“Fasten your business transactions by developing an app like C3Pay.”

Traditional payment methods are gone and digital solutions came with cashless apps. C3Pay like apps are delivering numerous services to users in the UAE and other Middle East countries. Additionally, the introduction of such platforms encouraged entrepreneurs to build an app like C3Pay for the users to increase engagement and retention.

You can experience the popularity of these digital payment gateways by knowing that around 8 out of 10 people in the UAE are using them. So, it is a golden chance for businesses to invest in digital payment app development.

For that, it is necessary to know various aspects related with how to develop an app like C3Pay.

In this blog, we will examine them. So, let’s get started.

What is C3Pay?

A smartphone application known as C3Pay was created to make financial transactions and salary management easier, especially for UAE blue-collar workers. Through their cell phones, users can pay bills, send money abroad, receive their earnings, and safely manage their accounts. A mobile app development company may help businesses to deliver all these services

C3Pay, which is run under the Wage Protection System, makes sure that workers who don’t have access to traditional banking can nevertheless carry out necessary financial tasks. The program is easy to use for a varied workforce because it supports many languages. It encourages financial inclusion and consumer ease with features including prepaid card integration, balance checking, and rapid money transfers.

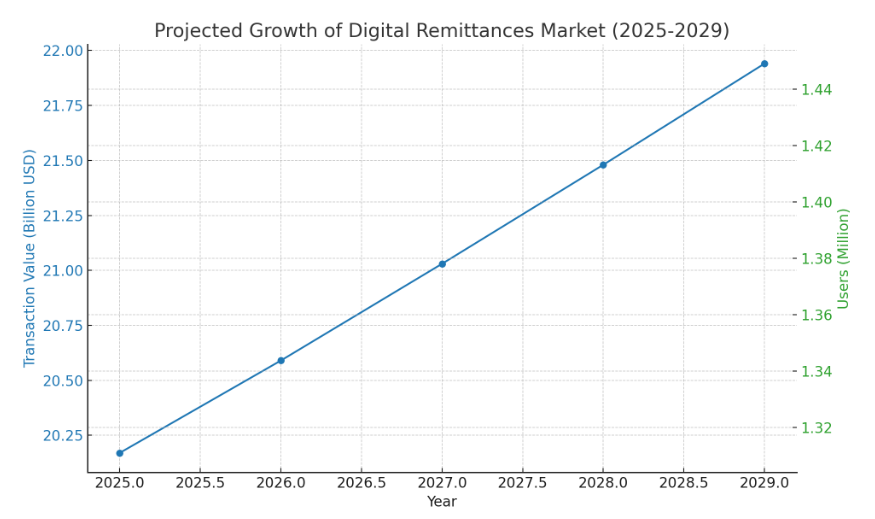

Current & Future Stats on Digital Payments in UAE

- The digital remittances market is expected to achieve a transaction value of $20.17 Billion by the end of 2025.

- The transaction value is anticipated to expand at a rate of 12% CAGR between 2025 and 2029, reaching a predicted total of $21.94 Billion by 2029.

- By 2029, there will likely be 38 Million users in the digital remittances sector.

- With an anticipated total transaction value of $20.09 Trillion in 2025, digital commerce is the market’s largest segment.

- According to a global comparison, with $44.64 Billion, the United States achieved the greatest transaction value in 2025.

