Creating a mutual fund app is a calculated move for financial institutions and fintech firms looking to meet the rising demand for digital investing products. This in-depth tutorial explores the features and mutual fund app development costs, including information on what influences costs and the necessary elements to produce a competitive app.

Developing user-friendly and secure software requires an awareness of these components, which range from simple portfolio tracking to sophisticated analytics and AI-driven suggestions. This blog offers the necessary information to properly manage the difficulties of mutual fund app development, regardless of whether you’re creating a new project or improving an already-existing platform.

Quick Summary

This blog has everything you need to know about mutual fund app development costs, from the factors affecting reduction to its features, so dive straight into it to avoid misconceptions.

What is Mutual Fund App Development?

Developing a mobile application that enables users to manage, invest in, and keep an eye on mutual funds is known as mutual fund app development. These applications include functions such as transaction history, real-time market updates, portfolio tracking, and performance analysis. In addition to setting investing goals and getting tailored suggestions based on their financial profiles, users may easily purchase and sell mutual fund shares.

Creating a user-friendly interface, including safe payment channels, and ensuring financial rules are followed are all part of the development process. Apps for mutual funds are designed to streamline the investing process and make it easier for consumers to manage their money while on the go.

What is the Mutual Fund App Development Cost?

The complexity, features, and development methodology of a mutual fund app can all substantially impact the cost to develop a mobile app. An entry-level mutual fund app with minimum functionality may run anywhere from $9,000 to $16,000. The mutual fund app development cost of a more feature-rich software with sophisticated features like real-time data analytics, AI-driven suggestions, and cross-platform compatibility can range from $16,000 to $27,000 or more.

The cost to build a banking mutual fund app includes UI/UX design, front-end and back-end programming, security features, testing, and third-party integrations. The overall mutual fund app development cost will also increase due to upgrades and continued maintenance.

The expected cost to develop mutual fund app is summarized in the following tiny table:

| Development Scope | Estimated Cost |

| Basic Mutual Fund App | $9,000 – $16,000 |

| Advanced Mutual Fund App | $16,000 – $27,000+ |

Working together with an experienced mobile app development services providers will help to guarantee that your software satisfies industry requirements and offers a flawless user experience. Efficient mutual fund app development cost management and the development of a strong mutual fund app that meets user and market criteria may be achieved with careful planning and well-defined specifications.

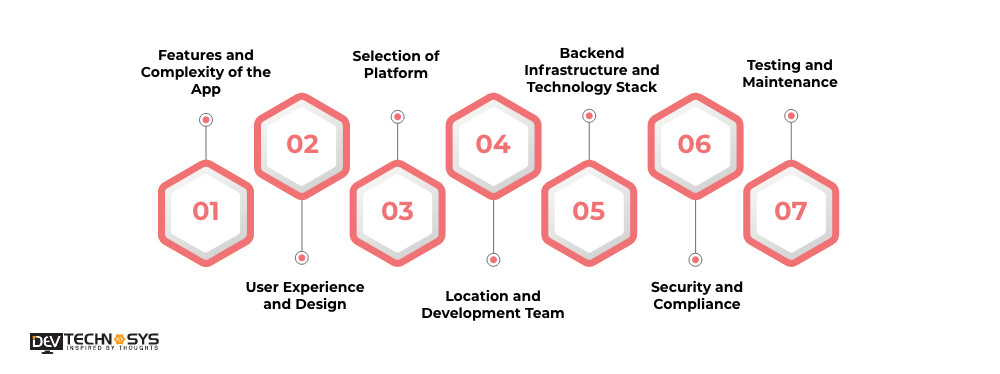

7 Factors Affecting the Mutual Fund App Development Cost

The process of creating a mutual fund app is intricate and comprises several steps and factors. Several things can affect the total cost to develop mutual fund app like this. Knowing these things aids in budgeting and guarantees that the software satisfies the requirements for functionality and quality. The following seven significant variables influence the cost to launch mutual fund app in UAE.

1. Features and Complexity of the App

Its features and general complexity mainly determines the cost to launch mutual fund app in UAE. Implementing basic functionality like transaction history, portfolio tracking, profile management, and user registration is cheap. However, the mutual fund app development cost may increase significantly when you add advanced features like AI-driven suggestions, real-time market data integration, customized investment advice, multi-currency compatibility, and enhanced security measures. Every extra feature increases the time and resources needed for development, which drives up cost to launch mutual fund app in UAE.

