Have you ever thought about how creating a banking app could change your financial services business? Well, we are talking about the mobile banking app.

The time has gone when people waited in line at the banks to open an account or do other financial transactions. Nowadays, demand for the on-the-go and convenient banking solutions is growing rapidly. Hence, investment in a banking app opens the door to endless business growth opportunities. As per a study, the market for digital banking platforms was estimated to be worth $30.4 billion globally in 2023 and is projected to increase to $168.3 billion by 2032. As per this data, developing a banking app is a strategic business move that can take your business to the next level.

So, if you are an entrepreneur who wants to build an app like HSBC UAE, this blog is for you. This guide will explore each and every step to help you develop a successful banking app.

What is HSBC – A Banking App?

HSBC is a mobile banking app that conveniently allows users to manage their finances, make payments, and access different banking services directly from their smartphones. Using the app, users can transfer funds and also monitor their transactions securely.

HSBC offers features like global money transfer and mobile cheque deposits that provide a seamless banking experience. Hence, this ensures users stay in control of their finances anywhere, anytime. Overall, HSBC is an ideal solution for users who want a user-friendly or eligible digital baking service.

Market Analysis of Banking App

Digital Banks – United Arab Emirates

- By2024, the Net Interest Income from Digital Banks in the United Arab Emirates is predicted to have increased significantly and be valued US$2.86 billion.

- Additionally, a consistent annual growth rate (CAGR 2024-2029) of 4.77% is predicted for Net Interest Income, resulting in a market size of almost US$3.61 billion by 2029.

- With an estimated value of US$463.0 billion in 2024, China is expected to produce the most Net Interest Income when compared globally.

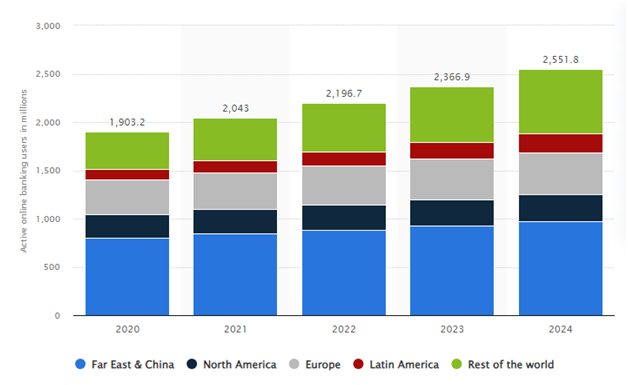

Number of active online banking users worldwide in 2020 with forecasts from 2021 to 2024, by region(in millions)

It is anticipated that the Asian market will hold the highest share of the growing usage of online and mobile banking between 2021 and 2024. Over 805 million active users of online banking were based in China and the Far East in 2020.

Top 5 Banking Apps

If you are investing in a mobile app development, study your competitors. This will provide you with insights into the market and consumer preferences. So, understand the market landscape by studying the following key competitors:

- Liv Bank

- SNB Mobile

- Arabi-Mobile

- DIB MOBILE

- Muscat Mobile Banking

1. Liv Bank

The app offers a range of features, including transfers, bill payments, and ad investments. What makes it different is its round-the-clock customer support and user-friendly interface. To develop an app like Liv Bank, emphasize seamless integration with gamification, social media, and real-time financial insights.

2. SNB Mobile

This mobile banking app provides superior security and offers robust features for seamless business transactions. Its fast processing and intuitive design make it a convenient option for business finance. To build an app like SNB Mobile, ensure robust business banking features, advance secure measures, and multi-currency account management.

3. Arabi-Mobile

It’s an ideal solution for international business owners. This app offers competitive exchange rates, supports multiple currencies, and provides real-time updates on global trends. To build an app like Arabi-Mobile, culturally appropriate features and multi-language support must be ensured while offering cross-broader transactions.

4. DIB MOBILE

This banking app boasts innovative features and a modern interface, such as personalized financial insights and biometric authentication. It’s committed to providing customer satisfaction, which makes it a trusted choice among customers. To develop an app like DIB Mobile, ensure that you integrate all its features into your app.

5. Muscat Mobile Banking

The app has gained huge popularity because of its security and reliability. It offers a comprehensive banking services, including foreign exchange, investment options, and trade finance facilities. To develop an app like Muscat Mobile Banking, enhance personalization with AI-driven customer service, ensuring seamless user experience.

Benefits of Developing the Banking Apps

As you know, the financial landscape is undergoing a major transformation, and it has become significant for businesses to invest in banking or e wallet app development solutions. Apart from this, there are several benefits that you can enjoy with HSBC UAE app development, as mentioned below:

- Strengthen Brand

- Additional Revenue Streams

- Improved Competitiveness

- Higher Return on Investment

- Robust Security

1. Strengthen Brand

If you build bank app HSBC UAE, your brand’s visibility and trustworthiness will be enhanced. You can provide users with a seamless mobile experience, making them more likely to stick around, build loyalty, and recommend services to others.

