third-party services, and technological stack.

3. Hiring Stage

It is important to select an internal team, or independent contractors from an ewallet app development company. Put together a group of QA engineers, UI/UX designers, frontend/backend developers, and a project manager. To guarantee regulatory compliance, confirm fintech and app security experience.

To make a smart payment app like Touch ‘n Go eWallet screen applicants by using sites like Clutch, Upwork, or LinkedIn. Collaboration requires agile procedures and effective communication.

4. Design User Interface

Create a clear, user-friendly interface that prioritizes accessibility, speed, and simplicity. Use responsive design to accommodate different screen sizes while adhering to UI/UX best practices. To improve visual identity, use icons and colors that are consistent with your brand.

Create user-friendly dashboard interactions, QR scanning, and payment flows. Use animations and micro-interactions to improve user engagement.

5. Secure API Integration

Incorporate scalable and safe APIs for bank connections, KYC, payment gateways, and alerts. Make use of custom financial APIs or well-documented APIs such as Stripe or Razorpay. For safe transactions, hire dedicated developers who uses OAuth2 protocols, tokenization, and data encryption.

Use Touch ‘n Go eWallet app development services for biometric login and multi-factor authentication. Check for adherence to data protection, AML, and PCI DSS regulations.

6. Testing & Security

Perform several testing tiers like functional, integration, unit, and user interface testing. To look for flaws, compatibility problems, and performance concerns, use automated testing tools by approaching a mobile app development company in Dubai, UAE by focusing on business goals for vulnerability scanning.

Fraud attempts, late payments, and network outages impact the cost to develop an app like Touch ‘n Go eWallet. Test session timeouts, OTP delivery, and biometric login.

7. Launch & Maintenance

Once the app has received final QA and regulatory approval, release it on app stores. Have a soft launch first to get early feedback and fix any problems. Use analytics tools to track the process to develop a smart payment app like Touch ‘n Go eWallet for quickly addressing support inquiries.

To plan feature updates, entrepreneurs must avail mobile wallet application development services to enhance performance, and address bugs. Maintain adherence to changing laws and payment requirements.

Interesting Features of Apps Like Touch ‘n Go eWallet

The goal of apps like Touch ‘n Go eWallet is to give users a simple, safe, and digital payment experience. These apps streamline daily transactions and lifestyle by fusing financial capabilities with ease:

1. Digital Wallet Functionality

It enables digital money storage for convenient access and cashless transactions. You must avail digital wallet app development to deliver credit cards, linked accounts, or bank transfers.

2. QR Code Payments

This allows for quick, contactless payments through the creation or scanning of QR codes. It is widely acknowledged by F&B, retail, and transportation businesses.

3. Bill Payments

A smart payment app like Touch ‘n Go eWallet supports users to pay for subscriptions, mobile top-ups, and utility payments. For convenience, users can automate regular payments and receive reminders.

4. Peer-to-Peer (P2P) Transfers

It enables users on the same wallet platform to send money instantly to one another. An ewallet app like Payit allows users to give money to loved ones, sharing expenses, or splitting bills.

5. Transportation Payments

This connects to parking systems, public transportation, and tolls. Direct payments can be made by users via linked car IDs, NFC, or QR codes.

6. E-commerce Integration

This feature supports in-app purchases and internet buying through partner sites. It frequently contains coupons, promo codes, and special deals.

7. Loyalty Programs

These apps provide specials, reward points, and cashback to loyal customers. You can build an ewallet app like LikeCard that increases user engagement and promotes repeat business.

8. Secure Authentication

Online payment apps incorporate encryption, PINs, and biometric logins for secure access. They guarantee the protection of user data and aids in the prevention of fraud.

9. Expense Tracking

This feature helps users to show spending summary and automatically classifies transactions. It aids consumers in better budgeting and money management.

10. Insurance & Investment Options

It gives access to financial goods, savings tools, and microinsurance programs. Businesses must hire mobile app developers to extend the functionality of the app with financial management.