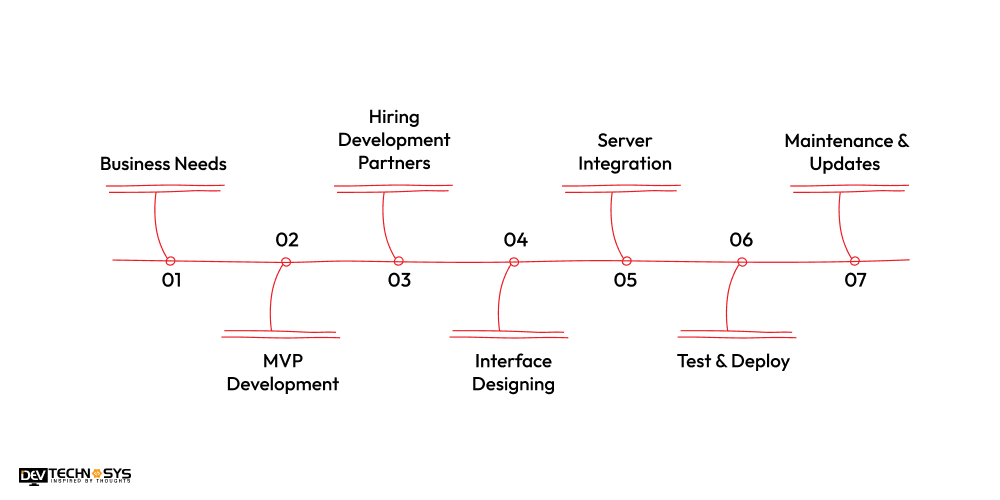

How to Create Applications Like C3Pay?

So, now we are discussing the steps to build an app like C3Pay in this section. Additionally, some fundamentals are also cleared to help businesses with cost management:

1. Business Needs

Initially, you need to clearly define your business goals for C3Pay app development. Determine the issues that your app will address like bill payment and money transfers. To properly study market trends you should avail custom software development services in UAE at reasonable rates.

Assess the requirement for compliance, particularly with regard to UAE fintech rules. An effective roadmap aids in directing the development process.

- Who is the primary target audience?

- What financial services should be provided?

- What are the regulatory requirements in the UAE?

2. MVP Development

Developing an MVP enables you to build C3Pay application clones with essential features. Pay attention to key features including secure transactions, user registration, and simple wallet administration. Without requiring a significant upfront cost, an MVP assists in testing market demand.

To learn about early users’ expectations and problems, get their comments. On the basis of actual user insights, improvements can then be developed.

- Which core features are essential?

- How to get user feedback after MVP deployment?

- What is the estimated timeline and budget for building MVP?

3. Hiring Development Partners

Businesses should approach an eWallet App Development Company to select in-house teams or independent developers. Additionally, collaborate with professionals having expertise in safe payment systems and fintech. Examine their technological portfolio with compliance regulations.

It is essential to communicate clearly regarding budgets, deadlines, and milestones. A knowledgeable development partner guarantees quicker time to market and more seamless advancement.

- How to hire the right development team?

- Does the team have experience with fintech apps and security protocols?

- Will I get post-launch support and maintenance services?

4. Interface Designing

For engagement and trust, user interface (UI) and user experience (UX) design are essential. Create layouts that are accessible to all user demographics, with clear iconography and easy-to-use navigation. Pay attention to responsive design to ensure that it works on a variety of screens and devices.

Businesses should use graphics that are consistent with the brand identity for C3Pay similar app development. Make user flows as simple as possible, particularly when it comes to money transactions.

- How to ensure an attractive user interface for diverse users?

- What design elements can enhance user engagement in a NFC payment app?

- How will the design adapt to different devices and screen sizes?

5. Server Integration

Managing sensitive data and real-time transactions requires strong server integration. So, businesses should hire dedicated wallet app developers to select secure server options to handle heavy data loads and traffic. Make sure that all sensitive data is encrypted and that data protection regulations are followed.

For functions like currency conversion, payment gateways, and notifications, integrate third-party APIs. Fast performance and app dependability are ensured by a properly configured server.

- Which server infrastructure is the best for security?

- How to handle data encryption and user privacy with server integration?

- Which third-party APIs are used for transactions and notifications?

6. Test & Deploy

To guarantee performance, security, and functionality, extensive testing is essential. Perform user acceptability, integration, and unit testing. To guarantee compatibility, test on a range of platforms, devices, and network configurations.

Based on test results, improve speed, fix defects, and fortify security. After testing is over, release the app on a few platforms, such as iOS and Android.

- What testing methods are used for various devices and platforms?

- How to handle bugs or vulnerabilities?

- What monitoring tools are used to track app performance?

