Gone are the days when people used to visit banks and apply for loan approvals. It is now possible with the advent of mobile app technologies. Users can easily advance small amounts of cash with the help of the Cash advance app and pay later.

Building an app like Cash Advance Loan App LMS can be a great way to tap into the lucrative payday loan industry. It is a popular loan app that allows users to quickly and easily access cash advances. It’s easy to use, secure and simple to set up. This type of app is becoming increasingly popular due to its convenience and user-friendly interface.

However, planning for on demand app development solutions for cash advance apps can be an outstanding way to connect with individuals seeking to take out loans for their use. It is an investment opportunity that may build a lot of revenue over a period of time.

Due to the immense popularity of BNPL services, numerous businesses are looking to grab this profitable opportunity. If you’re looking to build app like Cash Advance, and want to grab this opportunity? Then you’ve come to the right place. This blog will discuss the essential steps to building your own loan app and features. So if you’re ready to make your mark in the loan app market, let’s start the blog.

Some Essential Facts About the Cash Advance App

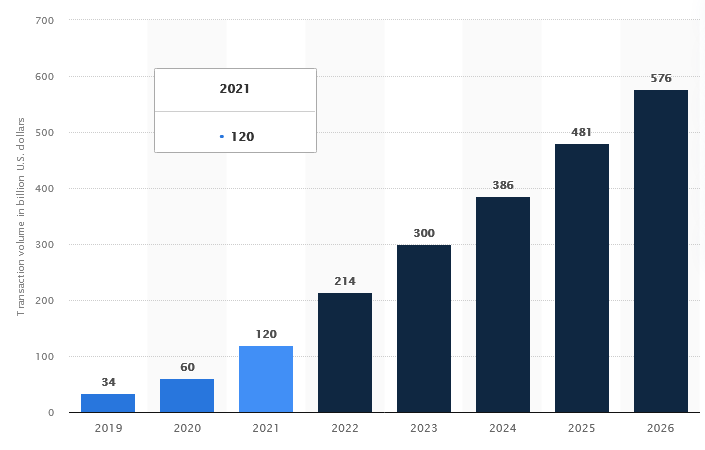

- BNPL transactions are anticipated to expand to $450 billion from 2021 to 2026 worldwide.

- Online banking has become increasingly widely used recently, and this trend is expected to continue.

- For instance, the market share of BNPL services in domestic e-commerce payments was around ten times greater in Sweden and Germany than the equivalent market share in international e-commerce payments.

- Digital Payments will be the market’s largest category, with a total transaction value of US$9,471.00bn in 2023.

- In the Neobanking segment, it is anticipated that the average transaction value per user will reach US$18.08k in 2023.

- The size of the global market for merchant cash advances, which was estimated at USD 620.31 million in 2021, is anticipated to grow at a CAGR of 19.33% throughout the forecast period and reach USD 1791.21 million by 2027.

- In 2024, it is anticipated that the Neo Banking sector’s income will increase by 28.9%.

What is a Cash Advance App?

A cash advance app is a type of financial service app that provides users with short-term loans or advances against their future earnings or credit. Cash advance apps typically allow users to apply for a loan using their smartphone or other device and provide quick access to funds that can be used to cover unexpected expenses or emergencies.

Some of these apps may also offer additional financial services, such as budgeting tools, savings accounts, or other types of loans. However, if you want to build app like cash advance, you must Hire dedicated developers. Some of the most popular BNPL apps are listed below.

List of Top 5 App like Cash Advance

Here is the list of the top 5 apps, like a cash advance, that you must consider while developing the app for your business. So let’s have a look

| App Like Cash Advance | Available Platforms | Ratings | Downloads |

| Chime | Android | iOS | 4.7 | 10M+ |

| EarnIn | Android | iOS | 4.6 | 5M+ |

| MoneyLion | Android | iOS | 4.5 | 1M+ |

| Current | Android | iOS | 4.6 | 1M+ |

| Dave | Android | iOS | 4.4 | 5M+ |

Features to Consider for an App like Cash Advance

Now that you know the types of cash advance apps, it is time to check out the most crucial features to build app like cash advance. So let’s have a look at them.

- Easy Registration

Users can easily register through the app with an email or contact number. After successfully signing in, users can set a password and username.

- User-Friendly Interface

The app should have a user-friendly interface that is easy to navigate, allowing users to access all features and functions easily. Many mobile app development providers can build cash advance loan app for your business.

- Quick Loan Approval

The app should have a quick loan approval process, with a simple online application form that can be completed in a matter of minutes. With this feature, users can easily and quickly get loan approval.

- Instant Funds Transfer

The app should offer instant funds transfer, so users can access their loan amounts as soon as they are approved. So by using this feature, users can instantly transfer funds. If you want to Build app like payit, hire dedicated developers.

- Multiple Loan Options

The app should offer multiple loan options to accommodate different financial needs, including short-term, payday, and instalment loans.

- Flexible Repayment Options

The app should offer flexible repayment options, allowing users to choose the repayment plan that suits their financial situation. To integrate this amazing feature into your app, you must take assistance from a full stack app developer.

- Real-Time Loan Tracking

The app must have a real-time loan tracking system, allowing users to monitor their loan status and keep track of their payments.

- Easy Loan Renewal

The app should have an easy loan renewal process, allowing users to renew their loans quickly and easily.

- 24/7 Customer Support

The app should offer 24/7 customer support, providing users with help and assistance whenever needed.

- Secure Data Encryption

The secure data encryption feature protects users’ personal and financial information from theft and fraud. Several iOS app development services providers can help you by integrating this feature into your app.

- Mobile Notifications

The app should have a mobile notification system, providing users with updates on their loan status, payment reminders, and other important information.