Top 10 Alternatives of Touch ‘n Go eWallet in the UAE

Digital wallets have quickly gained attention in the UAE market, providing citizens with a variety of safe and practical payment options. Touch ‘n Go eWallet is founded in Malaysia, but the UAE has a number of local and foreign eWallet apps that do comparable tasks. Businesses must target iOS app development solutions to deliver features like peer transfers, bill payments, contactless payments, and other financial services:

Top 10 Touch ‘n Go eWallet Alternatives |

Supported Devices |

Downloads |

Ratings |

| Google Wallet | Android|iOS | 1B+ | 4.0 |

| Revolut | Android|iOS | 50M+ | 4.7 |

| Wise | Android|iOS | 10M+ | 4.6 |

| WavePay | Android|iOS | 10M+ | 4.3 |

| Octopus | Android|iOS | 5M+ | 4.4 |

| ACE Money Transfer | Android|iOS | 1M+ | 4.7 |

| e& money | Android|iOS | 1M+ | 4.6 |

| urpay | Android|iOS | 1M+ | 4.3 |

| FAB Mobile | Android|iOS | 1M+ | 4.2 |

| Payit | Android|iOS | 1M+ | 4.0 |

What is the Cost to Develop Applications Like Touch ‘n Go eWallet?

Several key elements determine the cost to build an app like Touch ‘n Go eWallet. Every component, from geographic location to technological breadth, affects the cost to develop an ewallet app. Planning an effective and practical development strategy is made easier with an understanding of these cost factors.

1. App Complexity

The cost to develop an app like Touch ‘n Go eWallet is increased by sophisticated features like financial interconnections, biometric security, and real-time transactions. More work and knowledge are required for more screens, workflows, and third-party APIs.

App Complexity |

Development Time |

Estimated Cost |

| Simple | 2-5 months | $5000-$10000 |

| Moderate | 5-8 months | $10000-$15000 |

| Complex | 8-12 months | $15000-$20000 |

| Premium | More than 12 months | $20000-$25000 |

2. Impact of Location

The ewallet app development cost varies by area, for example, Western Europe and North America are more costly than Asia or Eastern Europe. Costs can be reduced without sacrificing quality by hiring developers from nations like the Philippines or India.

Impact of Location |

Estimated Cost |

| USA | $25000-$30000 |

| Australia | $20000-$25000 |

| India | $5000-$12000 |

| UK | $15000-$20000 |

| UAE | $8000-$15000 |

| Brazil | $12000-$16000 |

3. Experience Level

Highly skilled developers or firms charge more, but they provide solutions that are more safe, scalable, and of higher quality. They may save money up front, junior developers frequently need more supervision and attention reducing the Touch ‘n Go eWallet app development cost.

Experience Level |

Cost Estimation |

| Junior/Entry-Level | $8000-$12000 |

| Mid-Level/Experienced | $12000-$16000 |

| Senior/Expert | $16000-$20000 |

| Professional | $20000-$24000 |

4. Team Hiring

There are several cost structures associated with hiring a development agency, freelancers, or an internal team. While freelancers help businesses to develop an ewallet app in minimum budget but might not be as coordinated, agencies provide comprehensive packages but can be more costly.

Team Hiring |

Estimated Cost |

| In House Team | $5,000-$8,000 |

| Full-Time Freelancers | $3,500-$5,000 |

| Developer Outreach | $8,000-$15,000 |

5. Technical Cost

The cost of build a smart payment app like Touch ‘n Go eWallet comprises cloud hosting, data storage, payment gateways, security tools, and third-party API connections. Licensing, compliance testing, and server maintenance are examples of ongoing expenses.

Technical Cost |

Estimated Cost |

| Artificial Intelligence | $10,000-$15,000 |

| Blockchain | $15,000-$20,000 |

| Cloud Computing | $20,000-$25,000 |

| IoT Integration | $25,000-$30,000 |

How to Monetize Smart Payment Applications?

