Convenience is king in this modern world. This is especially true when it comes to taking care of our money. Banking apps like SNB Mobile have changed the way we handle our accounts by making things easier and giving us more control while we’re on the go. But have you ever wondered how to build an app like SNB Mobile?

You can learn how to make a good banking app from this blog. We’ll talk about a step-by-step plan that includes designing and building, as well as doing market research and making prototypes. You’ll know how to make your own fun game like SNB Mobile by the end.

So, let’s begin!

What Is An SNB Mobile App?

The SNB Mobile App is a mobile banking application offered by the Saudi National Bank. It allows you to perform various banking tasks conveniently from your smartphone, anywhere, anytime. You can check account balances, transfer money, deposit checks, pay bills, and even locate SNB ATMs, all without visiting a branch. The app is designed for a secure and user-friendly experience. If you’re a customer of SNB, the app is a handy tool to keep your banking on track. So, if you want to build an app like SNB Mobile, you must hire a full stack app development services provider.

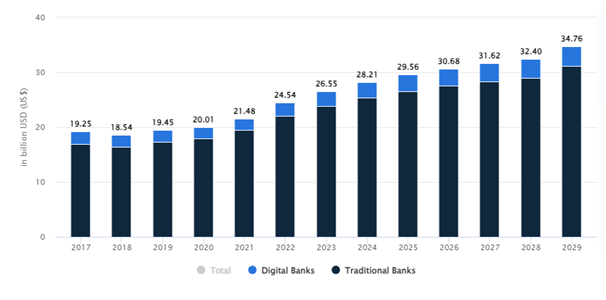

Market Statistics & Growth Of Banking Industry

- The banking market in the United Arab Emirates is forecast to make US$28.21bn in net interest income in 2024.

- With a market size of $25.35bn expected in the same year, this section of the market is expected to be dominated by traditional banks.

- Looking ahead to 2029, the Net Interest Income is expected to grow at a rate of 4.26% per year, which will create a market worth US$34.76bn.

- China is expected to have the most Net Interest Income compared to other countries, hitting US$4,332.0bn in 2024.

- The UAE, along with Saudi Arabia, had the most 5G service users in the MENA area.

How To Build An App Like SNB Mobile?

To get into the growing market of digital banking change, do you want to build an app like SNB Mobile? It’s important to understand how to make a mobile banking app, which is more than just writing code. Check out the below process of SNB Mobile app development.

1. Conduct Research and Make a Plan

When making apps for banks, the first thing that should be done is to research the market, your rivals, app development trends, the people who use your apps, and their specific needs. When a developer is making a unique and valuable business model, all of these things are very important.

2. Find the Team

Building a mobile banking app takes a lot of time, and the best way for a bank to make sure it’s done right is to hire the right people. There are a lot of fintech app development companies that make banking apps, but you need to pick the one that does everything right, from signing an NDA to giving you a system with all the right features to help you after the app is released.

3. Build and Verify a Prototype

Developers give the idea life by making a prototype of the app that shows the app’s structure, logic, design elements, content, and looks. Fixing a mistake in the design is cheaper when the prototype is being made than when the product is being developed. This is one of the best things about making a prototype.

4. Make a Graphic Design

When making UI/UX design for a mobile banking app, one of the best things to do is to give each customer a personalized experience, make the app as easy to use as possible, help users handle their bank accounts, and make sure the app is safe and clear. As an important piece of advice by a hybrid app development company is for making a great-looking mobile app with graphics, the navigation of the app should match the system’s logical layout.

5. Choose a Technology Stack

For developing mobile banking, the most important thing is to pick the right tool stack. With the right tech, you can get push alerts, online passbooks, customer service, and more. A smart choice of tech stacks can also cut down on the time it takes to develop an app like SNB Mobile, the money it costs, and the time it takes to sell the app.

6. Develop Your Banking App

Next, either a banking app development company or an in-house team should help make an app like SNB Mobile. This can be done once the tech stack has been chosen. And the bank can only do this if it has the money and time to hire professionals who know how to make banking apps.

7. Final Launch

Once you’ve made a great app, the next step is to make it public. That job is also very hard to do without a group of pros. The professionals can improve the app so that it’s ready to be put on Google Play or Apple’s App Store. And once the app is out there, it’s time to get comments, stars, or ratings from people who use mobile banking. The iOS or Android app development company can also reach out to the right people by marketing the team.

Must-have Features To Build An App Like SNB Mobile

Now, let’s say you want to build an app like SNB Mobile that stands out from the rest. Then you should think of some special features that will add value. And if you want to get to the top, you should at least think about adding the following features.

1. Security

This is the most important feature of any banking app. SNB Mobile should use strong encryption and multi-factor authentication to keep your financial information safe.

2. Account Management

You should be able to view your account balances, transaction history, and statements. An app like Taptap Send allows users to download your statements in PDF format.

3. Funds Transfer

You should be able to transfer money between your SNB accounts, as well as to other banks in Saudi Arabia. You should also be able to schedule transfers for future dates.

