“Seamless online banking”

In this fast-forward world, everyone wants faster and peer-to-peer payment transactions with high-security measurements. Here comes the BDO online banking app. With the help of this, users can easily transfer funds, either internationally or locally, and it can also send money to other banks with higher transaction limits.

According to a survey, the online banking app market size was valued at $1.16 billion in 2023, and it is projected to grow around $4.26 billion by the end of 2032.

The above data reveals that investing in an app like the BDO online banking app is a profitable opportunity for entrepreneurs to grow their businesses and achieve higher success rates.

This blog will explore how to Develop a banking app like BDO, which can help entrepreneurs expand their businesses.

Read this blog!

Quick Summary:

In this blog, we will explore different stages of how to Develop a banking app like BDO and similar online banking apps. We also provide robust development stages, benefits, cost of overall development, and successful monetization techniques.

What is a BDO Online Banking App?

BDO online banking app is a universal bank in the Philippines. It allows users to view and manage their BDO accounts and make large transactions. This platform provides advanced features such as viewing balances, managing credit or debit cards, and securely logging in to an internet-connected device. If you want to develop app like BDO online banking, contact a mobile app development company for successful online banking apps.

- It allows users to check their payment history of PHP and USD savings accounts.

- This platform can send money to other bank accounts with higher transactions.

- BDO online banking app allows users to pay bills for electricity, water, mobile recharges, and other things.

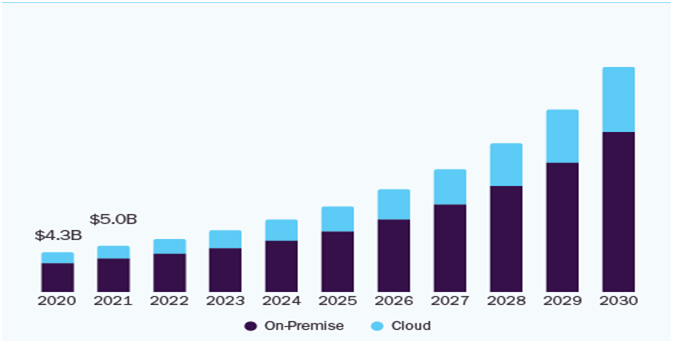

Market Analysis of Online Banking Apps

- According to the global market, the online banking app market size was valued at $1.16 billion in 2023, and it is projected to grow around $4.26 billion by the end of 2032.

- According to a report, the online banking app’s Compound annual growth is 7% from 2023 to 2030.

- In 2023, 66% of the US population used online banking, which will increase to over 79% by the end of 2029.

- According to the global market, the total revenue of online banking apps in one year is $8

- According to a report, the projected net interest income worldwide will reach US$1.50tn by the end of 2024.

Top 5 Online Banking Apps

For successful banking app development solutions, you need to observe or analyze the popular online banking apps to understand their services and functionalities. Because existing online banking apps are successful in the competitive market and you need to understand their strategies. So, here we provide the best online banking apps:

- Muscat Mobile Banking

- DIB MOBILE

- Arabi-Mobile

- Alinma Bank

- SNB Mobile

1. Muscat Mobile Banking

It is one of the best online banking app like BDO banking, that allow users to access their bank accounts and transfer the funds to other bank accounts seamlessly. An app like Muscat Mobile Banking offers a wide variety of features, such as generating or changing PINs, paying bills, sending or receiving money, checking balances, and managing multiple cards.

2. DIB MOBILE

This is Dubai Islamic Bank’s most popular online banking app. It allows users to easily transfer their funds via mobile devices and view their total balance. Develop an app like DIB MOBILE, which offers premium features like account management, currency converter, bill payments, cash withdrawals, and many more.

3. Arabi-Mobile

Arabi-Mobile is an Arab online banking app that provides convenience or flexibility for users to send or receive funds and also offers pre-approved loans. If you build an app like Arabi-Mobile, then it is a massive opportunity for entrepreneurs to grow their businesses. It offers various features such as payments by QR code scanner and instant registration by debit or credit cards.

4. Alinma Bank

It is one of the most used online banking apps. It was founded in 2006 by Royal Decree and offers a wide range of financial services such as investments, retail services, and corporate services. An app like Alinma Bank provides premium banking services like transaction history, making payments, currency converters, and more.