Smart payment apps give access to a variety of revenue streams. App owners may increase user engagement and create a steady revenue stream by using intelligent monetization approaches:

1. Transaction Fees

Charge users a nominal fee for each transaction, particularly when it comes to cross-border payments, currency conversion, or quick transfers. Due to enormous transaction volumes, even micro-fees can produce sizable revenue at scale. Depending on consumption, fee structures can be dynamic or tiered.

2. Merchant Commissions

Make money by keeping a portion of the payments made by app-using retailers. This device is compatible with both QR payment acceptance and integrated point-of-sale systems. You can approach a fintech app development company to offer loyalty programs and analytics that can support greater commission rates.

3. Premium Features

Provide features that offer value, such greater transaction limits, thorough financial analysis, or quicker assistance. Subscriptions or one-time purchases allow businesses to manage the cost to develop an app like Touch ‘n Go eWallet. Additionally, this freemium strategy makes more money.

4. Advertisement Models

Show customized advertisements from outside companies on the transaction screens or app interface. To increase relevance and click-through rates, use mobile banking app development services in UAE based on user behavior data. Additionally, promoted deals and sponsored placements boost ad revenue.

5. Financial Services Integration

Collaborate with financial institutions or fintech firms to provide investment opportunities, insurance, or microloans. Receive referral fees or commissions by implementing targeted business solutions. By transforming the software into a financial ecosystem, this also increases user engagement.

6. Data Monetization

Utilize aggregated user data to give marketers and companies insights. You can create a smart payment app like Touch ‘n Go eWallet to make sure data management conforms with privacy regulations such as GDPR. Partners must use ewallet app development services in Kuwait to improve their offers and marketing tactics.

In a Nutshell!!

Have you understood the need to create an app like Touch ‘n Go eWallet? If, yes, then it is the right time for businesses like you to start investing money. But, you need to identify the cost to build an app like Touch ‘n Go eWallet at first. Let’s see some essential points:

- Observe leading business models to list features and other necessary requirements.

- Contact a reputed ewallet app development company in UAE at lower rates.

- Follow a suitable hiring and development process with maintenance.

- Make use of suitable monetary methods to build a growing business.

You can establish a fintech brand by executing these points timely. Additionally, you can keep your competitors behind by generating a huge profit and gathering people in large numbers.

Frequently Asked Questions

1. Which are the Top Ewallet Applications in the UAE?

Payit (by FAB), Etisalat Wallet, Apple Pay, Samsung Pay, and Careem Pay are among the top eWallet applications in the United Arab Emirates. Retail purchases, transfers, and utility payments are just a few of the many services that these apps provide.

2. How Long Does it Take to Build an App Like Touch ‘n Go eWallet?

It usually takes 4 to 6 months to develop a basic version of an eWallet program, such as Touch ‘n Go. Depending on complexity and integrations, a more sophisticated, feature-rich version could take 6 to 12 months to complete. The tech stack, staff size, and legal constraints all affect timelines.

3. Which Tools are Used for Developing Touch ‘n Go eWallet Like Apps?

- Frontend Development: React Native for cross-platform development.

- Backend & Database: Nodejs or Python with databases like MongoDB.

- Payment & Security Integration: Stripe APIs with security tools like biometric authentication.

4. What is the Maintenance Cost of Apps Like Touch ‘n Go eWallet?

Depending on the features, user base, and size of the app, monthly maintenance expenses might range from $5,000 to over $20,000. Bug patches, security upgrades, server hosting, and third-party APIs are all included in the price.

5. Are Apps Like Touch ‘n Go eWallet Safe to Use?

Yes, because of encryption, biometric logins, and regulatory compliance, they are generally safe. Apps that are trusted adhere to global security standards and undergo frequent audits. Users should still use caution while making purchases, such as turning on 2FA and staying off of public Wi-Fi.