7. Maintenance & Updates

Additionally, providing support after launch is crucial to preserve software functionality. It is mandatory to update the app to address issues and add new features. So, to balance changing fintech management with required adjustments, you should contact an iOS app development company in UAE.

To keep improving the user experience, pay attention to C3Pay app development services. Additionally, maintenance entails data protection, infrastructure scaling, and server monitoring.

- What should be the update count?

- How to collect user feedback?

- What fintech regulations will be ensured with UAE laws?

Incredible Features of Money Transfer Applications

Mobile payment applications provide strong features that guarantee quick, safe, and easy transactions. They offer specialized features to ensure a smooth experience:

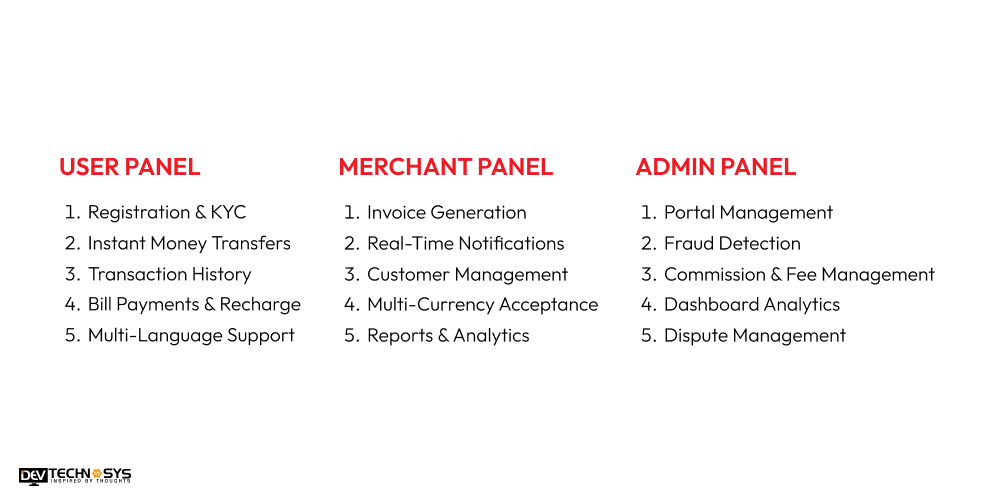

User Panel

1. Registration & KYC

With easy instructions, users may sign up and complete identity verification quickly. A C3Pay app clone can keep onboarding simple and guarantee adherence to financial requirements.

2. Instant Money Transfers

Users can send money both domestically and abroad with a C3Pay clone app. Convenience is ensured by transfers occurring in real time or within minutes. Support for multiple currencies facilitates easy cross-border transactions.

3. Transaction History

A thorough record of every transaction done with an app like eFAWATEERcom. This function lets consumers keep an eye on their expenditure and offers transparency.

4. Bill Payments & Recharge

A mobile payment app like C3Pay allows users to recharge cell services and pay utility bills. Time is saved and fewer apps are required because of this all-in-one feature. Missed deadlines are avoided with cashless alternatives.

5. Multi-Language Support

For a wide range of user bases, the software supports multiple languages. It improves usability for users of various ethnicities. Localized information guarantees a better user experience and fosters confidence.

Merchant Panel

1. Invoice Generation

For their transactions, merchants have the ability to generate and oversee invoices. It facilitates receivables tracking and streamlines billing procedures. Automated reminders guarantee that clients pay on time.

2. Real-Time Notifications

When a payment is made, merchants are immediately notified. An app like Remitly facilitates cash flow management and instant order processing. Additionally, it provides notifications for various transactions.

3. Customer Management

Customers’ profiles and transaction history can be kept up to date by merchants. It fosters client loyalty and helps customize offerings. Targeted advertising and offers are supported by data insights.

4. Multi-Currency Acceptance

Different currencies can be easily accepted by merchants. An app like Canara ai1 increases their ability to reach clients abroad. Transactions run smoothly thanks to integrated currency conversion.