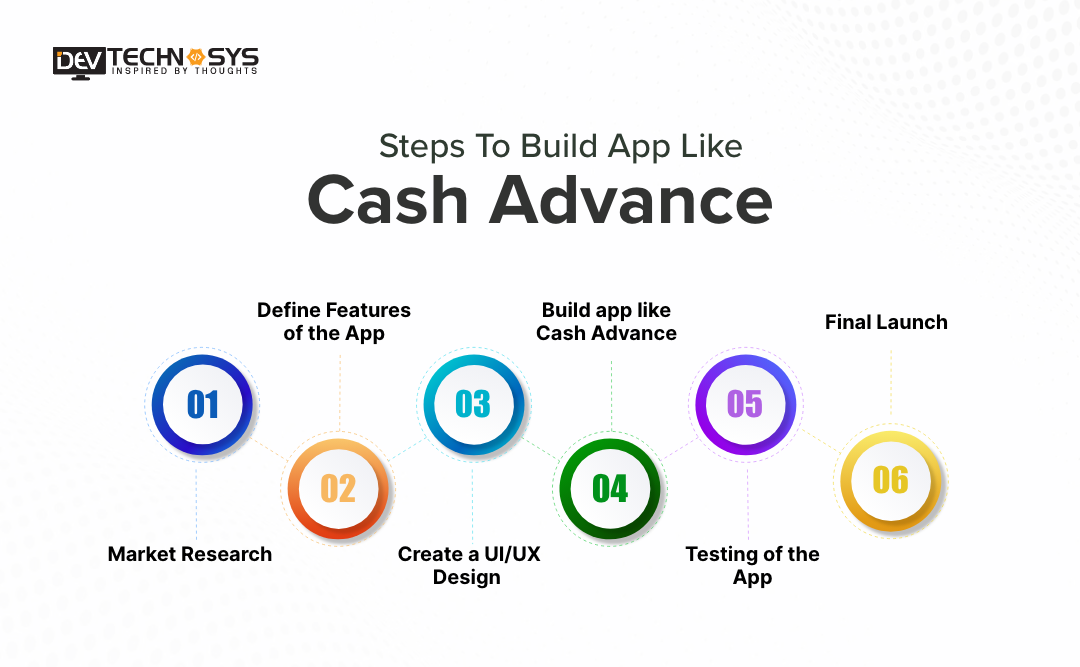

Steps to Build App like Cash Advance

Now that you are familiar with the essential features, it is time to build app like cash advance. So let’s see each of the steps in detail.

Step 1: Market Research

The first step to build app like cash advance is thorough market research. It will assist you in knowing the current market situation and the latest ideas to start a development of loan app. Additionally, you need to conduct market research to understand the target audience’s needs and the market’s competition. It will help you tailor the app to meet the specific needs of the users and differentiate it from the competition.

Step 2: Define Features of the App

The next most important step of BNPL app development is clearly defining the app’s features. Integrating advanced features and basic features is vital to make your app unique from others. Ensure to add those features that your competitor app doesn’t have.

Step 3: Create a UI/UX Design

Now you get an idea about what features you want to integrate into your app, and it is time for the UI/UX design of the app. You should first work on the user interface before jumping on the development part.

Design the app’s user interface to make it user-friendly, visually appealing, and easy to navigate. It is an important aspect of the app that can impact its success or failure. So, you will need to hire specialized designers from a hybrid app development company who can work on the appearance, color scheme, layout and functionality.

Step 4: Build app like Cash Advance

Once you have designed the app’s user interface or front end, the next step in building an app like Cash Advance is to develop the back end. The dedicated loan app developer will build the server, database, and APIs.

The backend is where the app’s core functionality will be developed, so it needs to be robust, scalable, and secure to handle high traffic and user data. This step is crucial in ensuring the app works smoothly and efficiently, providing a seamless user experience.

Step 5: Testing of the App

Once you have successfully built the app, it is time to test it thoroughly. Test the app thoroughly to ensure it’s bug-free and that all features work as expected. It is a critical step in the development process and should not be skipped. Ensure comprehensive testing is done before launch to ensure a smooth user experience.

Step 6: Final Launch

Now that everything is done, the main question arises how to launch an on demand app like a cash advance. This step involves publishing the app on the Apple App Store or Google Play Store and ensuring that all the necessary preparations have been made, such as security measures and user data protection. It is important to ensure that the app is fully functional and meets the target audience’s needs before launching it.

Final Thoughts

Building app like Cash Advance loan LMS requires a comprehensive understanding of the financial services industry, user requirements, and market trends. Creating your own loan app can be daunting, but with the right guidance and resources, you can easily create an app like Cash Advance.

So, for that, you can hire an experienced mobile application development company that can build a successful app like Cash Advance or a loan app LMS that can meet the needs of its users and provide a valuable service to the market.

FAQs

1. How Much Does it Cost to Build App like Cash Advance?

The Cost to develop cash advance app depends on various factors. The estimated Cost with basic features will be around $25000-$35000. However, if you want to integrate advanced features, the Cost will increase to $50000 and more.

2. How Much Time Does it Take to Build App like Cash Advance?

The time it takes to build app like cash advance depends on numerous factors. On average, it can take time anywhere from 4-7 months to finish an MVP and an additional 2-4 months for a full version. However, the cost estimation can change depending on the project’s specific needs.

3. What is the Cost to Hire a Mobile App Developer?

The cost to hire app developers can vary greatly depending on the factors. On average, it can cost anywhere from $50 to $250 per hour for a freelancer and $100,000 to $500,000 for a development team. It’s important to budget and negotiate based on the particular needs of your project.

4. What are the Benefits of Cash Advance Apps?

The benefits of Cash Advance Apps include quick access to funds, an easy application process, and flexible repayment options. They are also convenient for those who cannot visit a bank or other lending institution in person.