2. Additional Revenue Streams

With a well-crafted mobile banking app, you can enjoy new revenue channels. You can generate income beyond traditional banking activities through personalized offerings, transaction fees for premium services, or in-app ads. Hence, at this digital hub, value meets convenience.

3. Improved Competitiveness

Nowadays, it has become significant for businesses to stand out. Hence, you can stay at the forefront and meet changing customer needs by developing a feature-rich mobile banking app. As per the iPhone or Android app development company, you must develop an intuitive app with personalized features to make your service more attractive than others.

4. Higher Return on Investment

You are undoubtedly taking a big step by investing in a banking app. However, the return can be substantial. If you build an app like HSBC UAE, cost savings can be achieved through automated services to improve customer engagement; the best will translate into long-term profitability and growth.

5. Robust Security

Banking apps enable businesses to incorporate cutting-edge technology to protect user data. With features like multi-factor authentication, biometric login, and data encryption, customers can trust that their data or sensitive information is safe and that they have peace of mind.

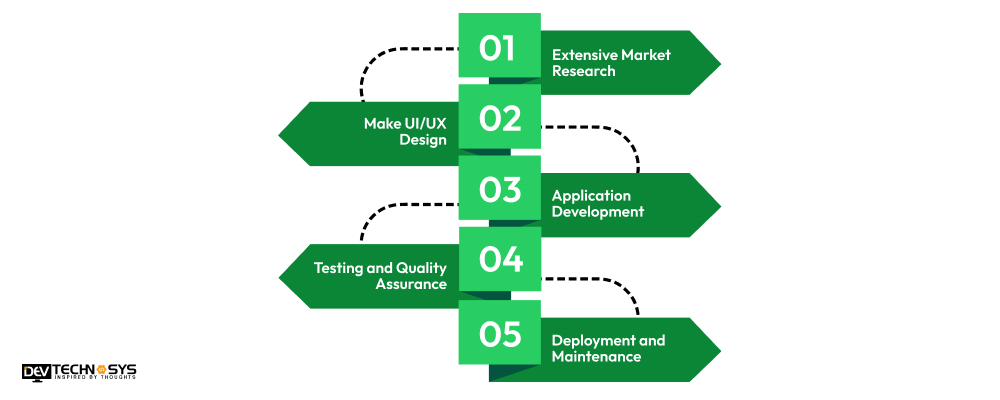

Key Steps to Build an App Like HSBC UAE

You might be wondering what it takes to create an app like HSBC UAE. Well, creating a banking app requires careful planning and a complex mindset for success. Here, we mentioned the critical step that you must consider for banking app development solutions:

- Extensive Market Research

- Make UI/UX Design

- Application Development

- Testing and Quality Assurance

- Deployment and Maintenance

1. Extensive Market Research

It’s the first stage of banking app development, which you can not skip. Before starting the app development process, conduct market research to understand your audience, what they want in your online banking app like HSBC UAE, what frustrates them, and what pain points they have. Also, explore your competitors to analyze what makes them strong and where they are lacking. Hence, this will help you develop your banking app accordingly.

2. Make UI/UX Design

Now that you have your insights, it’s time to focus on design. Remember that a user-friendly interface and engaging user experience are customer retention criteria. You are advised to hire a mobile app development company to create wireframes and prototypes to visualize how your banking app will function and look. To build an app like HSBC UAE, keep your app’s design attractive and intuitive, using fonts and colors that appeal to the targeted users.

3. Application Development

Once the app design is ready, you can start to build your banking app. To do this, you must first choose the tech stack used in your app development. Whether you go for the cross-platform or native, your app must be scalable. You must understand that a wrong technology selection can spoil all your efforts. Hence, ask the banking app development company to choose the most suitable tech stack so that the desired outcome can be attained with the app.

4. Testing and Quality Assurance

As your mobile banking app has been developed, you might be excited to launch it. However, before this, it’s critical to conduct testing so that bugs and errors can be identified and resolved, ensuring that everything in the app is working well. Here, the quality assurance team is responsible for delivering a reliable banking app that users can trust.

5. Deployment and Maintenance

Finally, it’s time to launch your app. You can deploy your banking app on relevant platforms, such as the Google Pay Store and Apple App Store. However, your work does not end here. Regular maintenance and updates are significant to keeping your banking app fresh and competitive. Hence, this ongoing support will help build loyalty and trust among your users.

Must-have Features of a Banking App

Do you want to thrive in today’s competitive financial industry? If yes, you can do this by delivering a robust user experience while ensuring convenience and security. We are talking about the app’s features that contribute to the app’s success.