5. Reports & Analytics

Merchants have access to comprehensive settlement information on a daily, weekly, or monthly basis. Analytics shed light on consumer behavior and sales trends. Making decisions based on data improves corporate performance.

Admin Panel

1. Portal Management

Administrators are able to effectively monitor and manage merchant and user accounts. This guarantees fraud prevention, seamless onboarding, and compliance.

2. Fraud Detection

All app transactions are visible to administrators in real time. Suspicious activity is automatically detected by sophisticated algorithms. Quick action to protect the system is made possible via timely alarms.

3. Commission & Fee Management

Admins have the ability to set and modify commissions and transaction fees. Changes can be made according to user kinds, areas, or amounts through an app like PhonePe.

4. Dashboard Analytics

A thorough dashboard offers information about how well an app is performing. Admins are able to monitor revenue sources, transaction volumes, and user growth. Strategic decision-making is aided by custom reports.

5. Dispute Management

Admins are able to effectively handle support tickets and settle conflicts. A centralized system guarantees prompt resolution of merchant or user problems. Sustaining service quality increases user retention and trust.

Top Alternatives of C3Pay in UAE

The fintech industry in the United Arab Emirates is flourishing, offering various robust alternatives of C3Pay. You must know the banking app development cost to offer smooth financial services and money transfers through C3Pay app clones. Additionally, customers can determine which one best suits their unique remittance and payment requirements:

Top 10 Alternatives of C3Pay |

Supported Devices |

Downloads |

Ratings |

|

Google Pay |

Android|iOS | 1B+ | 4.4 |

| PhonePe | Android|iOS | 500M+ |

4.2 |

|

PayPal |

Android|iOS | 100M+ | 3.7 |

| Remitly | Android|iOS | 10M+ |

4.8 |

|

e& UAE |

Android|iOS | 10M+ | 4.7 |

| Canara ai1 | Android|iOS | 10M+ |

4.4 |

|

LuLu Money |

Android|iOS | 1M+ | 4.7 |

| Al Ansari Exchange | Android|iOS | 1M+ |

4.6 |

|

Mashreq UAE |

Android|iOS | 1M+ | 4.6 |

| Payit | Android|iOS | 1M+ |

4.2 |

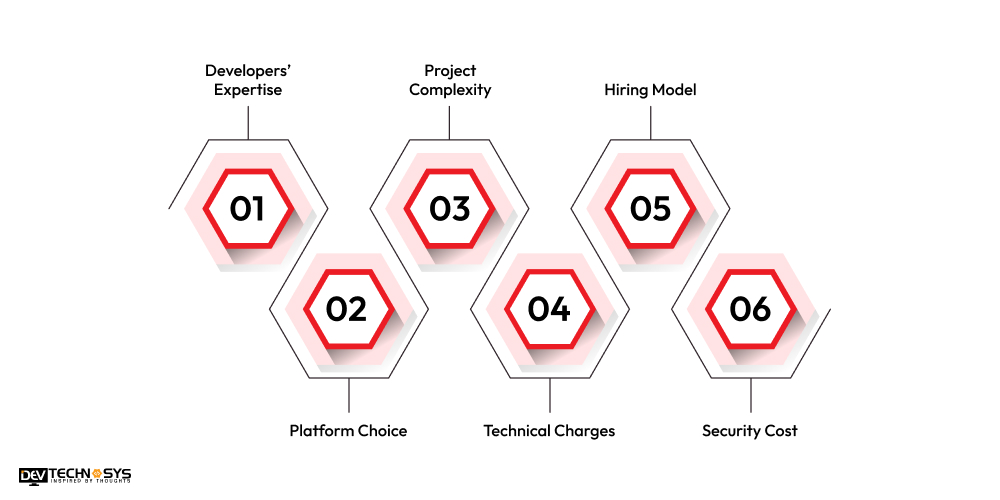

What is the Cost to Build an App Like C3Pay?