2. User Experience and Design

Attracting and keeping users depends on having intuitive, well-designed software. The degree of customization and intricacy needed will determine how much UI/UX design will fund app development costs. A straightforward, practical design could be less expensive, but the price will increase if the application requires a highly dynamic, eye-catching interface with unique animations, transitions, and visuals. Investing in a top-notch design may raise user happiness and engagement, eventually affecting how well the app performs.

3. Selection of Platform

The mutual fund app development cost is influenced by the platform(s) used. Creating an application just for one platform, like iOS or Android, is typically less costly than creating a cross-platform application that functions on both. Cross-platform development frameworks like Flutter or React Native can reduce costs by enabling platform code reuse. Nevertheless, more development and testing may still be necessary to guarantee the software runs smoothly on both platforms, which would raise the overall mutual fund app development cost.

4. Location and Development Team

The on-demand app development company location and level of experience significantly impact the mutual fund app development cost. Due to increased labor expenses, hiring a local development team in New York may be more expensive than exporting the work to areas with cheaper rates. Experience and skill level within the team are also necessary; while more seasoned designers and developers may charge more, their work will always be of higher caliber. The project’s success depends on selecting the correct development team and balancing cost and quality.

5. Backend Infrastructure and Technology Stack

The technological stack and backend infrastructure are critical components of the mutual app development costs. For processing user data, transactions, and real-time changes safely and effectively, a backend that is both scalable and resilient is required. The mutual fund app development cost will vary depending on the databases, hosting services, programming languages, and third-party integrations (such as payment gateways and market data providers) that are selected. Scalability may be achieved using cloud services like AWS or Google Cloud; however, doing so may increase the ongoing operational expenses.

6. Security and Compliance

Security is critical to any application involving money. The mutual fund app development cost increases to ensure the app conforms with financial standards and regulations like GDPR, PCI-DSS, and other local laws. It takes more time and money to implement complex security features like encryption, two-factor authentication, secure APIs, and frequent security audits, and this requires a team of iOS app development services providers. Even if this raises the initial development costs, it is necessary to safeguard user data and uphold confidence to prevent future legal and financial complications.

7. Testing and Maintenance

Extensive testing is necessary to guarantee that the app works correctly on many devices and in various settings. The cost to build a mutual fund app covers testing covers user experience, security, performance, and functionality testing, as well as automated testing. Once the app launches, regular updates and maintenance are required to address any issues and add new features. The total cost to maintain an app should account for these recurring expenses. In addition to providing technical assistance, maintenance entails monitoring user input and implementing the required changes to improve the app’s functionality and user experience.

Best Mutual Funds Apps in 2024

Here is the amazingly curated list of mutual funds apps, which you must know before going further in this blog.