If you want to build an app like HSBC UAE, here is a list of significant features that you must incorporate into your app like Alinma Bank or HSBC UAE:

|

Features |

Descriptions |

| User Profile |

Build an app like HSBC UAE that allows users to manage their details and banking preferences easily. |

|

Check Account Balance |

This feature allows users to conveniently monitor their account balances, ensuring real-time awareness of their finances. |

| Money Transfer |

Whether it’s intra-bank or inter-bank, ensure a seamless fund transfer between accounts to enhance the user experience. |

|

Bill Payment |

Allow users to schedule monthly or one-time payments within the app and pay when notified through push notifications, email, or both. |

|

Customer Support |

Hire dedicated developers to integrate supply channels like FAQs, live chat, or direct contact options so that users can easily get assistance. |

| Push Notification |

Build an app like HSBC UAE that updates users with account changes, real-time transaction alerts, and important announcements. |

|

Personalized Offers |

Your banking app must provide personalized financial products, promotional offers, or rewards based on users’ preferences and behavior to enhance user engagement. |

| Expense Tracking |

With this feature, users can easily manage their finances by categorizing spending and providing insights into their spending habits. |

|

Crypto Wallets |

Integration with crypto wallets manage digital currencies that appeal to today’s users investing in cryptocurrencies. |

| Safety and Security |

Develop an app like HSBC UAE with encryption, strong authentication, and other security measures to keep users’ financial data secure. |

Cost Analysis to Build an App Like HSBC UAE

Now, you might figure out the banking app development cost. Well, first, you need to understand that determining the cost and time for a banking app is quite a complex task. This is because the HSBC UAE mobile app development cost depends on a range of the factors- including, features, development team, and more.

However, if we take a rough idea, building a banking app costs $8,000 to $27,000. Remember that the cost to develop a banking app in UAE is flexible and can be changed as per the project’s complexity, as mentioned in the table below:

Cost To Build Banking App Like HSBC UAE

|

Banking App Development |

Estimated Cost | Time Frame |

| Simple Banking App Development | $8000 – $13000 |

3 to 6 Months |

|

Medium-Complex Banking App Development |

$13000 – $21000 | 6 to 9 Months |

| High-Complex Banking App Development | $27000+ |

10+ Months |

Tech Stack for Banking App Development

If you have decided to make an app like HSBC UAE, you are responsible for choosing the right tech stack, ensuring optimal performance, security, and user experience. With a well-chosen tech stack, you can not just enhance your app performance but also simplify its maintenance and future updates. Here are key components you must consider for your Android or iOS app development:

|

Component |

Technologies |

| Frontend |

React Native, Flutter, Swift, Kotlin |

|

Backend |

Node.js, Java (Spring Boot)

Python (Django/Flask), |

| API Integration |

GraphQL, RESTful APIs, SOAP |

|

Database |

SQLite, PostgreSQL,MySQL, MongoDB, Firebase |

| Analytics |

Google Analytics, Firebase Analytics |

|

Authentication |

OAuth, JWT |

| Push Notifications |

Apple Push Notification Service, Firebase Cloud Messaging |

|

Version Control |

Git, GitHub, Bitbucket |

| Deployment |

Apple App Store, Google Play Store, TestFlight, Firebase App Distribution |

Wrapping Up!

This blog has concluded that investing in a mobile banking app is the key to staying relevant and competitive in today’s competitive financial landscape. Entrepreneurs can strengthen brand loyalty and drive business growth by offering personalized experience, customer security, and convenience.

So what are you waiting for? Build an app like HSBC UAE today and differentiate yourself from the others.

If you need any help, just consult an on demand app development company. For instance, you can connect with Dev Technosys. We have 14+ years of experience in on-demand banking app development and have delivered 1100+ of projects.

Frequently Asked Questions

1. How Much Does It Cost to Develop an E Wallet App?

The e wallet app development cost can range between $8,000 and $27000. However, the final cost depends on factors such as the app’s design complexity and features, the technology stack used to develop it, and the development team.

2. How Long Does It Take to Build an App Like HSBC UAE?

The time to create banking application HSBC UAE can be 3 to 6 months to create. However, an exact timeline depends on several factors, including the app’s functionality, complexity, and project requirements.

3. How do the Banking Apps Work?

If you develop app like HSBC UAE, this will work in the following ways:

- Download the app

- Register or log in

- Set up security

- Access account and services

- Manage cards and receive alerts

4. How to Earn Money with Banking Apps?

If you build an app like HSBC UAE, you can earn money with the below app monetization techniques:

- Transaction fee

- Advertising partnership

- Subscription models

- Data analytics services

- In-app financial services.