4. Bill Pay

You should be able to pay your bills electronically using SNB Mobile. This includes bills for utilities, phone service, credit cards, and more.

5. Mobile Deposit

When you develop an app like Al Rajhi bank, allow users to deposit checks into your account by taking a picture of the front and back of the check with your phone’s camera.

6. Mobile Top-Up

When you create a SNB Mobile application, users can easily top up their mobile phone with prepaid airtime.

7. Investment Management

You should be able to view your investment accounts and holdings, as well as buy and sell investments.

8. Branch and ATM Locator

When you build an app like SNB Mobile, you should be able to find the nearest SNB branch or ATM with it.

9. Customer Support

You should be able to contact SNB customer support through an app like Al Ansari Exchange, if you have any questions or problems.

10. Personalization

You should be able to personalize the SNB Mobile app to fit your needs. This could include things like setting up quick access to frequently used features, and customizing the order of the accounts that are displayed on the home screen.

Why Must Businesses Invest In SNB Mobile App Development?

There are a couple of ways to interpret “SNB” in your question. Here’s how investing in a SNB Mobile app development can benefit businesses, considering both interpretations:

1. Increased Convenience for Customers

An SNB mobile wallet app development allows customers to bank anytime, anywhere. This provides greater flexibility and caters to those who prefer mobile banking over traditional methods.

2. Improved Efficiency and Productivity

Business owners can manage finances on the go. They can check account balances, transfer funds, make payments, and approve transactions – all from their smartphones. This saves time and streamlines financial operations.

3. Enhanced Security Features

Mobile apps can offer robust security features like fingerprint authentication and two-factor verification. This protects sensitive financial data and builds trust with customers.

4. Better Communication and Engagement

The fintech app like Slice provides a direct communication channel between SNBs and their customers. Businesses can send targeted notifications, offer promotions, and provide real-time account updates, fostering stronger customer relationships.

Top 5 Banking Apps Like SNB Mobile

|

Top Banking Apps Like SNB Mobile |

Available Platform | Downloads | Ratings |

| Mashreq Neo | Android | iOS | 1M+ |

4.7 |

|

Liv.UAE |

Android | iOS | 1M+ | 3.5 |

| YAP | Android | iOS | 100K+ |

2.4 |

|

ADIB |

Android | iOS | 1M+ | 4.1 |

| DIB Mobile | Android | iOS | 1M+ |

4.7 |

What Is the Cost To Build An App Like SNB Mobile?

Before you go and raise money to build your own banking app like SNB Mobile, let’s discuss how much you’ll need approximately. So, “how much does it cost to create a banking app?”. That’s an approximate cost to develop a mobile app from scratch.

And if you are a fintech startup looking to address a niche customer need with a mobile app, the cost to build an app like SNB Mobile should squeeze within the $10,000–$25,000 or can exceed. The below table showcasing the SNB Mobile app development cost:

|

App Complexity |

Cost Estimation |

| Simple SNB Mobile App |

$10000-$15000 |

|

Medium SNB Mobile App |

$15000-$20000 |

| Complex SNB Mobile App |

$25000+ |

So, if you want to know the exact cost to develop an app like SNB Mobile, then you must consult with a mobile app development services provider.

Final Thoughts!

Building an app like SNB Mobile requires a combination of meticulous planning, comprehensive development, and robust testing. By following the outlined steps, you can develop a banking app in UAE.

Remember, staying current with the latest trends and technologies is crucial for ensuring your app remains competitive in the ever-evolving mobile landscape. Are you thinking about switching to digital banking?

Getting together with a skilled iOS app development services provider like Dev Technosys could make all the difference. Get in touch with us, and let’s make a great banking app together.

FAQs!

1. How Much Does It Cost To Build An App Like SNB Mobile?

The exact cost to build an app like SNB Mobile can vary significantly depending on the complexity of the features you want to include. But as a ballpark estimate, it can range from $10,000 to $25,000+. You must hire dedicated developers and get your banking app developed within your budget.

2. How Long Will It Take To Build An App Like SNB Mobile?

The time to build an app like SNB Mobile depends on features. A basic version with account viewing and transfers might take 2-4 months, while adding complex features like credit score or investment tools could extend it to 7 months or more.

3. What Are the Benefits Of SNB Mobile App Development?

When you build an app like SNB Mobile, you will get many benefits:

- Increased Convenience: Manage finances anytime, anywhere on your phone.

- Enhanced Security: Leverage mobile banking’s security features for peace of mind.

- Improved Efficiency: Complete tasks faster through the app than traditional methods.

- Greater Accessibility: Bank on your schedule, not branch hours.

- Potential Cost Savings: Reduced reliance on physical branches may lead to lower fees.

4. How To Monetize A Banking App Like SNB Mobile?

If you have a mobile banking app and wants to monetize it, here are ways to monetize a banking app like SNB Mobile:

- Transaction fees: Charge for P2P transfers or bill payments.

- Monthly fees: Offer premium accounts with extra features for a fee.

- Interest on loans: Earn interest by providing loans and credit cards.

- Investment products: Offer investment options within the app.

- Partnerships: Partner with other financial services for revenue sharing.