5. SNB Mobile

Saudi National Bank(SNB) is one of the most popular online banking app in Saudi Arabia, it allows users to manage their multiple bank accounts and view balances. Build an app like SNB Mobile that provides many advanced financial services like account management, payments, card controls, cash withdrawal, branch locator, and deposits.

5 Benefits For Entrepreneurs to Develop a Banking App Like BDO

In today’s generation, everyone wants faster and more convenient fund transfers; no one wants to visit a branch and deposit funds. So, if you develop an app like Liv Bank or BDO online bank, it’s a profit-making opportunity for entrepreneurs to expand their businesses and reach new heights of success.

- Convenience and Flexibility

- User Engagement

- Data Insights

- Competitive Advantage

- Cost Efficiency

1. Convenience and Flexibility

In this first benefit, a BDO online banking app provides flexibility to pay bills such as mobile recharges, electricity, water, and credit card bills. These flexible features can motivate the users to use the online banking app and increase the user base. It allows users to easily deposit the check via mobile device and locate nearby branch.

2. User Engagement

In this second benefit, a BDO online banking app with unique or additional functionalities can engage more users globally and increase its popularity. Using a mobile banking app with high-security measures such as biometrics, fingerprints, and PINs can increase user engagement and make a reputed position in this market.

3. Data Insights

Let’s come to the third benefit, a BDO online banking app observes the users habits, demographics, preferences, purchasing patterns, favorite services or products, and behviours. According to the e wallet app development solutions provider, the collection of useful data insights can improve the products or services quality and it can identity or generate the new ways for improvements.

4. Competitive Advantage

This fourth benefit is that a well-designed or functional online banking app can gain a competitive advantage in the relevant industry’s competitive market. Unique features or functions from other similar banking apps can attract more users globally, and it can be a turning point for entrepreneurs to grow their businesses and receive higher success rates.

5. Cost Efficiency

Let’s come to the last benefit, online banking app has automated operations performed without data redundancy and complete the process of transactions securely. These automated processes can reduce the overall development cost and these are the features such as user support, transaction history, push notifications, and more.

7 Key Steps to Develop a Banking App Like BDO

To create banking application like BDO online banking, consider the robust development stages for a successful online banking app. So, here we provide the successful or robust mobile app development process:

- Research and Identify Requirements

- Identify Core Features

- Choose the Best Tech Stack

- Design of UI/UX

- Development of app

- Testing and Maintenance

- Publishing and Marketing

1. Research and Identify Requirements

In the first stage of development, similar banking apps are observed to understand their functionalities and workings. Research in this competitive market about the existing app for implementing their features in your app. Identify the project requirements and the ideal users of the app.

2. Identify Core Features

In the second stage of development, hire dedicated developers to identify the core or basic features of the app that must be added to your online banking app. Prepare a list of the core features for reducing the data redundancy and make a plan for the competitors that how can compete with them.

3. Choose the Best Tech Stack

In this third stage of development, select the right tech stack for the successful development of an online banking app and research the robust tech stacks. Because robust tech stacks can lead to an app’s success in this competitive market, it involves programming languages, storage, and databases.

4. Desin of UI/UX

Let’s come to the fourth stage of development: Hire mobile app developers from an on demand app development company to design a user-friendly interface that allows users to easily navigate all functions. This stage includes many design factors, such as inbuilt plugins, menubars, and dashboards.

5. Development of app

In this fifth stage of development, assemble professional developers to successfully all the implementations and manage all the automated operations effectively. It involves many advanced integrated modes such as built-in functions, designs, models, classes, and features.

6. Testing and Maintenance

Let’s move to the sixth stage of development; it’s time to test your online banking app under different conditions and scan for bugs or glitches that can be automatically generated. Maintenance includes ensuring all features and functions are working correctly and providing regular updates.

7. Publishing and Marketing

In the last stage of development, hire a React native app development company to launch the app on selected platforms such as iOS and Android. After successful publishing, it’s time for the marketing, which includes email marketing, affiliate marketing, and paid collaborations.