The entire cost to build an app like C3Pay is influenced by a number of cost-driving factors. The amount of time and resources required depends on these factors. A reasonable budget for a safe, high-performing payment app can be planned with the aid of an understanding of these elements:

1. Developers’ Expertise

The cost to develop an app like C3Pay is higher for qualified developers with fintech and secure payment system experience. Their knowledge guarantees robust encryption, regulatory compliance, and seamless connections with banking APIs. Hiring excellent staff lowers the chance of mistakes and expensive future repairs, but it also increases the cost to create an app like C3Pay.

| Developers’ Expertise | Cost Estimation |

| Junior/Entry-Level | $8000-$12000 |

| Mid-Level/Experienced | $12000-$16000 |

| Senior/Expert | $16000-$20000 |

| Professional | $20000-$24000 |

2. Platform Choice

The decision between cross-platform development, iOS, or Android affects the cost to create an app like C3Pay. Better performance is provided by native apps, but they also require distinct codebases, which raises fintech app development cost. By allowing shared code, cross-platform solutions such as Flutter or React Native can reduce expenses.

|

Development Platform |

Estimated Cost |

| Flutter App |

$15,000-$20,000 |

|

Native App |

$20,000-$25,000 |

| Hybrid App |

$25,000-$30,000 |

3. Project Complexity

The cost to make an app like C3Pay increases with the number of features like quick transfers and multi-currency support. Additional design, testing, and development work is needed for complex functionality. Complexity is increased by extensive security procedures, third-party services, and custom UI/UX.

Project Complexity |

Development Time |

Estimated Cost |

|

Simple |

2-5 months | $5000-$10000 |

| Moderate | 5-8 months |

$10000-$15000 |

|

Complex |

8-12 months | $15000-$20000 |

| Premium | More than 12 months |

$20000-$25000 |

4. Technical Charges

Database administration, server hosting, and third-party API fees are examples of ongoing technological UPI app development costs. The C3Pay app development cost is influenced by cloud services, payment gateways, and email/SMS notification technologies. In order to handle user data securely and guarantee app speed, you should use banking app development services.

|

Technical Model |

Estimated Cost |

| Artificial Intelligence |

$30,000-$40,000 |

|

Blockchain |

$35,000-$50,000 |

| Cloud Computing |

$40,000-$45,000 |

|

IoT Integration |

$45,000-$50,000 |

5. Hiring Model

The C3Pay fintech app development cost is impacted by the decision to utilize a development agency, freelancers, or in-house developers. Although they have higher fixed pay and perks, in-house teams give you more control. Agencies offer low cost to develop app like C3Pay but freelancers are more flexible with less accountability.

|

Hiring Cost |

Estimated Cost |

| In House Team |

$5,000-$8,000 |

|

Full-Time Freelancers |

$3,500-$5,000 |

| Developer Outreach |

$8,000-$15,000 |

6. Security Cost

For financial apps that handle sensitive user data and transactions, security is essential. Implementing encryption technologies and obtaining compliance certifications can increase the cost to develop C3Pay app. Investing in cutting-edge security measures prevents breaches and increases user trust. Security avoids high NFC payment app development cost, even though it may raise initial expenditures.