| App Name | Downloads | Rating |

| Robinhood | 10M+ | 4.3 |

| Acorns | 5M+ | 4.7 |

| Betterment | 1M+ | 4.5 |

| Wealthfront | 1M+ | 4.6 |

| Stash | 5M+ | 4.4 |

| E*TRADE | 10M+ | 4.5 |

| Fidelity Investments | 10M+ | 4.7 |

| TD Ameritrade | 5M+ | 4.5 |

| Charles Schwab | 5M+ | 4.6 |

| Vanguard | 1M+ | 4.4 |

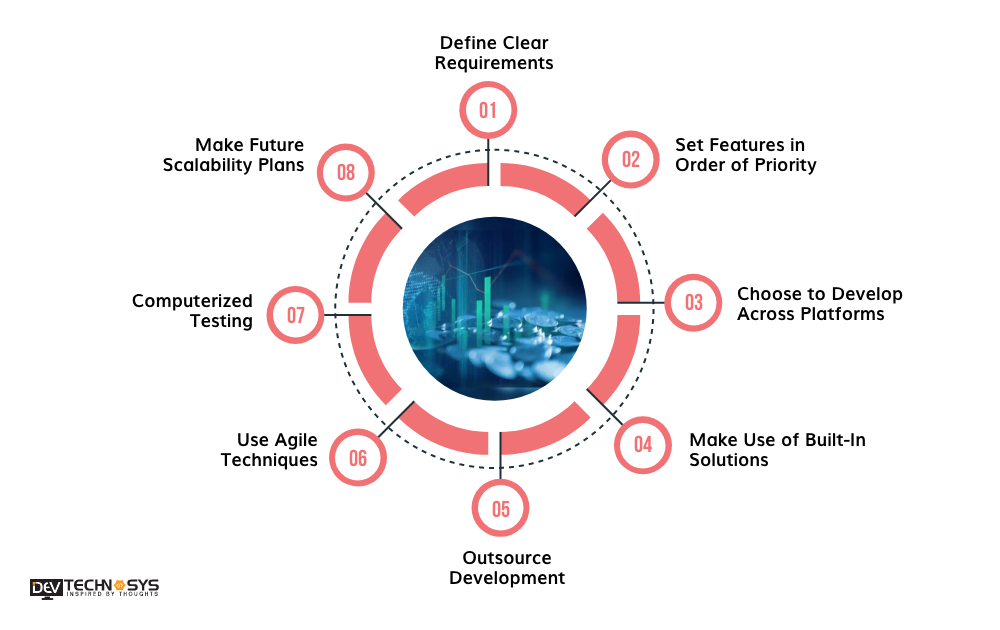

How to Reduce the Mutual Fund App Development Cost?

Creating an app for mutual funds may need a substantial financial outlay. You may, however, use a number of techniques to lower the overall cost of development without sacrificing functionality or quality. Here are a few efficient methods to cut mutual fund app development cost :

1. Define Clear Requirements

From the beginning, having precise and well-defined criteria is one of the most essential elements in reduce the cost to create best mutual funds apps. Spend time carefully considering what functions and features your best app for mutual fund investment must have. You may prevent needless modifications and revisions during the development process, which can result in higher expenses, by establishing a thorough project scope.

2. Set Features in Order of Priority

Even while it might be tempting to offer as many features as possible, concentrating on the most important ones can help reduce the cost to create best mutual funds apps. A Minimum Viable Product (MVP) should be the first step, containing only the essential features needed to satisfy customer demands. This enables you to get user input and launch the best app for sip investment faster. You may spread out the expense over time by adding more features and prioritizing them based on this input for upcoming upgrades.

3. Choose to Develop Across Platforms

It is expensive to create separate apps for iOS and Android. Alternatively, consider using cross-platform development frameworks like React Native or Flutter. By using these frameworks, you may drastically reduce the time and cost to build a mutual fund app by creating a single codebase that functions on both platforms. Since modifications only need to be made once, cross-platform programming makes maintenance and upgrades easier.

4. Make Use of Built-In Solutions

For some app functionality, use third-party services and pre-built solutions rather than creating everything from the ground up. For example, incorporate an already-existing secure payment system rather than creating a new payment gateway. Similarly, employ pre-built modules for analytics, alerts, and user authentication functions. These pre-made solutions can reduce the time and cost to build mutual fund apps.

5. Outsource Development

Think about outsourcing the development to areas where labor prices are lower without sacrificing quality. A sizable pool of highly qualified hybrid app development company is available in nations like India, the Philippines, and the Ukraine, who can provide excellent work for a far lower price than local New York developers. Ensure you select a trustworthy development partner with a track record while outsourcing.

6. Use Agile Techniques

Effective expense management may be achieved by utilizing an agile development process. Agile development features iterative progress with frequent updates and feedback loops. This method makes better control over the development process possible, aiding in the early detection of problems and making modifications easier in response to real-time input. By segmenting the project into more manageable, smaller pieces, you can monitor expenses more closely and make any required modifications as you go.

7. Computerized Testing

Although testing is an essential component of app development, it may be expensive and time-consuming if done only by hand. Repetitive and regression testing may be performed effectively by streamlining the procedure with the use of automated testing solutions. Automated testing decreases the amount of time needed for testing, which also aids in early issue detection and helps avoid expensive repairs later in the development cycle.

8. Make Future Scalability Plans

Long-term cost savings can be achieved by considering future scalability at the first stages of banking mutual fund app development, even though this may appear paradoxical. By building the best mutual fund app with a scalable design from the start, you may avoid spending a lot of money re-engineering it to accommodate expansion. Scalability should be incorporated into the app’s design to save money on retrofitting.