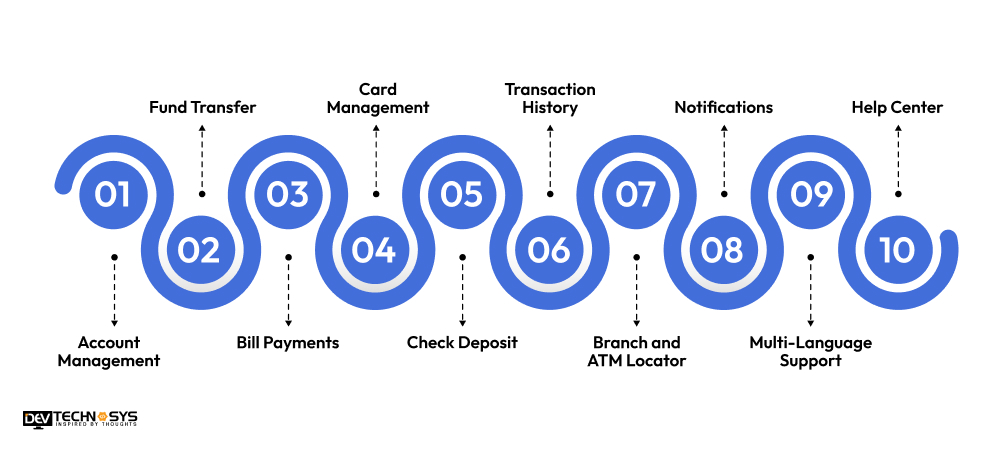

Must-Have Features to Develop a Banking App Like BDO

To access all the services easily, you must know all the features of the online banking app. With the help of a hybrid app development company, you can install the following incredible features in your banking app:

1. Account Management

It allows users to easily manage multiple debit or credit card and savings accounts in one online banking app.

2. Fund Transfer

This platform allows customers to transfer funds to other bank accounts and self-bank accounts with a higher transaction limit.

3. Bill Payments

Build banking App Like BDO online banking, which allows users to pay various bills, such as credit cards, electricity, water, and mobile recharges.

4. Card Management

It can manage all the cards added to the app and perform various activities such as blocking cards, PIN generation, spending limits, and more.

5. Check Deposit

This platform allows users to deposit checks via mobile, snap a snapshot of the check, and submit it to the app.

6. Transaction History

An online banking app provides a detailed statement of payment transactions. To install this feature in your online banking app, reach out an Android app development company.

7. Branch and ATM Locator

It allows users to find or search for a nearby bank branch or ATM for cash withdrawals, which can save time and money.

8. Notifications

This platform sends alert messages for depositing funds, bill payments, mobile recharges, etc.

9. Multi-Language Support

A banking app like BDO online banking allows users to change the app’s language according to their comfort and flexibility.

10. Help Center

If a user encounters problems with the online banking app, customer support is available 24/7.

The Cost to Develop a Banking App Like BDO

The cost to develop a banking app in UAE usually depends on the project’s complexity, functions, features, size, requirements, and infrastructure. The average cost to build application like BDO online banking is around $8,000 to $25,000. So, here we provide the cost chart for a detailed explanation:

Cost to Develop Banking Application BDO Online Banking

|

Online Banking App Development |

Estimated Cost | Time Frame |

| Simple App Development | $8000 – $13000 |

2 to 5 Months |

|

Mid-Complex App Development |

$14000 – $21000 | 5 to 8 Months |

| High-Complex App Development | $25000+ |

9+ Months |

Tech Stack to Develop a Banking App Like BDO

For a successful BDO online banking App development, choose the robust tech stacks because that can help to engage more users by designing a unique or attractive UI/UX:

|

Category |

Tech Stack | Description |

| Frontend | Javascript, HTML |

These powerful platforms build robust user interfaces. |

|

Backend |

PHP, Java | Powerful backend frameworks build robust applications. |

| Database | MYSQL, Postman |

Securely stored massive data and organized structured data. |

|

APIs |

REST, GraphQL |

Sharing data between applications, systems, and devices. |

|

Authentication |

OAuth, JWT |

Verifies the user’s identity and access token from a trusted server. |

|

Cloud Services |

Microsoft Azure, AWS |

Allowing apps to access resources in the cloud. |

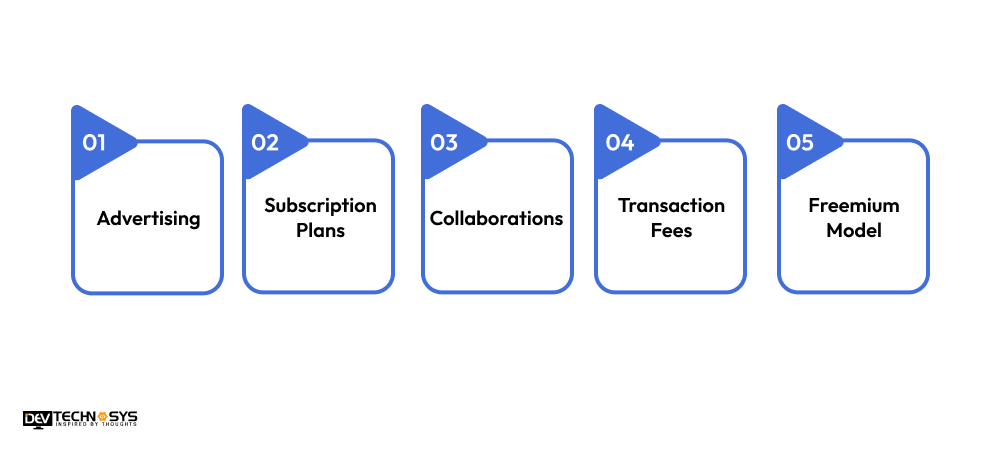

Monetization Techniques to Develop a Banking App Like BDO

To build an app like BDO online banking with extensive functionalities, but businesses have no idea how to make a profit from the online banking app. So, here we provide the best monetization techniques:

- Advertising

- Subscription Plans

- Collaborations

- Transaction Fees

- Freemium Model

1. Advertising

In this monetization technique, the online banking app allows third parties to display their products and services in your app as advertising. You can charge a fee for the advertising. It includes many formats, such as banner ads, display ads, pop-up window ads, and native ads.

2. Subscription Plans

This second monetization technique offers paid subscription plans to access the app’s additional functionalities. Subscription plans can be divided into three tiers: basic, premium, and enterprise. To access all the features, users must purchase the premium plan.

3. Collaborations

In this monetization technique, collaborate with related businesses or merchants to sell their products or services via your app and earn a commission on every sale. According to the Android or iOS app development company, this can increase the company’s overall valuation.

4. Transaction Fees

In this monetization technique, charge a transaction fee for every payment transaction through your online banking app. The transaction fee will be added to the total amount if users want to send funds to an international bank account. This can enhance trust and increase the user base.

5. Freemium Model

Let’s move to the last monetization technique: The online banking app offers a basic version with limited functions. If the user wants to access premium features or services of the app, then the user has to purchase subscription plans or additional features.

How Dev Technosys Will Help You?

In this blog, we discussed in detail how to develop a banking app like BDO and how it can benefit businesses by allowing them to expand in a new way. Build bank app BDO online banking offers various benefits to entrepreneurs, such as higher success rates, a reputed position in this competitive market, and global reach.

If you want to create a banking app like BDO, then book a consultation with a banking app development company that provides reliable or successful banking apps.

Frequently Asked Questions

1. How Long Does it Take to Develop a Banking App Like BDO?

To build a banking app like BDO, it usually takes around 3 to 8 months for overall development and depending on the projects requirements.

2. How Much Does it Cost to Develop a Banking App Like BDO?

The e wallet app development cost is around $8,000 to $25,000, depending on the project’s requirements, features, functions, and size.

3. What are the Key Features of the Online Banking App?

Here, we provide the core features of online banking app like BDO:

- Card Management

- Bill Payments

- Money Transfer

- ATM Locator

4. Which Technologies Are Used to Develop a Banking App Like BDO?

Consider the following robust technologies, that are mainly used to develop a banking app like BDO:

- Python

- Java

- PHP

- Kotlin

- Flutter

5. Why do Businesses Invest in Online Banking App Development?

Businesses invest in online banking app development; here we provide the list of benefits:

- Increased sales

- Brand reputation

- Competitive advantage

- Scalability

- User data insights