|

Development Platform |

Estimated Cost |

| SSL Certification |

$10,000-$15,000 |

|

Key Generation |

$15,000-$20,000 |

| Digital Authentication |

$20,000-$25,000 |

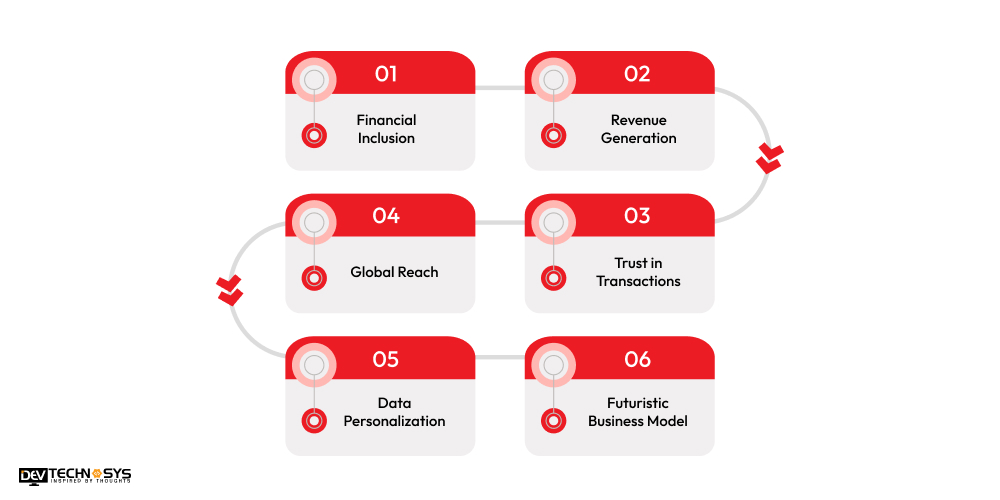

Benefits of Developing Payment Apps Like C3Pay

Creating payment apps such as C3Pay opens up new possibilities in the rapidly changing fintech sector. These applications facilitate transactions, give access to finance, and present an expandable business plan:

1. Financial Inclusion

Users without traditional bank accounts can fill the gap with the help of an app like LuLu Money. They empower marginalized populations by providing services including money transfers, bill payment, and salary deposits. Financial services are available to a wide range of users with multilingual support.

2. Revenue Generation

Commissions, transaction fees, and premium features are ways for developers and companies to make money. Additional monetization channels are created through alliances with banks, telecom companies, and retailers. Value-added services, in-app promotions, and advertisements all increase profitability.

3. Trust in Transactions

User data security is guaranteed by multi-factor authentication, advanced encryption, and financial rules. Customers feel secure by knowing that their funds are shielded from fraud and online attacks. Regular security updates are provided by a custom web development company in UAE with low investment.

4. Global Reach

Instantaneous payments and money transfers are convenient for users everywhere. Reach is increased with multi-currency capability and integration with international payment networks. Companies don’t have to worry about delays or expensive conversion costs when serving clients from other countries.

5. Data Personalization

Businesses have the choice to build an app like Al Ansari Exchange that gathers and examines user transaction data to provide useful information. This enables businesses to anticipate customer requirements, enhance services, and offer tailored incentives.

6. Futuristic Business Model

With modular features and cloud-based architecture, fintech apps may grow rapidly. The potential market expands together with the use of digital payments. The software is future-proofed through integration with cutting-edge technology like blockchain and artificial intelligence.

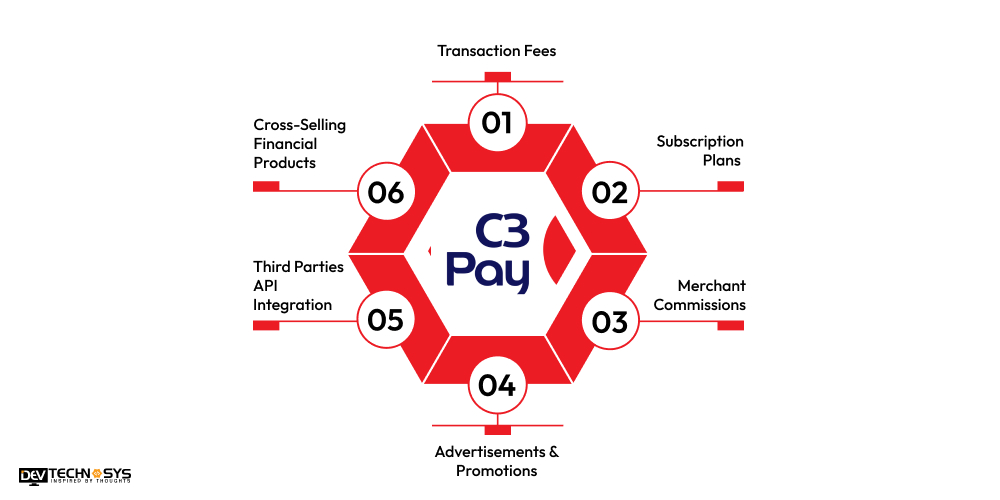

How to Monetize C3Pay Like Applications?