15 Features of Mutual Fund App Development

Developing a mutual fund app involves incorporating features that enhance user experience, ensure security, and provide comprehensive investment management functionalities. Here are 15 essential features to consider:

1. User Registration and Profile Management

A straightforward and secure registration process allows users to create and manage their profiles, including personal details, financial information, and investment preferences.

2. Portfolio Management

A comprehensive portfolio management system enabling users to view, track, and manage their mutual fund investments. Users can see real-time updates on their portfolio’s performance, asset allocation, and historical data.

3. Fund Search and Comparison

A powerful search and comparison tool to help users find mutual funds based on various criteria such as performance, risk level, expense ratio, and fund type. This feature aids in making informed investment decisions.

4. Real-Time Market Data

Integration with financial data providers to deliver real-time market updates, news, and insights. Users can stay informed about market trends and make timely investment decisions.

5. Transaction Processing

Secure and efficient transaction processing for buying, selling, and switching mutual fund units. This includes support for various payment methods and instant confirmation of transactions.

6. Investment Analysis and Reports

Advanced analytical tools and reporting features provide users with detailed insights into their investments. This includes performance metrics, risk analysis, and personalized investment recommendations.

7. Notifications and Alerts

Customizable notifications and alerts keep users informed about important events such as market movements, dividend payouts, and portfolio performance, ensuring they get all critical updates.

8. Goal-Based Investing

Tools to help users set and achieve their financial goals. This feature allows users to define investment goals, track progress, and adjust their investment strategies accordingly.

9. Customer Support

Integrated customer support options, including chatbots, live chat, and FAQs, to assist users with their queries and issues. Providing timely and efficient support enhances user satisfaction and trust.

10. Educational Resources

This section is dedicated to educating users about mutual funds, investment strategies, and financial planning. It includes articles, videos, webinars, and tutorials to help users make informed decisions.

11. Tax Management

Features to help users manage their tax liabilities related to mutual fund investments. This includes tax-saving investment options, capital gains reports, and automated tax calculations.

12. Security Features

Robust security measures to protect user data and transactions. This includes encryption, two-factor authentication, biometric login, and regular security audits to ensure the app’s integrity.

13. Performance Analytics

Detailed performance analytics to provide users with insights into how their investments are performing relative to benchmarks and market indices. This helps users evaluate the effectiveness of their investment strategies.

14. Integration with Other Financial Tools

Seamless integration with other financial tools and services, such as bank accounts, brokerage accounts, and financial planning apps, provides a holistic view of the user’s economic health.

15. Multi-language and Multi-Currency Support

Support for multiple languages and currencies to cater to a diverse user base. This feature makes the app accessible to users from different regions and enhances its global appeal.

How Dev Technosys Can Help You In Mutual Fund App Development?

Dev Technosys, a leading mobile app development company, can help you create a robust and feature-rich mutual fund app tailored to your needs. With expertise in fintech solutions, they offer end-to-end services, from creativity and design to development and deployment. Their team ensures top-notch security, seamless user experience, and compliance with financial regulations, providing a reliable platform for managing investments efficiently. Hire dedicated developers from Dev Technosys to bring your mutual fund app vision to life.

FAQ On Mutual Fund App Development

1. How Much Does It Cost To Develop a Mutual Fund App?

The cost to develop mutual fund app ranges from $9,000 to $27,000, depending on complexity, features, platform choice, and Android app development company location.

2. How Long Does It Take To Develop a Mutual Fund App?

Developing a mutual fund app typically takes 4 to 6 months, including planning, design, development, testing, and deployment stages.

3. What Are The Benefits To Develop a Mutual Fund App?

A mutual fund app offers investors convenience, real-time portfolio tracking, personalized investment advice, and improved accessibility, enhancing overall user experience and engagement.

4. Why Should You Choose Us To Develop a Mutual Fund App?

We provide comprehensive development services, industry expertise, top-notch security, and customized solutions to meet your specific needs, ensuring a high-quality and reliable app.

5. How Can You Monetize a Mutual Fund App?

Monetize a mutual fund app through subscription models, transaction fees, in-app advertising, freemium models, and affiliate marketing partnerships.

6. How Much Will It Cost To Maintain Your Mutual Fund App?

Maintenance costs for a mutual fund app typically range from $2,000 to $5,000 per year, covering updates, bug fixes, and server maintenance.