Apps like C3Pay can be monetized through a variety of revenue sources that increase profitability and add value for users. Several methods can transform a payment app into a profitable enterprise:

1. Transaction Fees

Charge a fixed fee or a tiny percentage for each transaction made using an app like Taptap Send. This covers payments to merchants, bills, and money transfers. When transaction volumes are huge, even small fees may add up. So, it guarantees consistent revenue, transparent pricing structures preserve user trust.

2. Subscription Plans

Provide tiers of subscription plans for more sophisticated features. Features including increased transfer limits, quicker processing, and better customer service are available to premium subscribers. This provides users with value-added options and generates a steady source of recurring money.

3. Merchant Commissions

Businesses can receive commissions from retailers through payment handling. Additionally, you must hire an Android app development company in UAE to ensure increased visibility and smooth transactions to merchants. More merchant partners may be attracted via special offers or promotions.

4. Advertisements & Promotions

Permit some companies to advertise or market their services through the app’s UI. Strategic placement of ads is possible, for example, during transaction confirmations or loading screens. Partnering with financial services or goods guarantees non-intrusive, pertinent advertisements.

5. Third Parties API Integration

Make your payment processing infrastructure available to other businesses as an API. Startups and developers can include your payment systems into their own websites or applications. Additionally, you can develop a currency converter app to charge API usage based on subscription tiers or volume.

6. Cross-Selling Financial Products

To cross-sell financial services, collaborate with banks, insurance providers, or investment platforms. Provide savings accounts, insurance plans, and personal loans all through the app. Receive commissions or referral payments for each successful transaction or signup.

In a Nutshell!!

Now, at this stage your motive to build an app like C3Pay must be clear. But, before starting there are few things that you need to keep in mind. Let’s understand them and help you to develop C3Pay-like app clones at reasonable rates:

- Gather useful and sufficient information to get an idea.

- Partner with a reliable ewallet app development company in UAE with experience in developing fintech apps.

- Analyze the process to make an app like C3Pay for cost-effectiveness.

- Use suitable money-making strategies for balancing the invested money.

These are some fundamentals that help you to improve your business growth and generate huge revenue streams. Additionally, it will be easy for you to increase customer satisfaction.

FAQs

1. Which are the Popular C3Pay Alternatives in UAE?

Apps like Payit by FAB, Emirates Digital Wallet, and Apple Pay are well-known alternatives for C3Pay in the United Arab Emirates. Google Pay and Careem Pay are also becoming more popular as they provide peer-to-peer transfers, bill payment, and contactless payment functions.

2. What is the Cost to Maintain Apps Like C3Pay?

Depending on their complexity, maintaining apps like C3Pay might cost anywhere from $1,000 to $6,000 each year. This covers third-party services, customer support, security patches, updates, and server hosting. Maintenance expenses may rise as a result of increased user traffic and sophisticated features like AI fraud detection.

3. How to Reduce the Cost to Build an App Like C3Pay?

- Businesses must use React Native frameworks.

- Target essential features to save initial development costs.

- Invest in ready-made solutions for payments and KYC.

4. How Much Does it Cost to Hire Mobile Payment App Developers?

Depending on location and level of experience, hiring mobile payment app developers might cost anywhere from $10 to $60 per hour. Rates may be higher in the United Arab Emirates or with professional fintech developers because of the increased need for secure coding.

5. Are Digital Payments Secure to Use?

Yes, using reliable apps with encryption and two-factor authentication makes digital payments typically safe. Users should, however, update their programs frequently and be on the lookout for phishing attempts. Transaction security is further improved by regulatory compliance such as AML requirements and PCI DSS.

6. What Technologies Are Required to Create C3Pay Like Apps?

- Frontend: Flutter, React Native, Swift (iOS), or Kotlin (Android).

- Backend: Node.js, Python (Django), or Java

- Cloud Server: AWS or Google Cloud.

- Security & Payment APIs: Encryption protocols (SSL/TLS) and compliance tools (PCI DSS, AML/KYC).